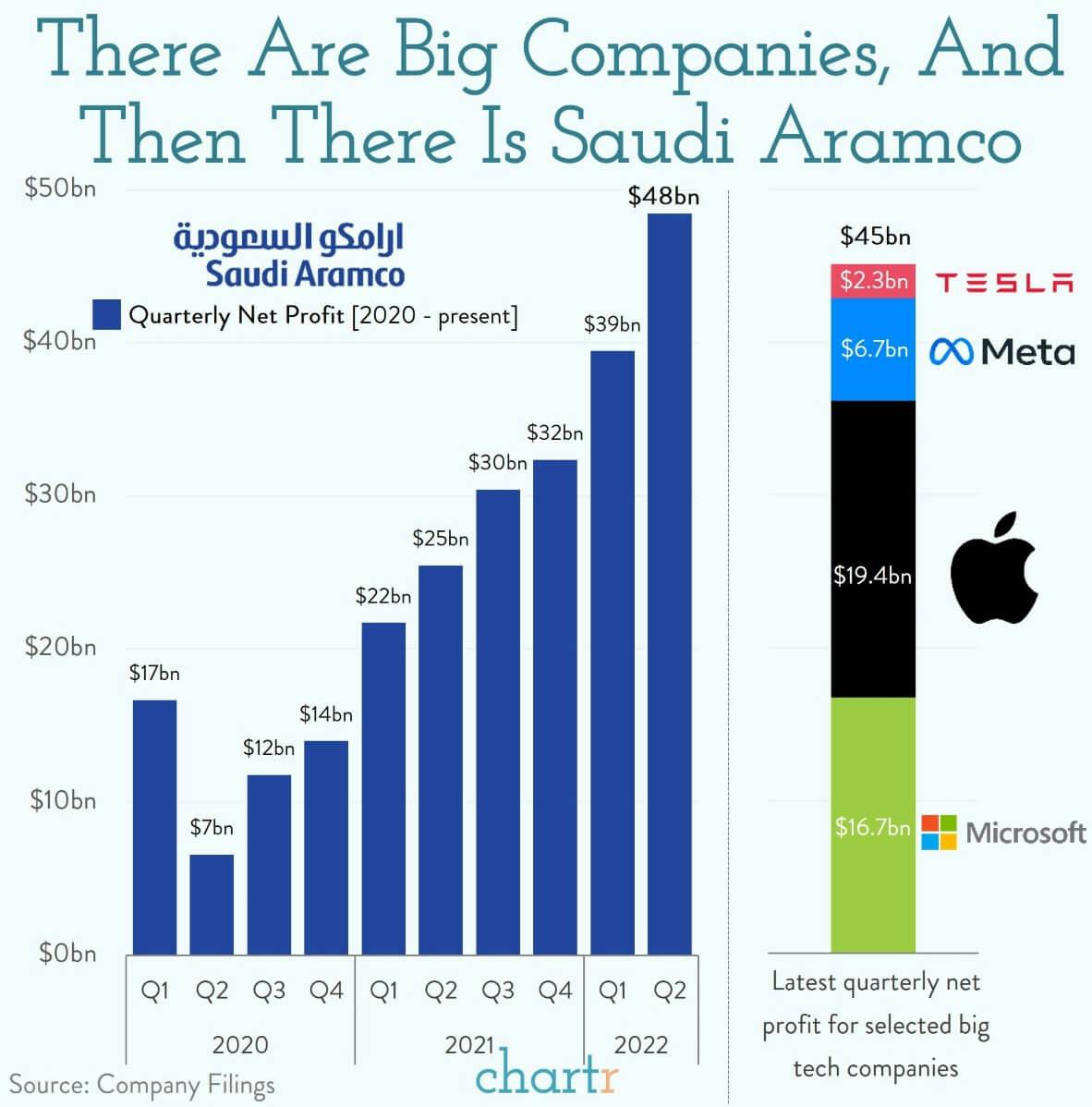

Been wondering where all that extra money you've been shelling out on gas over the last year has been going? Well, there's a decent chance at least some of it ended up in the pockets of Saudi Aramco, the world’s biggest oil firm, which this week announced a staggering $48.4bn of net income for the second quarter — an eye-watering sum even by their standards.

The Saudi Arabian company, which is largely state-run, is the latest to benefit from rising oil and energy prices, as many countries attempt to wean themselves off Russian supplies.

There’s Big and there’s BIG

It's hard to convey how big Saudi Aramco truly is — but the best bet is to compare it against the behemoths of big tech. Incredibly, Aramco’s net income more than doubles Apple’s comparatively measly $19.4bn in their latest quarter — and it takes adding Microsoft, Meta and Tesla to get to a number that's even slightly comparable to what Aramco pulled in for Q2.

Aramco’s results this year will be a huge boon for the state’s Public Investment Fund (PIF) — the financial body that invests on behalf of the government and seeks to expand Saudi prospects beyond oil. The PIF’s portfolio is certainly diverse: so far they’ve bought a soccer team, set up a controversial golf series, and are even attempting to establish a mirrored metropolis to “revolutionize our current way of life”.