Light’s out

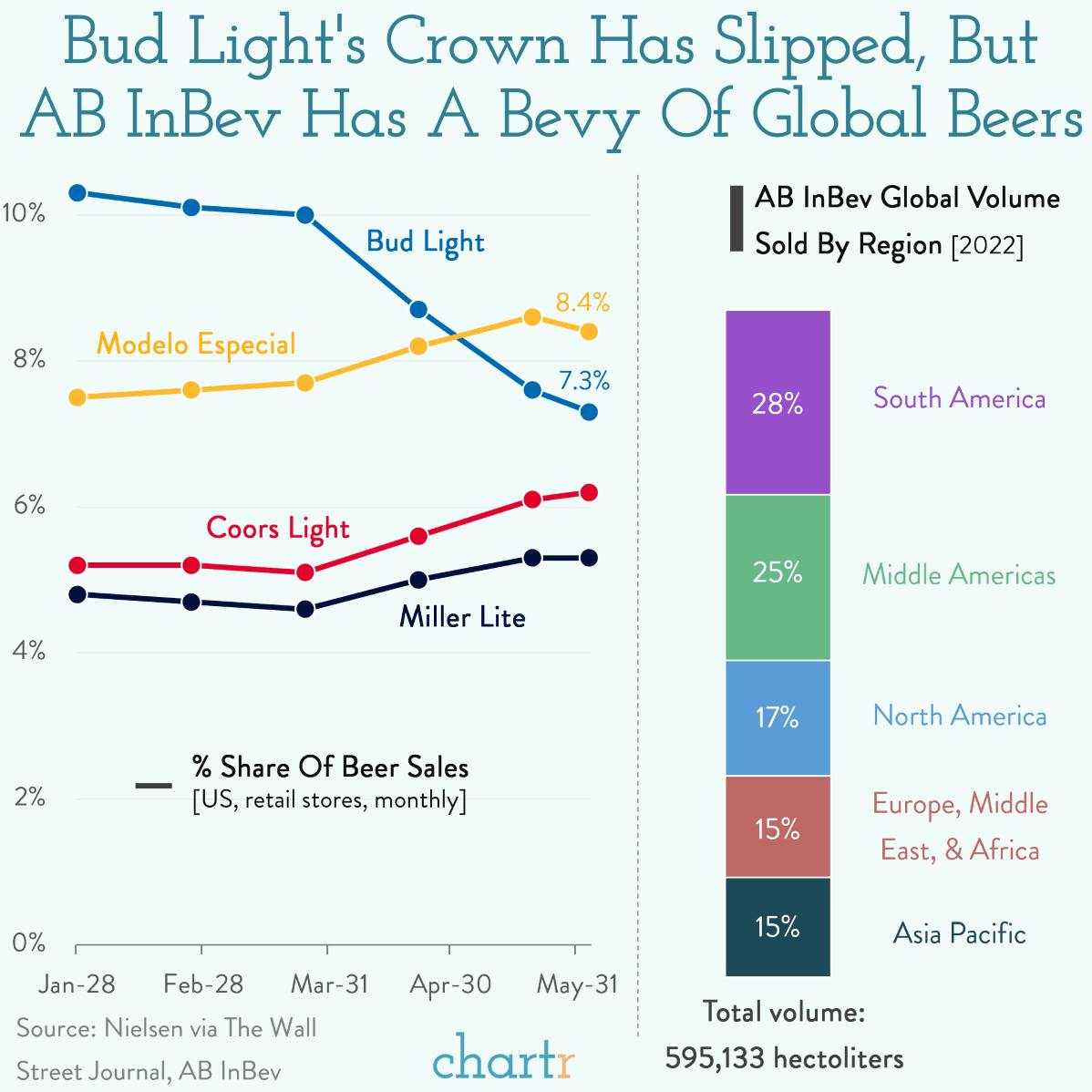

Bud Light has lost its spot at the top of the American beer market amidst ongoing controversy around a promotional partnership with trans TikTok influencer and actress Dylan Mulvaney. Sales reported by parent company AB InBev were down 23% year-over-year, as boycotts roll on in response to the Mulvaney ad from early April.

Originally released in 1982 as a lower-calorie alternative to Budweiser, Bud Light has since grown to become America’s most well-known beer brand alongside Corona, while building a strong international presence and becoming a core product for beer giant AB InBev. Leadership at the company will have been hoping that the Mulvaney furor may have dissipated by now, but Bud Light’s popularity continues to tumble.

Modelo Especial, the popular Mexican pilsner made by the same company behind Corona and Pacifico, has taken Bud Light’s title as America’s number-one beer brand in terms of retail store sales. AB InBev execs will be keen to take the top spot back, but with more than 500 brands worldwide — selling more than 59 million liters of beer last year — the company has other options to fall back on.

Indeed, in the US the Corona and Modelo brands are exclusively owned by Constellation Brands, but globally they belong to... you guessed it: AB InBev.