Dimon In The Rough

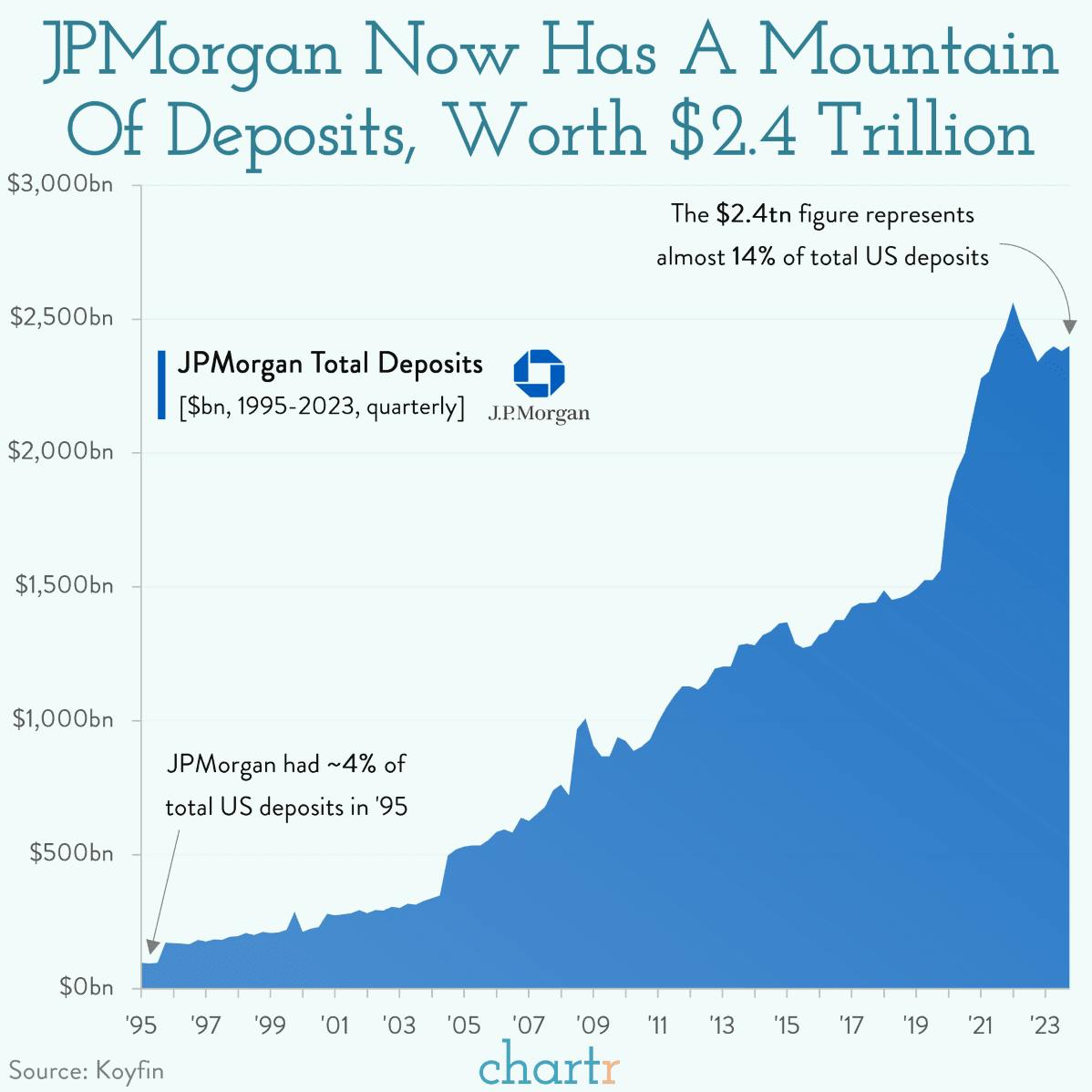

There are banks, and then there are really big banks, like Goldman Sachs, Wells Fargo and Bank of America… and then there’s JPMorgan, which has ballooned into a financial behemoth unlike any other in history over the last 20 years, holding some $2.4 trillion in deposits.

At the head of JPM is Jamie Dimon, a 67 year-old New Yorker, who pocketed a cool $36m last year, according to a regulatory filing made yesterday, after steering the company to its best ever financial year, in which it booked almost $50 billion in profit. That was one of the strongest reports from America’s banks earnings season, which has generally seen a healthy set of results, as America’s economy continues to defy expectations of an impending economic slowdown.

Running up that hill

It’s been less than a year since Silicon Valley Bank imploded almost overnight, sending shockwaves through America’s banking system, and leading to JPMorgan rescuing First Republic from collapse in May, reminiscent of its actions during the 2008 financial crisis, when it acquired Bear Stearns and Washington Mutual.

With every passing year, the sheer gravity of JPMorgan’s size makes it a compelling place for companies, individuals, and even governments, to store their cash. In fact, as of the latest data, roughly $1 in every $7 of deposits (~14%) is stored at the House of Dimon.