LinkedIn wants to use games and AI to keep you on the site

LinkedIn is a strange mosaic of features, but it makes a lot of money

Gamification

LinkedIn, the Microsoft-owned platform where people go to network, look for new jobs, or post nonsense dressed as enterprise sales wisdom, has added mini games and artificial intelligence features to help visiting become a “daily habit” for users, the site’s editor-in-chief told the FT.

The first games dropped in May, with some LinkedInners surprised by how fun the puzzles are, as the platform shifts further from its work-oriented origins. While its artificial intelligence features are likely a little less entertaining (employers can enlist AI assistants to “simplify the recruitment process” or “optimize job posts”) LinkedIn execs are hoping that the tech will see more of their ~1 billion members become power users.

B2Bs, humblebrags, and billions

After launching in 2003 and going public in 2011, LinkedIn has become a necessary platform for employees and employers around the world. In 2016, Microsoft splurged more than $26 billion to buy the company, making it the tech giant’s most expensive acquisition at the time. It’s hard to predict the future, but articles like “4 Reasons Microsoft Wasted $26.2 Billion To Buy LinkedIn” reflected a common school of thought at the time, with many questioning the platform’s financial potential.

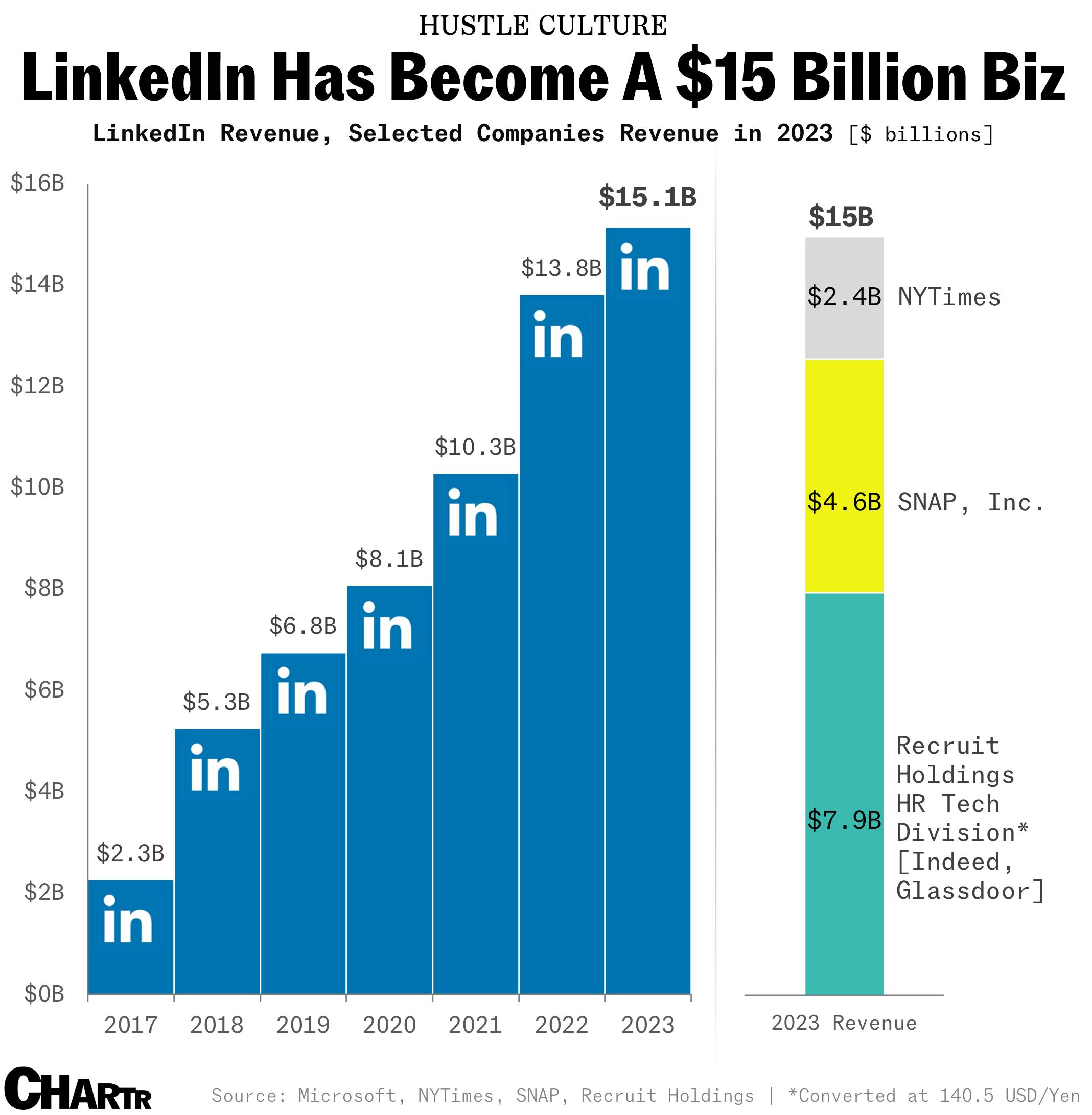

The mosaic that LinkedIn has become — a corporate social network, a job platform, a newsfeed, and now a games hub — might seem slightly strange, but the financial results are hard to argue with.

Indeed, last year LinkedIn contributed more than $15 billion in revenue, over 6x what it managed in its first year under the MSFT umbrella. Its premium subscription offering accounted for $1.7 billion of that, while another $7 billion came from hiring software that LinkedIn sells to recruiters.

While adding mini games and AI features might sound like the sort of efforts that Snapchat or Netflix would roll out, the additions reflect LinkedIn’s ambitions to go beyond the boring “congratulations on your new role” type of posts that often dominate users’ feeds.

Authors of this article own shares in Microsoft.