23andMe looks to go private after years of market woes

The DNA tester's value continues to sink from its strong debut

For anyone who went to one of 23andMe’s ‘spit parties’ back in 2008, the good news is you’ll likely never go to one again. But, for anyone that still optimistically owns shares in the company, the bad news is that co-founder Anne Wojcicki is looking to take it private, paying a mere 40 cents per share.

The threat of being delisted has hung over the DNA testing kit company since late last year, having traded below the $1 Nasdaq minimum for ~10 months. Now, with 23andMe stock still down more than 95% from its peak, Wojcicki has submitted a proposal to a special committee of directors to take the health co. private, according to an SEC filing earlier this week.

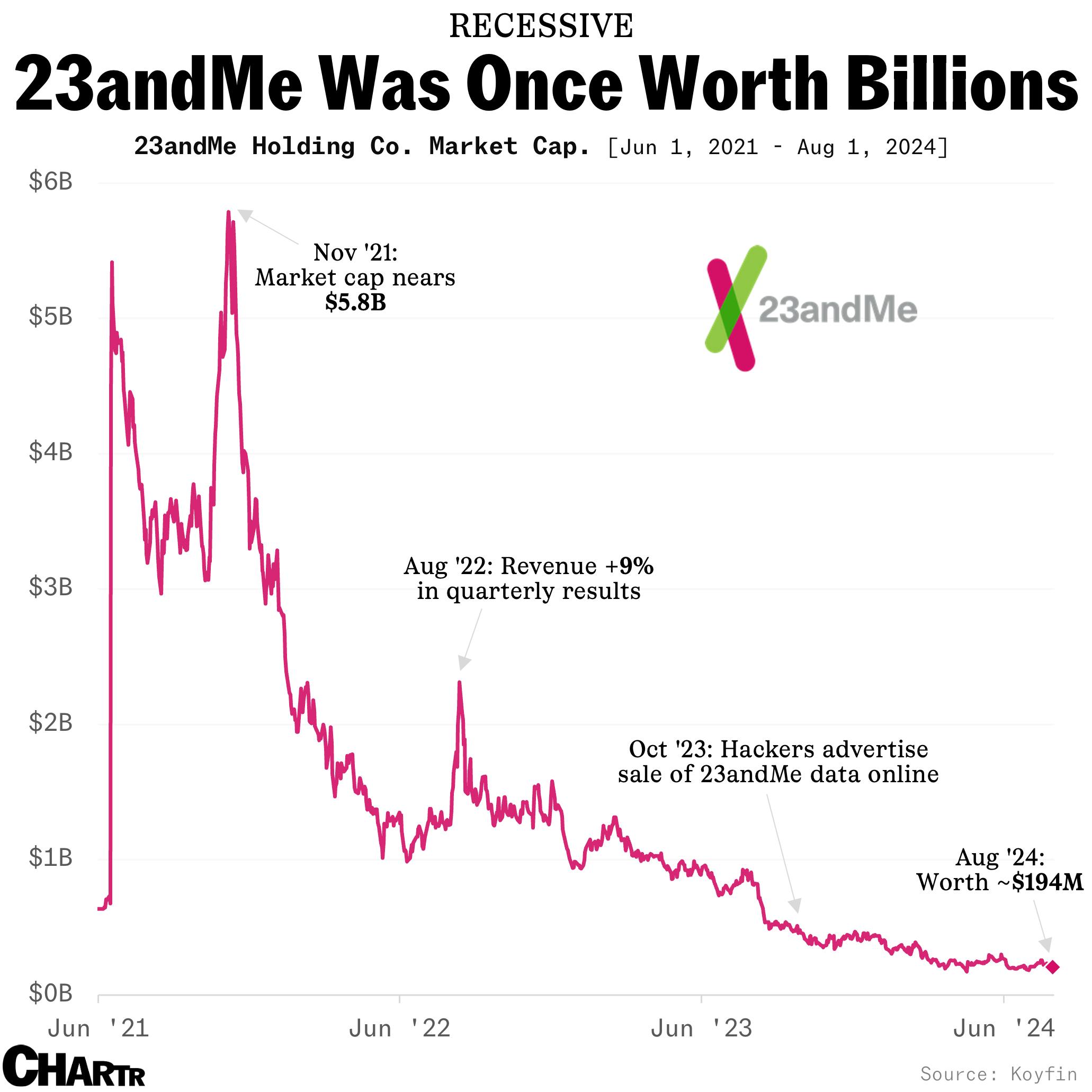

Founded in 2006, 23andMe was once one of the buzziest names in biotech, offering users an ancestry breakdown by mapping genes from saliva samples — spawning countless viral social media posts laying claim to percentages of previously unknown heritages. When it went public via a merger with a special purpose acquisition company in 2021, it was valued at ~$3.5 billion, before briefly peaking at $6 billion a few months later. Yesterday, 23andMe’s valuation stood at just $194 million.

Genetic lottery

Even at the height of its popularity, 23andMe never turned a profit, and the company’s struggle to generate steady revenue (customers only need to use the service once to get their results) continues. Indeed, in its most recent report, total revenue stood at $64 million, down 31% from the year prior. A massive data breach where hackers stole the personal data of almost 7 million customers last May, which the company only discovered 5 months later, hardly helped 23andMe attract new business either.

While Wojcicki has been attempting to pivot focus towards the company’s personalized healthcare arm and subscription model, a depleting cash pile — even after layoffs and subsidiary sales — could prove the task of reviving 23andMe to be a test too far.