Yesterday, Saudi Aramco announced record profits of $161bn for 2022, up 46% on the year prior.

That's the best year on record for the oil giant, which is ~95% state-owned, and the company remains second only to Apple on the list of the world's most valuable companies with a market cap of $1.9 trillion. Despite pressure to fund green projects, Aramco is planning to spend $45-55bn on capital expenditures this year, having warned of “persistent underinvestment” in the oil and gas sector.

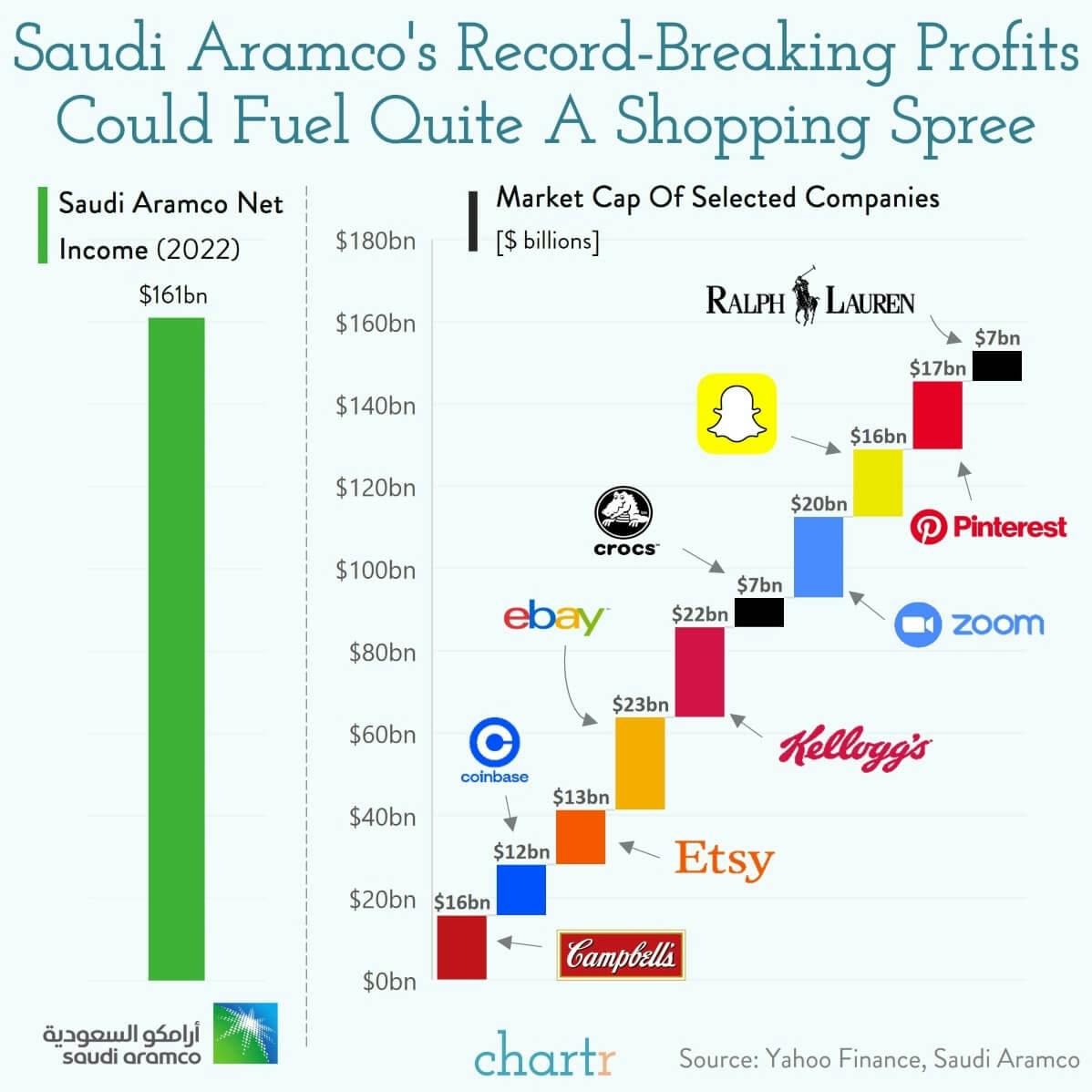

Shopping spree

Aramco’s CEO, Amin Nasser, said that “this is probably the highest net income ever recorded in the corporate world”.

It’s hard to wrap your head around what one billion can buy, let alone $161bn, but one exercise to give context is to think about the companies Aramco could (very theoretically) acquire. A combination of 10 that we came up with was: Campbell's, Coinbase, Etsy, eBay, Kellogg’s, Crocs, Zoom, Snap, Pinterest and Ralph Lauren. At current market prices that shopping list would come to ~$153bn, leaving Saudi Aramco with some change left over (remember this is just one year's profit).

Aramco’s record year is also good news for the Public Investment Fund (PIF) — Saudi Arabia's sovereign wealth fund, which is investing heavily to try and diversify the national portfolio away from oil. The most high-profile investments have come in the world of sport, with PIF funding the breakaway LIV Golf tour, purchasing Premier League soccer club Newcastle United and signing various deals in the world of Formula One.