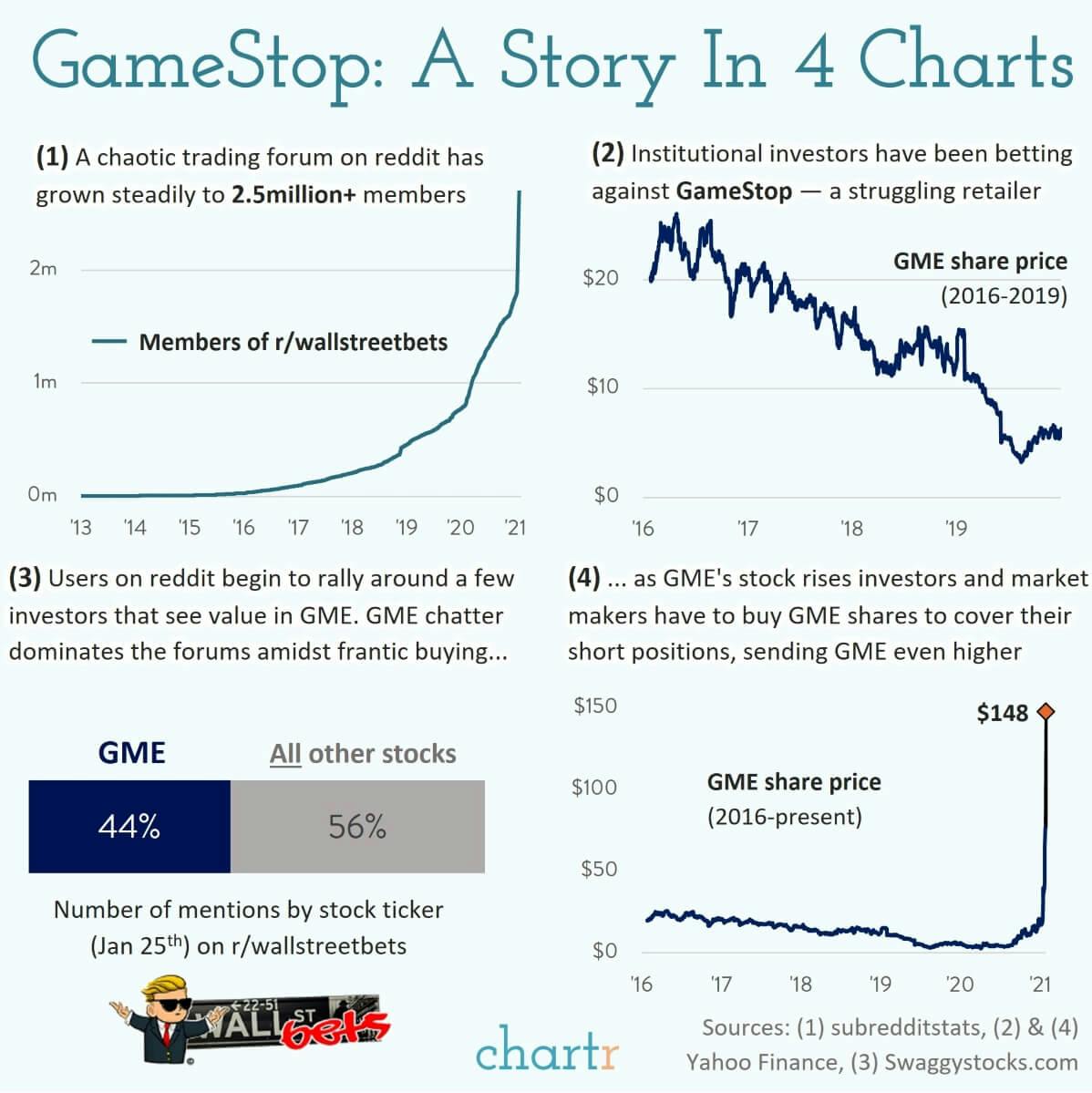

It's hard to ignore what is going on right now with GameStop's (GME) share price. In the last 2 weeks the shares of GME have gone up almost tenfold... mostly thanks to a ragtag collection of amateur traders on r/wallstreetbets — the always chaotic and often offensive forum dedicated to outlandish trading of financial derivatives on reddit.

The background

For the last few years GameStop has been a business in decline as a predominantly brick-and-mortar gaming retailer. Within the financial community the consensus view was simple: GameStop probably wasn't long for this world — and its share price had long reflected that view.

As GameStop shares really began to scrape the barrel (at around the $4-5 mark), a few investors began to see an opportunity. Among the more notable believers was Michael Burry, which is a name you might recognise from 2015 film The Big Short. Less notable investors included a reddit user who had bought $53k worth of call options back in the middle of 2019. We'll call him DFV.

Throughout 2020 a few other investors jumped on the GME bandwagon, including Ryan Cohen, and by late last year GME's share price rice had risen to the mid-teens, closing out 2020 at just under $19. That uptick in fortunes resolved more of the financial elite to bet against GME, buying put options or selling the stock short, anticipating it would eventually resume its downward trajectory. GME was among the most shorted stocks in the entire market.

The big squeeze

What those hedge funds didn't bank on was just how determined, stubborn, and reckless a group of hundreds of thousands of amateur investors could be. DFV's regular updates on his GameStop bets often revealed greater and greater profits — and reached a greater and greater audience. Inspired traders jumped on the GME train, and over the last few weeks this has coalesced into an enormous movement with 2 primary goals. The first is to make $$$. The second is to screw over the wall street elite that's betting against GME.

As traders buy call options (betting the price will go up), market makers hedge their own exposure by buying shares in the open market. If there's enough demand the price will move higher. That's good for everyone except the funds betting the other way — whose short positions begin to show huge losses. If they run out of courage, or money, they have to hedge that short exposure by... buying shares — that sends the share price even higher, triggering more short sellers to cover their position and starting a vicious feedback loop known as a short squeeze.

One hedge fund, Melvin Capital, that had been betting against GME, had to have almost $3bn of capital injected into it to shore up its finances on Monday. Reddit user DFV was up almost $23 million according to his latest update and as we write this, GameStop shares have opened trading at $308, up another 108% on the 93% they jumped yesterday. It's wall street vs. the internet and — for now — the internet is winning big.