March was a month to forget for banks, as smaller institutions bore the brunt of the collapse of Silicon Valley Bank and Signature Bank.

Deposit drain

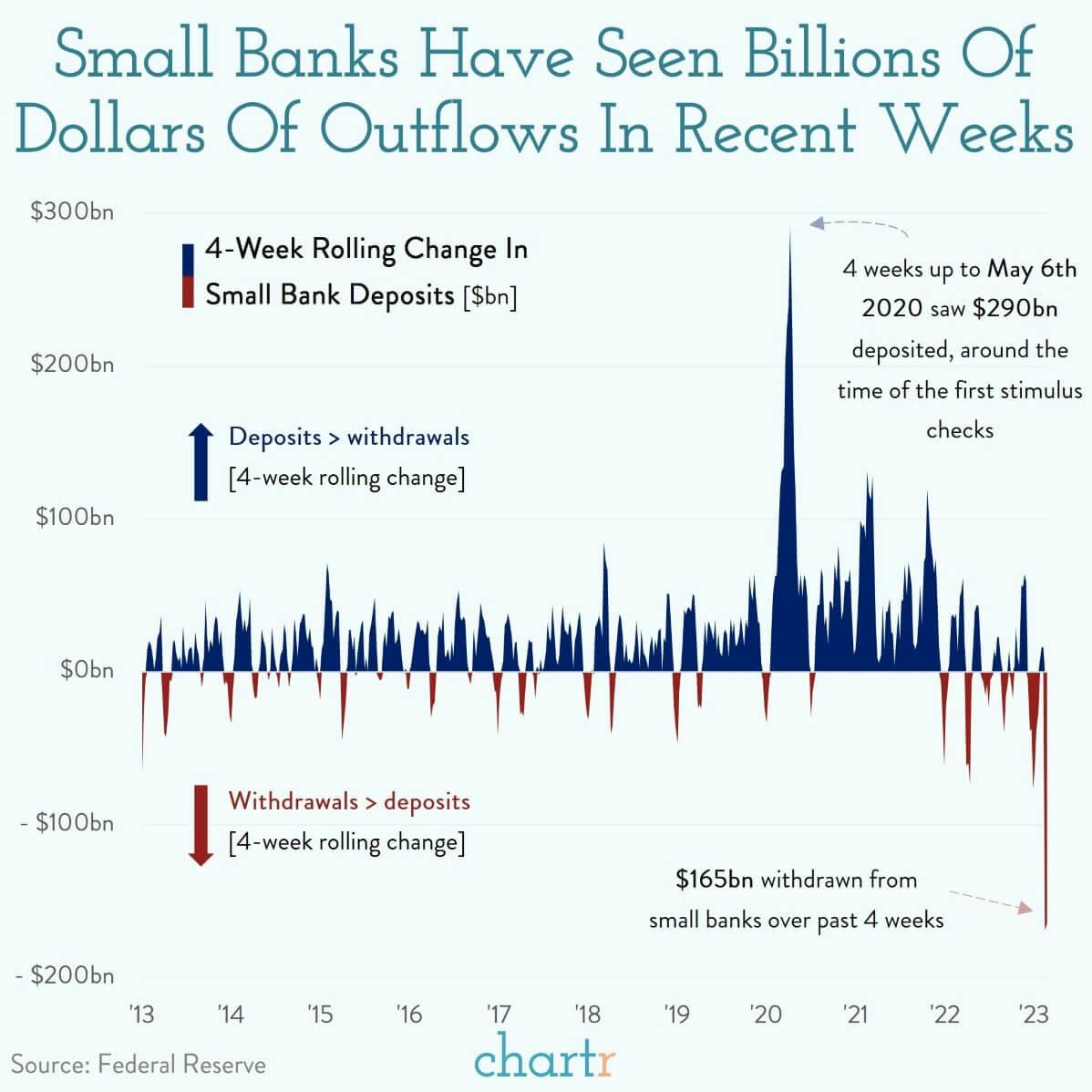

That crisis spilled out of financial circles onto social media feeds, as depositors wondered aloud about the security of their assets — with some concerned enough to move their money elsewhere. Indeed, Federal Reserve data shows that, over the past 4 weeks, smaller banks in the US have seen $165bn withdrawn. That's the largest 4 week withdrawal number since records began in 1973, representing about 3% of total deposits.

Deposit flood

During the pandemic, these smaller banks helped hand out billions in PPP loans whilst also accepting a flood of deposits from people receiving their first stimulus checks — as seen in the data in April and May 2020, when hundreds of billions of dollars were deposited into smaller banks.

However, as depositors lost faith in smaller institutions they turned to the industry behemoths as a safe haven for their cash. The 25 largest US banks saw a $120bn increase in deposits in the week following the two bank collapses, as depositors presumably decided that "bigger was better" in this case. This was more than enough to cover the $30bn that 11 of those larger banks used to help save First Republic and prevent contagion.