Yesterday Electronic Arts announced it would stop making FIFA-branded soccer games, ending a run from 1993-2022 which made FIFA one of the best-selling games of all time. The series will continue under the brand "EA Sports FC".

EA Sports, it's (not) in the game

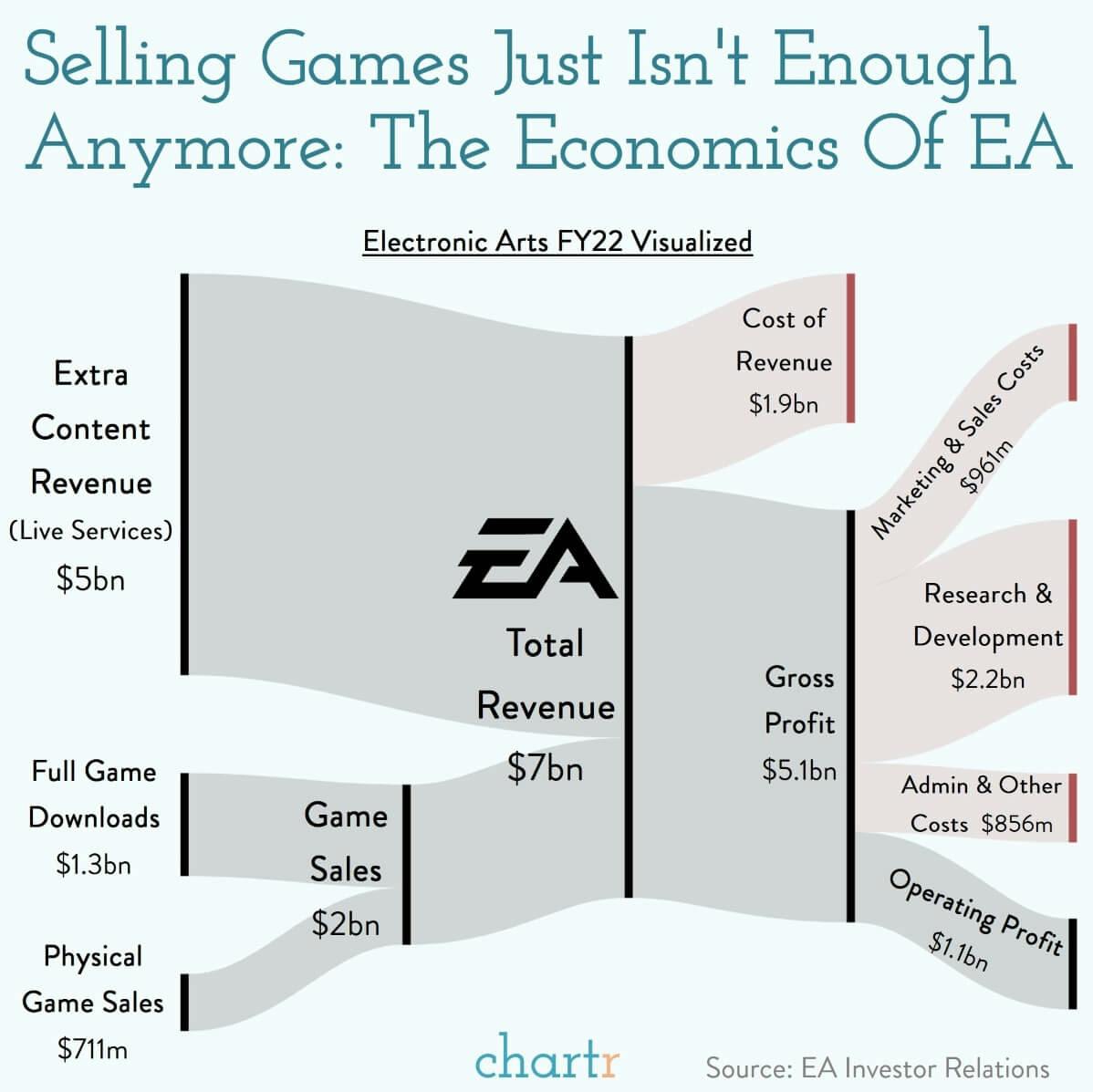

EA didn't want to fork over an increasingly large sum for the FIFA license, hence the company will be hoping that gamers look through the name change and keep buying copies of the game — although these days actual game sales is not really where EA makes its dough.

Indeed, EA — like many of its competitors — makes the majority of its revenue, more than 71%, from what it calls "Live Services". That's a broad bucket for sales of extra content, subscriptions, in-game rewards and other digital goodies.

In the FIFA series those sales come mostly through EA's "Ultimate Team" — a format which sees players compete against others, while building their own team of dream players. The best players in the world, think Lionel Messi or Cristiano Ronaldo, are the rarest — but you can swing the odds of getting those players in your favor by splurging real cash, which millions of people do.

EA hasn't disclosed the numbers for its most recent fiscal year, but in the year before Ultimate Team across its games was worth a whopping $1.6 billion in revenue, more than a quarter of the company's total.

Gone are the days when you might fork over $50 for the latest game and that would be it.