Don’t sweat the competition

Fitness giants Lululemon and Peloton are teaming up, announcing a 5-year partnership on Wednesday, releasing a line of co-branded clothing, while Peloton will produce content for Lululemon's exercise app The deal comes after years of both companies slowly encroaching on the other’s part of the fitness market.

In 2020, clothing giant Lululemon spent $500 million acquiring Mirror — a $995 device that allows users to work out in front of a huge, mirror-like 43-inch screen, signaling that Lululemon's intention to compete with Peloton during the peak of the pandemic-fuelled at-home fitness craze. Peloton then charged headfirst into the world of apparel, eventually triggering a legal battle with Lululemon over borrowed designs, before the matter was settled out of court.

Mirror, mirror on the wall

_Leggings were most profitable, after all_. That’s the likely conclusion of any recent Lululemon board meetings, as the company throws in the towel on its Mirror product entirely, stopping hardware sales by the end of 2023.

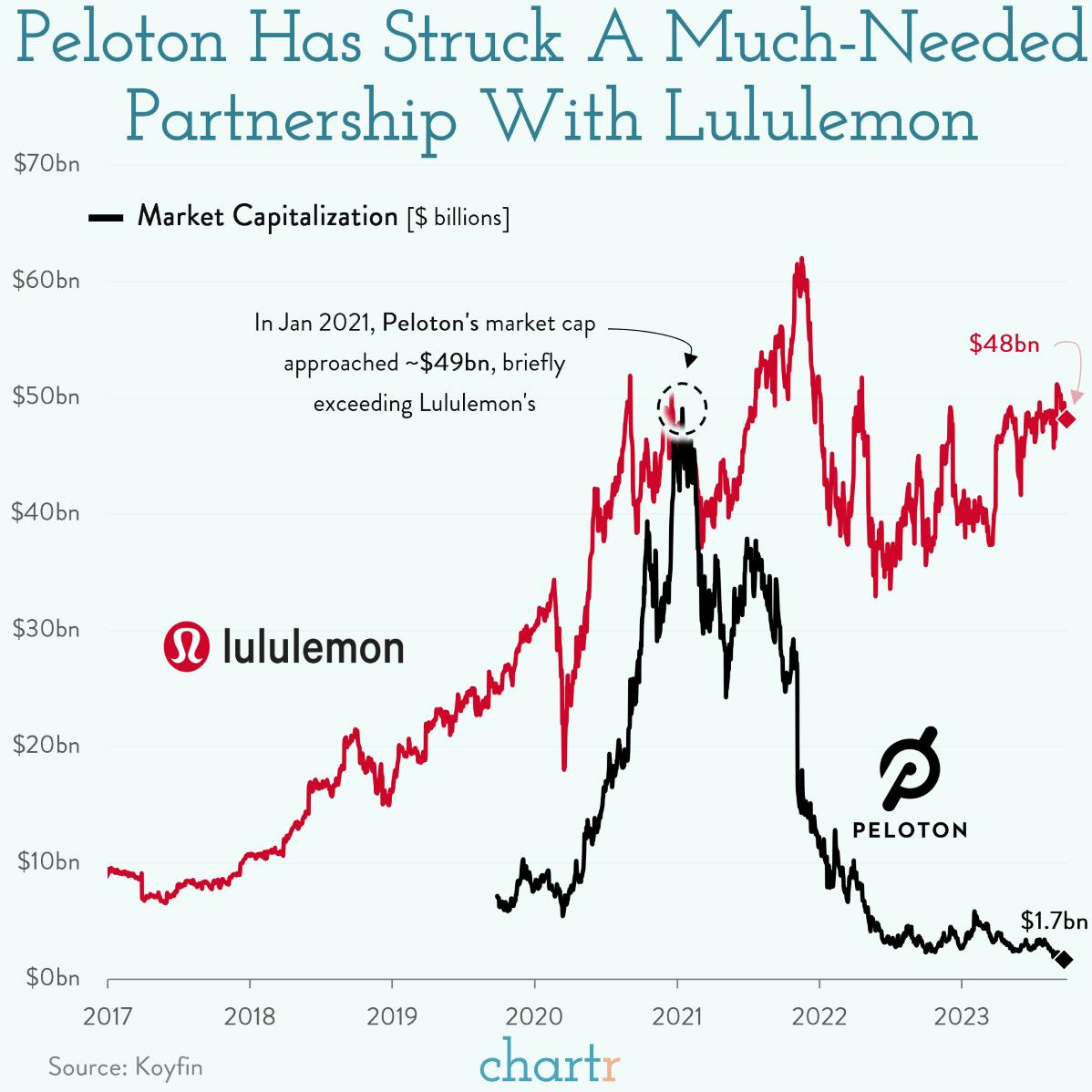

Of the two companies, the tie-up is a much bigger deal for Peloton (investors agreed) as shares in the fitness equipment company have lost a lot of their former shape — the company’s market cap is down 97% from its pandemic peak, as gyms re-opened and product issues rocked the company. Lululemon’s stock, on the other hand, has mostly held onto its pandemic gains — demand for premium gym wear hasn’t gone anywhere.