Whopper deal

Restaurant Brands International (RBI), the parent company of flame-grilling fast-food chain Burger King, yesterday announced plans to acquire its biggest US franchisee, Carrols Restaurant Group — bringing over 1,000 BK locations under RBI control for a stacked $1 billion (or, about 239 million Whoppers).

The move is part of RBI’s 2022 “Reclaim the Flame” plan, which will see the group — that also owns Tim Hortons, Popeyes, and Firehouse Subs — spend $400m over 2 years (separate to this acquisition) to revamp Burger King’s marketing, digital products, and restaurants.

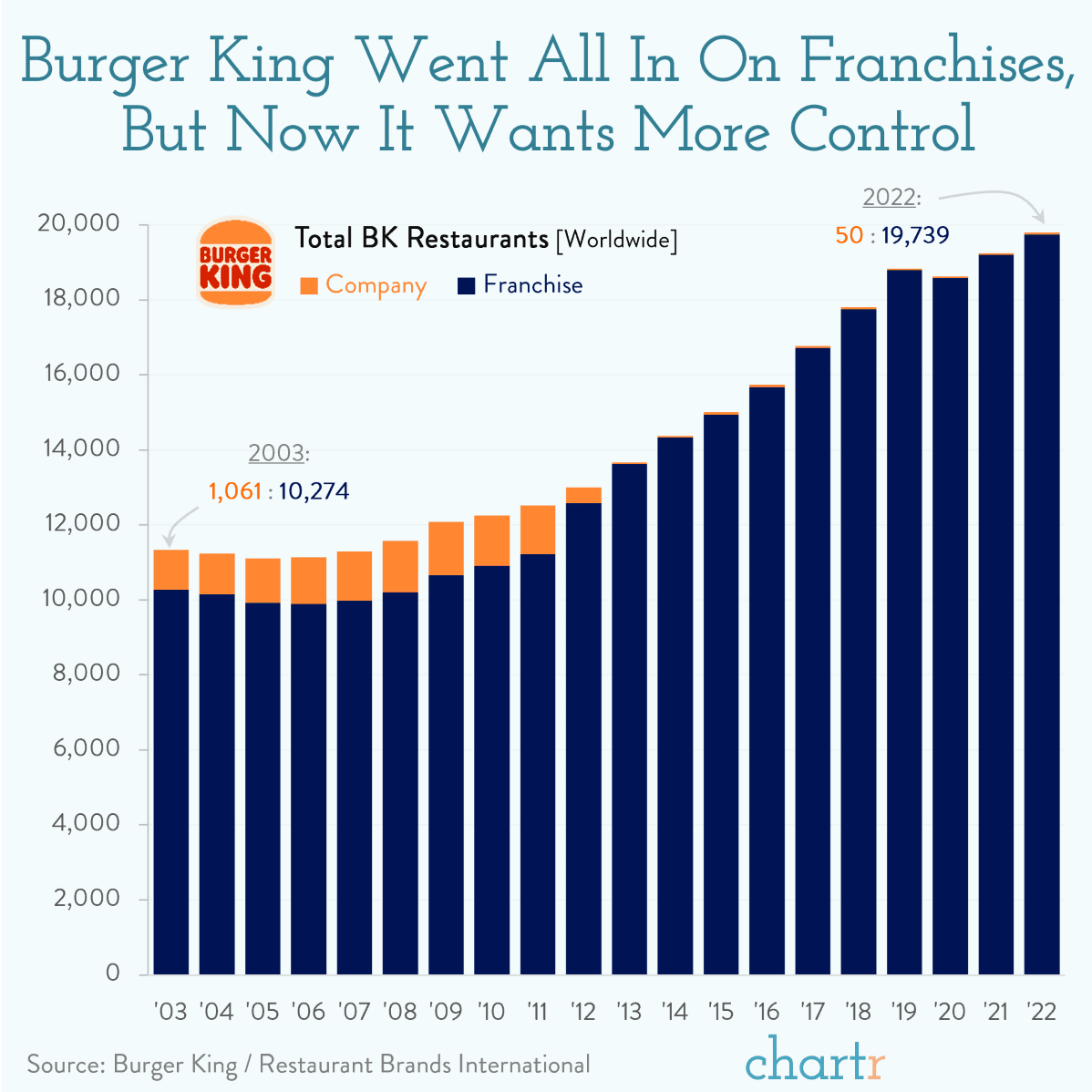

Carrols runs ~15% of US Burger King locations across 23 states, and while the acquired restaurants are anticipated to be re-franchised over 5-7 years, the company also plans to keep a couple of hundred outlets in its portfolio. That’s a departure from the strategy of the last decade, which saw RBI itself operate just a tiny sliver (around 50) of its Burger King restaurants.

Facing stiff competition from McDonald’s, which has been investing billions into its stores, BK is now playing catch-up. It's looking to modernize its stores and get smaller, local franchisees to run the restaurants — targeting new owners to take on 50 units or less, in order to keep their focus from splitting across locations. Following a number of advertising lawsuits, the deal has been described as an “accelerator” by the company’s president — as Burger King looks to get back to having things done their way.