Life and Primes

Depending on which millennial you ask, turning 30 in 2024 seems like a pretty good (or pretty daunting) opportunity to reflect... for Jeff Bezos’s ~$2 trillion baby, the financial results are more pleasing than most.

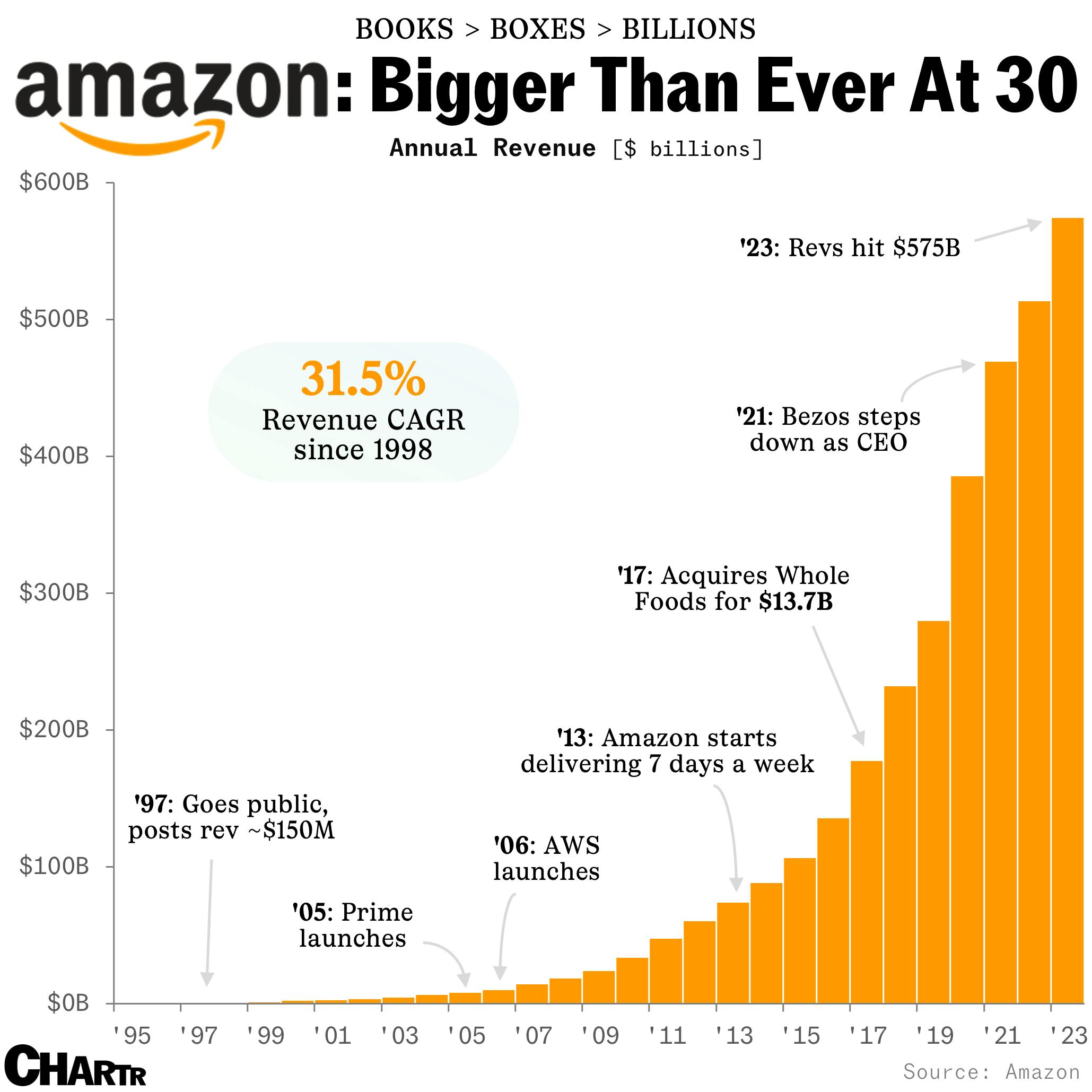

Since launching as an online bookstore on July 5th 1994, Amazon has seen its revenues grow every single year, becoming a one-stop online shop for hundreds of millions of customers around the world. In fact, in the last 25 years, the company has grown at an astonishing CAGR (compound annual growth rate) of 31.5% — the equivalent of doubling its revenue approximately every two and a half years.

All of that revenue growth has translated into AMZN becoming one of the biggest businesses in the world, its share price having soared more than 220,000% at the time of writing since it went public in 1997.

The everything store

It’s impossible here to unpack the boxed-up behemoth that is Amazon, but even the most whistle-stop tour of its history reveals many chapters that would, by themselves, dominate the stories of most other businesses.

In 2005, for example, Amazon launched its Prime subscription service, which has since been hailed as “the internet’s most successful and devastating membership program”. Just one year later, the company introduced Amazon Web Services, its cloud computing division that provides servers, storage, and basically everything else to some of the world’s most visited online real estate — the division accounted for 67% of its $37B operating profit last year.

Today, Amazon negotiates a trickier e-commerce landscape. Its forays into advertising have been wildly profitable, but the company still continues to struggle with long-standing issues like its huge global workforce’s unionization efforts, as well as newer battles too. China’s online marketplace phenomenon Temu, for instance, has quickly become serious competition, forcing Amazon to reportedly make plans to emulate the platform.