Shake Shack reported this week that its sales grew 17% last year, with operating losses narrower than analysts had expected.

After starting life as a humble hotdog stand in Madison Square Park in 2001, “The Shack” was eventually upgraded to a kiosk in 2004, but the burger chain didn’t fully take shape until 2010 when it opened its first store outside of New York. Since then, the company's restaurant count has grown quickly, with a total of 436 Shacks worldwide — though the financial side of the business hasn't stacked up quite as nicely.

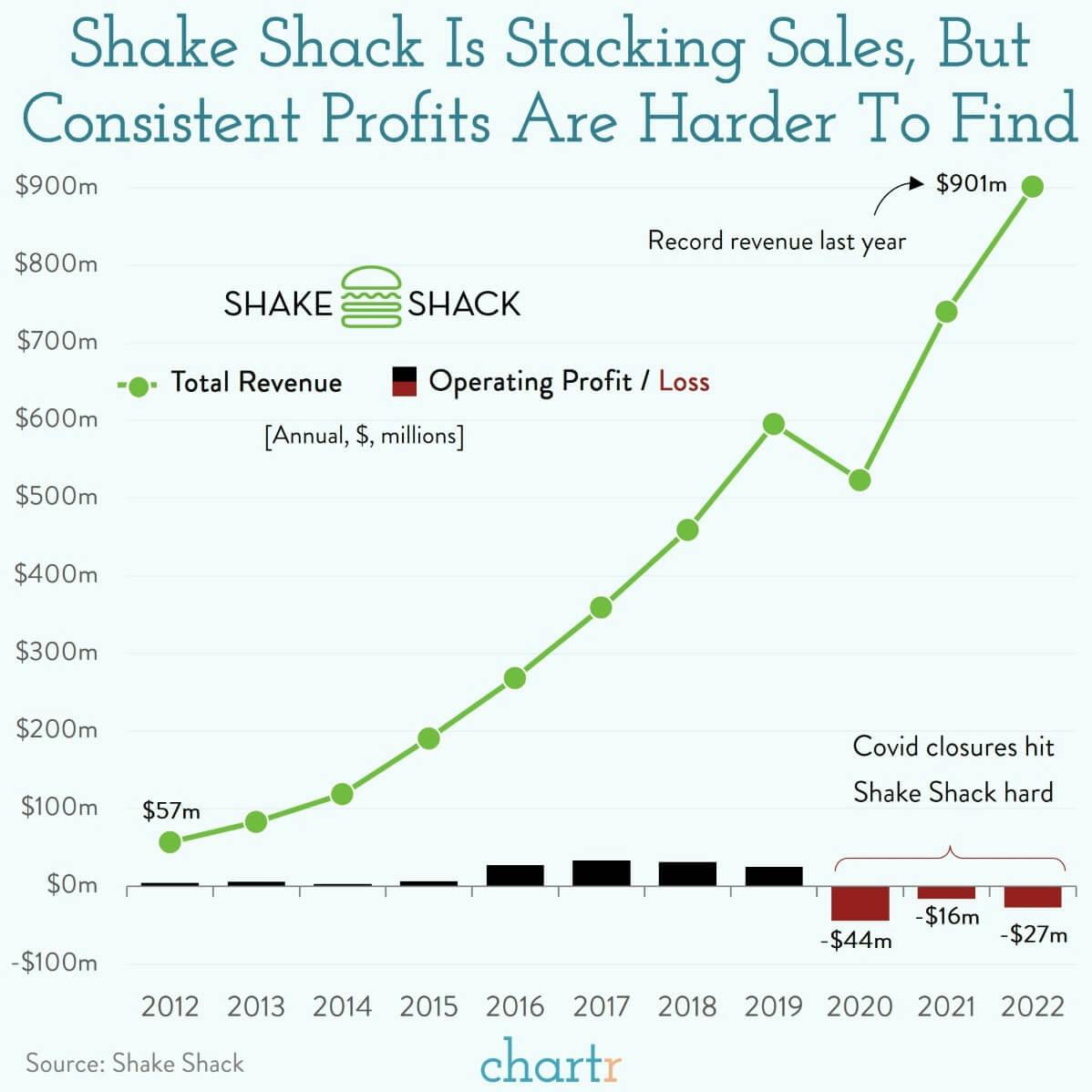

Steep shack

Shake Shack’s slim margins are hardly uncommon in the world of casual and fast food, but things really turned for the chain when the pandemic took a big bite out of its business. Revenue shrunk to $523m in 2020 and the company’s modest operating income quickly turned to a $44m loss. While revenues have bounced back since — the Shack took in over $900m last year — the company still hasn’t been able to get out of the red.

Shake Shack execs will be hoping that a new luxuriously decadent white truffle range will be the key ingredient to boost its margins. Unfortunately, it may have trouble convincing customers who already see it as the chain that offers the least “bang for your buck”.