Just do it, direct: Nike's latest numbers reveal how its direct-to-consumer strategy is progressing

Just do it, direct

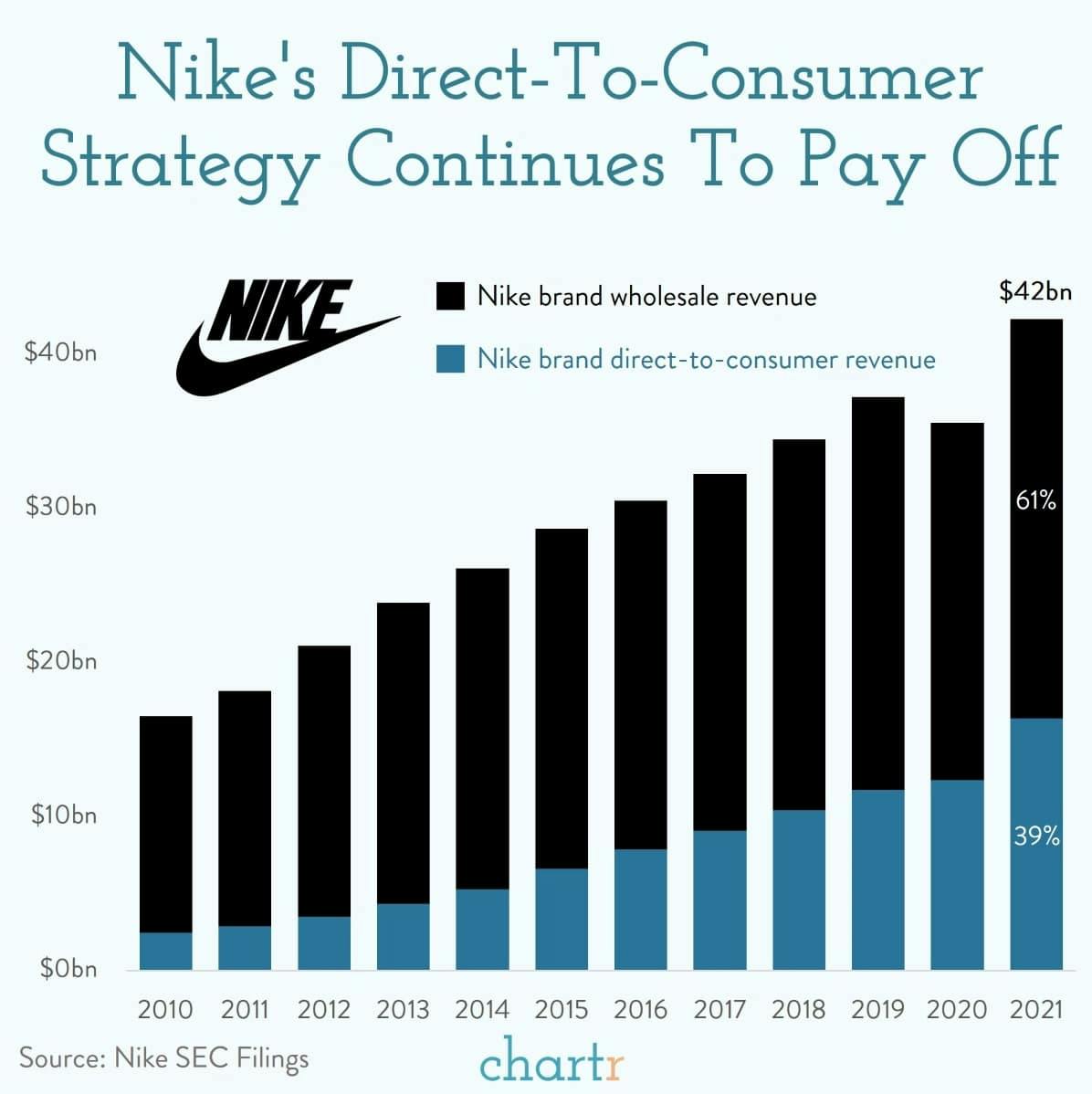

Nike's direct-to-consumer strategy is starting to pay off — big time.

This week Nike reported that its total Nike brand revenues for the 12 months ending in May topped $42bn for the first time. A whopping $16.4bn, or almost 40% of that total, came from direct sales to consumers. That's up from 35% last year when we charted this data.

The Nike marketing machine

Going direct to consumers sounds like a no-brainer. You cut out the middlemen (retailers) and get to keep a higher profit margin. But it also means you have to do a lot more. Customer service, managing returns and refunds, shipping and, most important of all, getting in front of your potential customers.

Nike continues to spend more than $3bn a year on what it calls "demand creation expense" (we'd call it marketing), keeping its association with the best athletes and stars across a wide variety of sports. That's a big number, but it's actually only around 7% of Nike brand revenue.

In reality, Nike is reaping the rewards of years of investment into its brand, even becoming Gen-Z's favourite clothing brand.

It's one thing for Nike, which is one of the most recognizable brands on the planet, to start cutting out retailers and going direct. But if nobody's heard of your brand, it's not quite that easy — and you'll probably have to spend a lot more than 7% of your revenue on marketing, demand creation expense, or whatever you want to call it.