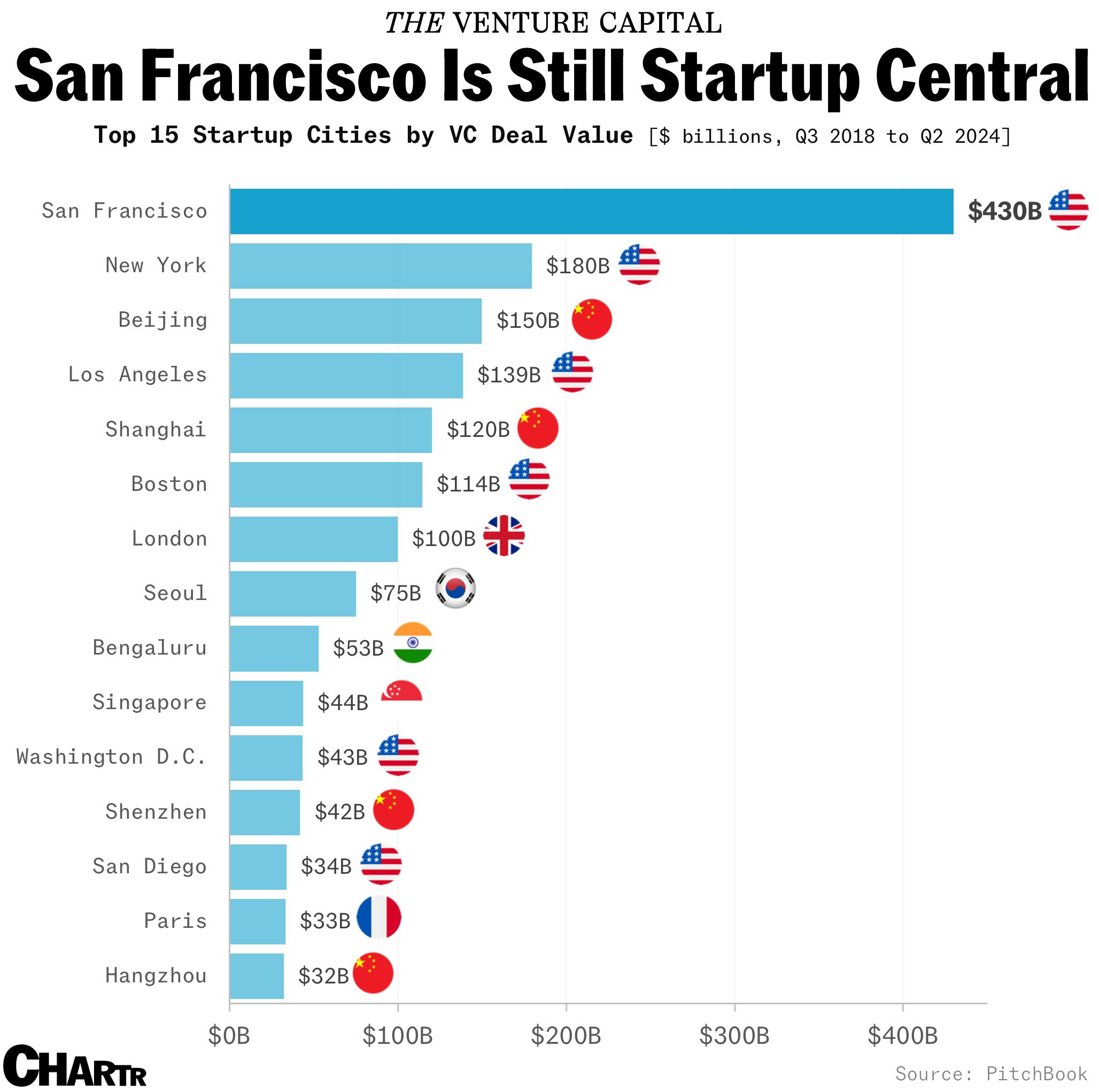

San Francisco is still the startup capital of the world

…and it’s not really close

In the same way that aspiring actors head to Hollywood to make it as a star (which now might be harder than ever), San Francisco — and its surrounding suburbs and towns — has long been the mass at the center of the startup universe, with founders flocking to the city, hoping to absorb the magic they’ll need to turn their company into a household name.

During COVID, as remote work spread across the country, there were a number of threats to its dominance. Austin and Miami pulled fledgling companies to their streets and some predicted San Francisco’s downfall as the tech hub. But, despite competitors at home and abroad, SF remains the largest hotspot for venture capital activity.

Indeed, according to PitchBook’s latest Global VC Ecosystem Rankings, in the six years leading up to Q2 2024, a massive $430 billion in venture funding flowed into SF-based startups — more than double the amount raised in New York, which was second. By comparison, Beijing attracted just over a third of San Francisco’s total deal flow.

On a global scale, the US leads with a total deal value of $1.2 trillion, more than double China’s $545 billion and substantially ahead of the UK’s $144 billion figure. And, with $300 billion worth of “dry powder” in the VC ecosystem, there's plenty of cash waiting to fuel the next generation of unicorns. Much of it is in San Francisco, and much of it is likely to end up in the bank accounts of AI startups, which have come to dominate the space... and led to some truly outlandish valuations.