The architect and the contractor

At 93 years young, Warren Buffett has penned his annual letter to Berkshire Hathaway shareholders. A plain-spoken update on the company’s results, filled with his usual folksy investment musings, the letter reads like many of the 58 that came before it, with one exception — a tribute to his business partner Charlie Munger, who passed away in November at 99, in which Buffett credits Munger as the true architect of Berkshire Hathaway.

Elsewhere in the letter, it's business as usual, with Buffett eschewing much discussion of the “bottom line” (net income) his company has to report, instead focusing, as always, on the underlying operating earnings of the collection of businesses, which were up 21% on the prior year.

Buffett’s rising sun

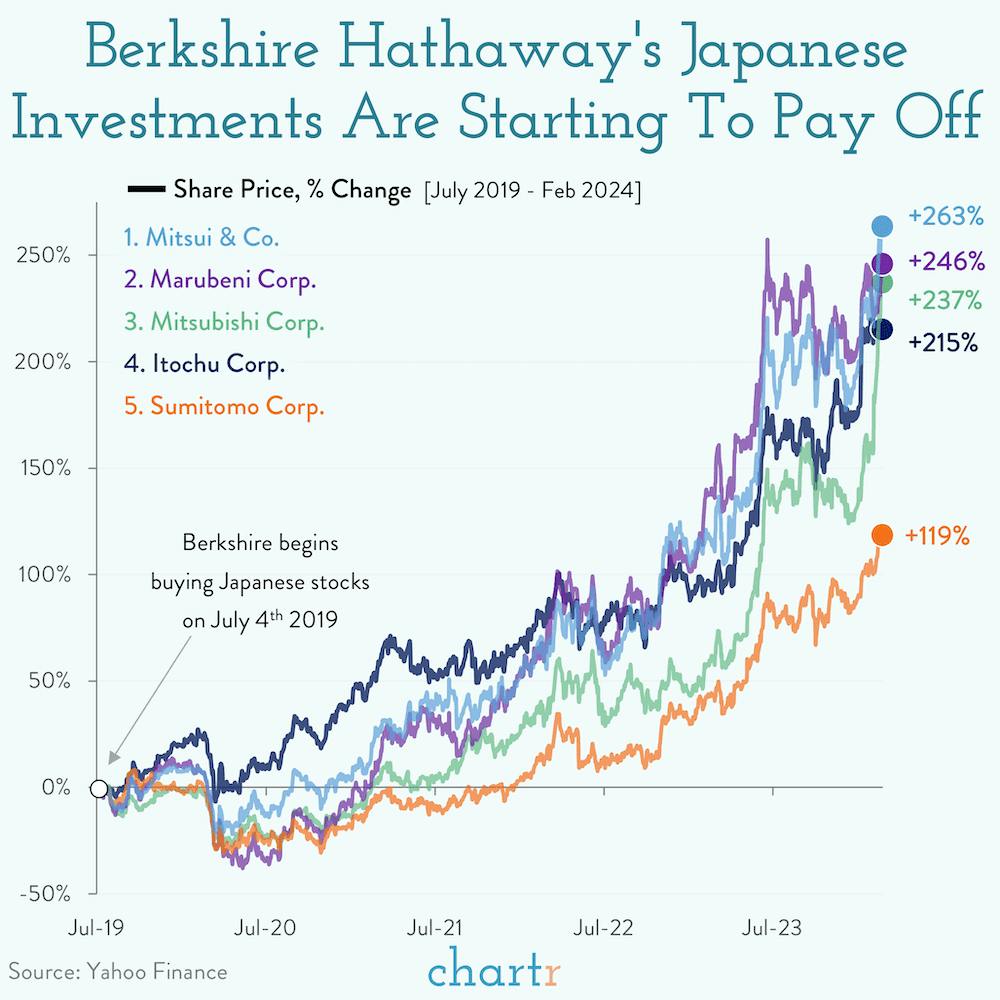

The billionaire businessman also spends a considerable amount of time explaining the company’s investments in 5 Japanese trading firms that have recently soared in value, as the Japanese stock market makes headlines for finally getting back to the record high it achieved back in 1989.

Buffett revealed that Berkshire first started investing in these firms — which themselves have sprawling interests in “unglamorous” industries such as mining and energy — back in 2019, when Japan’s stock market was far from being attractive to global investors. That bet didn’t pay off initially, but, like so many of Berkshire’s investments over the years, it's since come to bear fruit.

Indeed, since August 2019, the share prices of those 5 trading houses are now up 216% on average. Buffett has always bet on America, but now the company’s largest ever aggregate investment outside of the US is paying off handsomely, too.