Shein bright

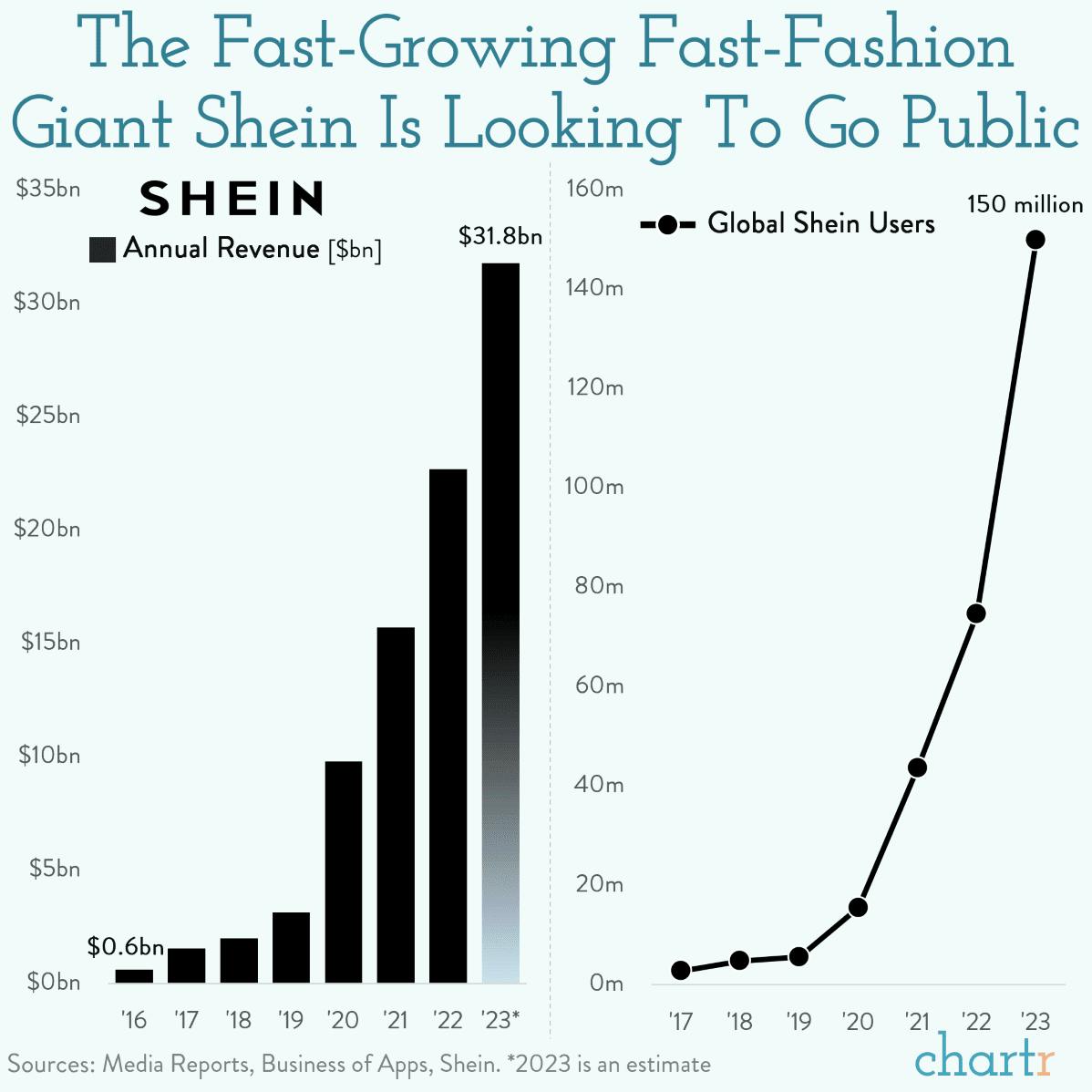

Fast-fashion giant Shein has filed confidential paperwork for a potential public listing in early 2024, seeking a valuation of up to $90 billion (per Bloomberg), which would make the 15-year-old company more valuable than Lululemon and H&M combined.

Established in China in 2008 as ZZKKO, Shein puts the fast in fast fashion: dropping as many as 10,000 new items on its website every day, producing items in small batches (50-100), and only ramping supply reactively for any products getting a lot of demand. Its wallet-friendly offerings — like earrings for less than 50¢ — have won over young consumers across the world, with its US customer base helping to catapult the company’s sales up 45% year-over-year, to $23 billion in 2022.

Shein hauls

Shein’s success has spawned a wave of aggressive e-commerce rivals, with many, such as Temu, following the company’s strategy of shipping directly to individual consumers — avoiding the need to hold a lot of inventory and dodging millions in import fees.

Once the brash upstart turning fashion on its head, Shein is now an industry giant, securing a staggering 50% share of all US fast-fashion sales as of November 2022 and surpassing titans like H&M and Zara. However, its industry dominance has put the company under the microscope: reports of 75-hour weeks, unsafe chemicals in its production, various environmental concerns, and accusations that it uses forced labor have all marred Shein for years.