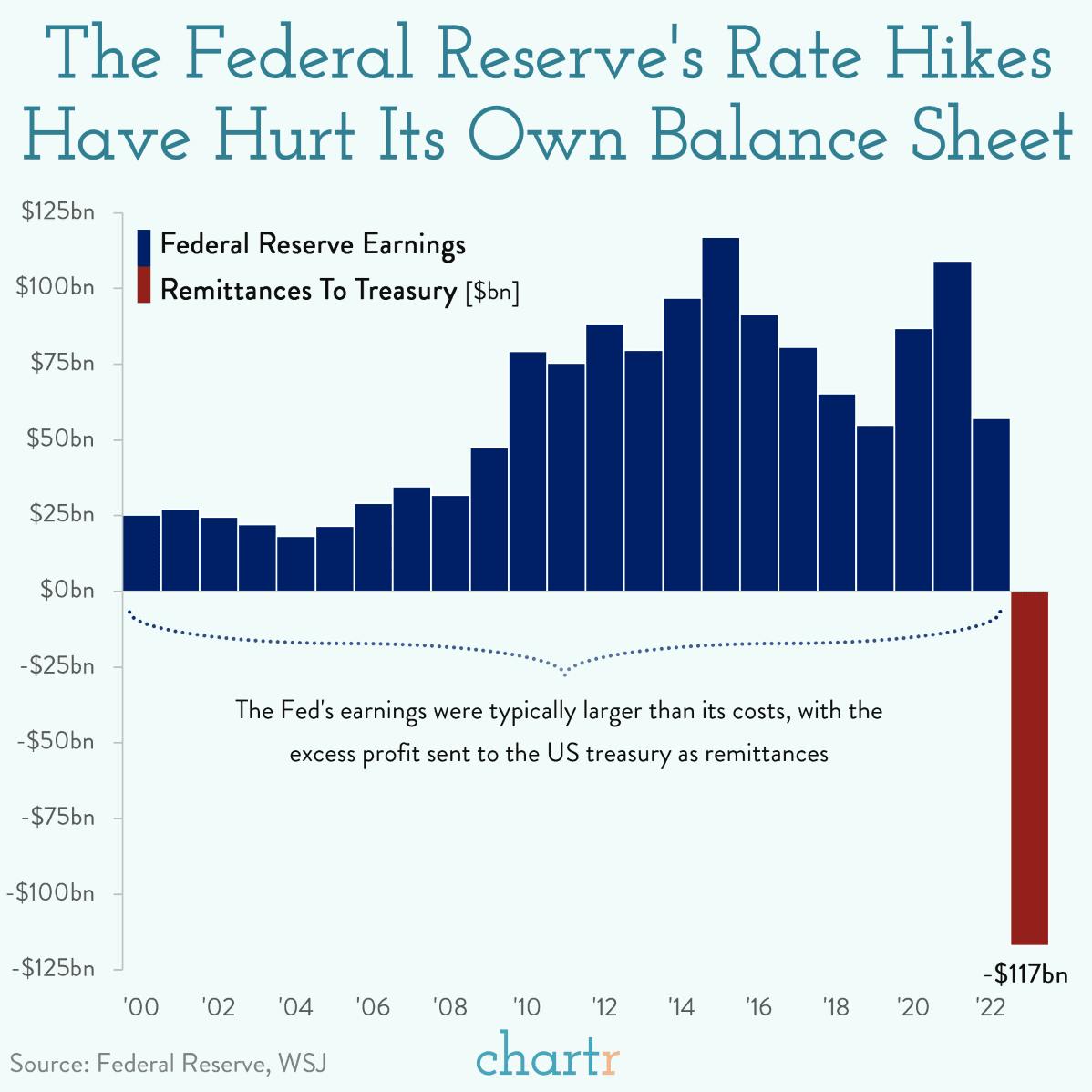

In its 110-year history, the Federal Reserve, America’s central bank, has been an almost constant source of funding for the US Treasury, sending billions of dollars of profits every year to bolster government spending. That all changed last year when the Fed began to operate at an unprecedented loss — the magnitude of which is becoming increasingly clear, with the central bank reporting a whopping $117 billion deficit, taking total losses since Sep 2022 to $133 billion.

What changed?

The Fed owns trillions of dollars of securities — many of which were purchased during the crisis of 2008/09 and the pandemic to stimulate the economy — and receives interest on those securities. That interest, combined with other fees for services to financial institutions, used to handsomely exceed the running costs and interest paid out to banks for parking their cash with the Fed… hence the many decades of profits sent to the Treasury.

However, in the pursuit of lowering inflation, the Fed hiked rates aggressively, sending its own interest expense soaring from $102bn last year to an eye-watering $281bn in its latest report.

The obvious question is: do the Fed losses really matter? There’s no-one at the Treasury chasing Fed members down for the $133 billion loss, with the Fed simply creating an IOU (technically a “deferred asset”), which, once profitable, will need to be paid down to zero, before it can get back to sending returns to the Treasury.