Uphill struggle

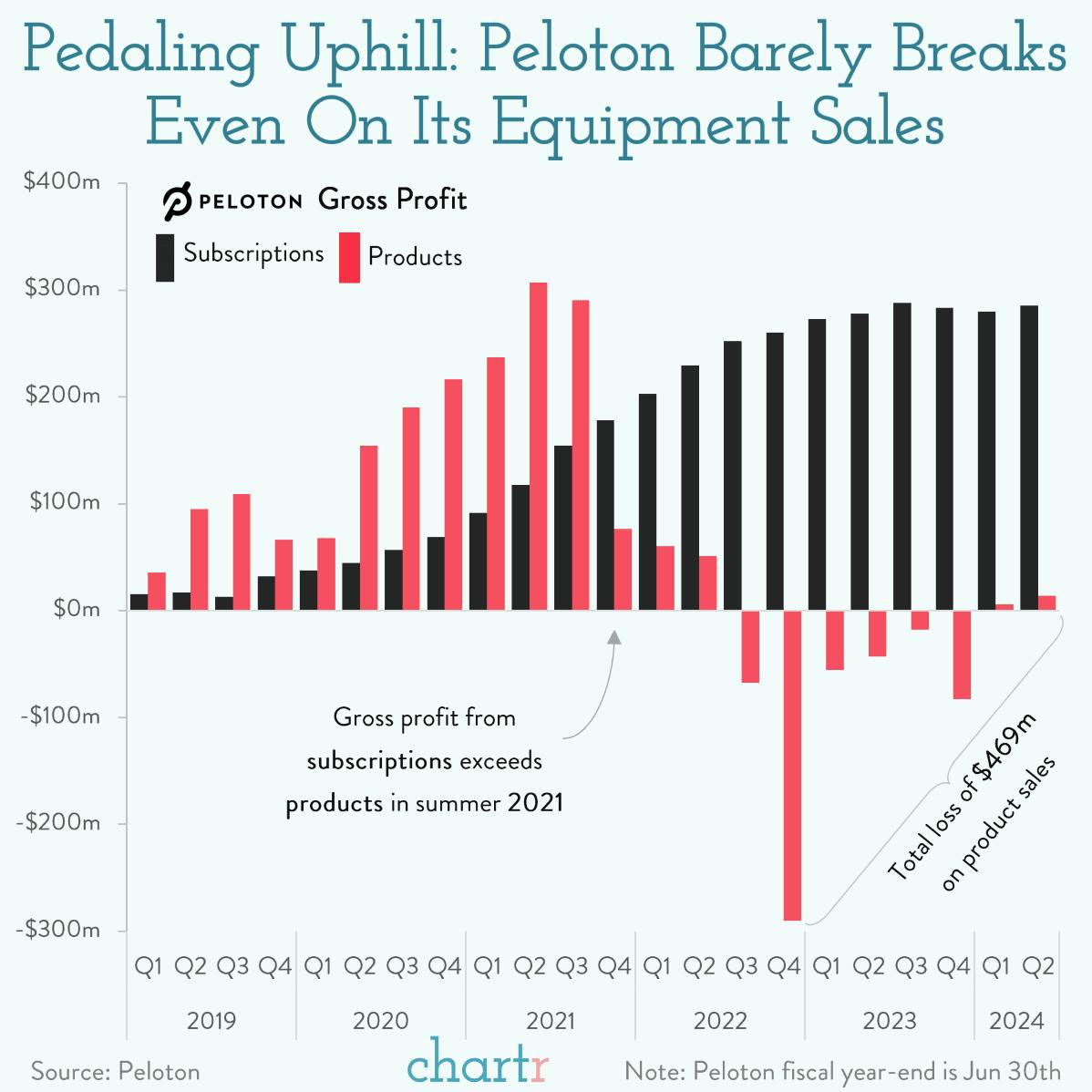

If you’ve ever wanted to buy a Peloton bike, but never wanted to part ways with the ~$2,000 required to get one, you might be able to justify the expense to yourself knowing that the company likely won’t be making any money from your equipment purchase.

Indeed, yesterday Peloton reported another strained set of earnings, slashing its outlook for the coming year and sending its shares down 25%: an all-time low for the company once hailed as the pandemic’s fitness savior. The high-end bike and treadmill maker reported that, in its latest quarter, it made just a sliver of gross profit ($13.8m) on actual product sales — that’s profit only derived from the sale of the item itself. Once sales and marketing expenses, general & administrative expenses, research and development costs, or any other “overheads” were accounted for, Peloton remained deeply in the red.

Shifting gears

Current CEO Barry McCarthy took the reins in February 2022, when gyms were fully reopened and product issues were shaking Peloton. Cutting prices helped stem the losses, but it left the subscription business as Peloton’s financial backbone, relying on the famously energetic live online classes to pedal the company forward. However, despite deals with Lululemon and TikTok — as well as new distribution channels through third-party retailers like Dick’s Sporting Goods and Amazon — Peloton just hasn’t been able to grow subscriptions meaningfully in recent months.

On paper, the business model isn’t inherently flawed: Costco, for example, has a wildly successful subscription-based service, selling a wide array of products for close to cost but profiting enormously on the membership needed to shop there.