Tencent Music has enough users — it just needs them to start paying

The stock is down this morning, undoing some of its stunning year-to-date rise.

Tencent Music Entertainment (TME), China’s largest music streamer, is learning to make more from less — as its user base shrinks but paying listeners grow.

In Q3, the company posted a 27% year-over-year jump in online music revenue — which makes up over 80% of total sales — to $989 million, driven by what it called “solid growth” in subscription revenues.

Indeed, TME has decided that it’s time to cash in, with its paying users for online music soaring to 125 million, more than 5x what it had when it went public in late 2018. Paying subscribers now account for nearly a quarter (23%) of its total monthly active users, up from just 4% seven years ago.

But that push has come at a cost: users are fleeing the platform.

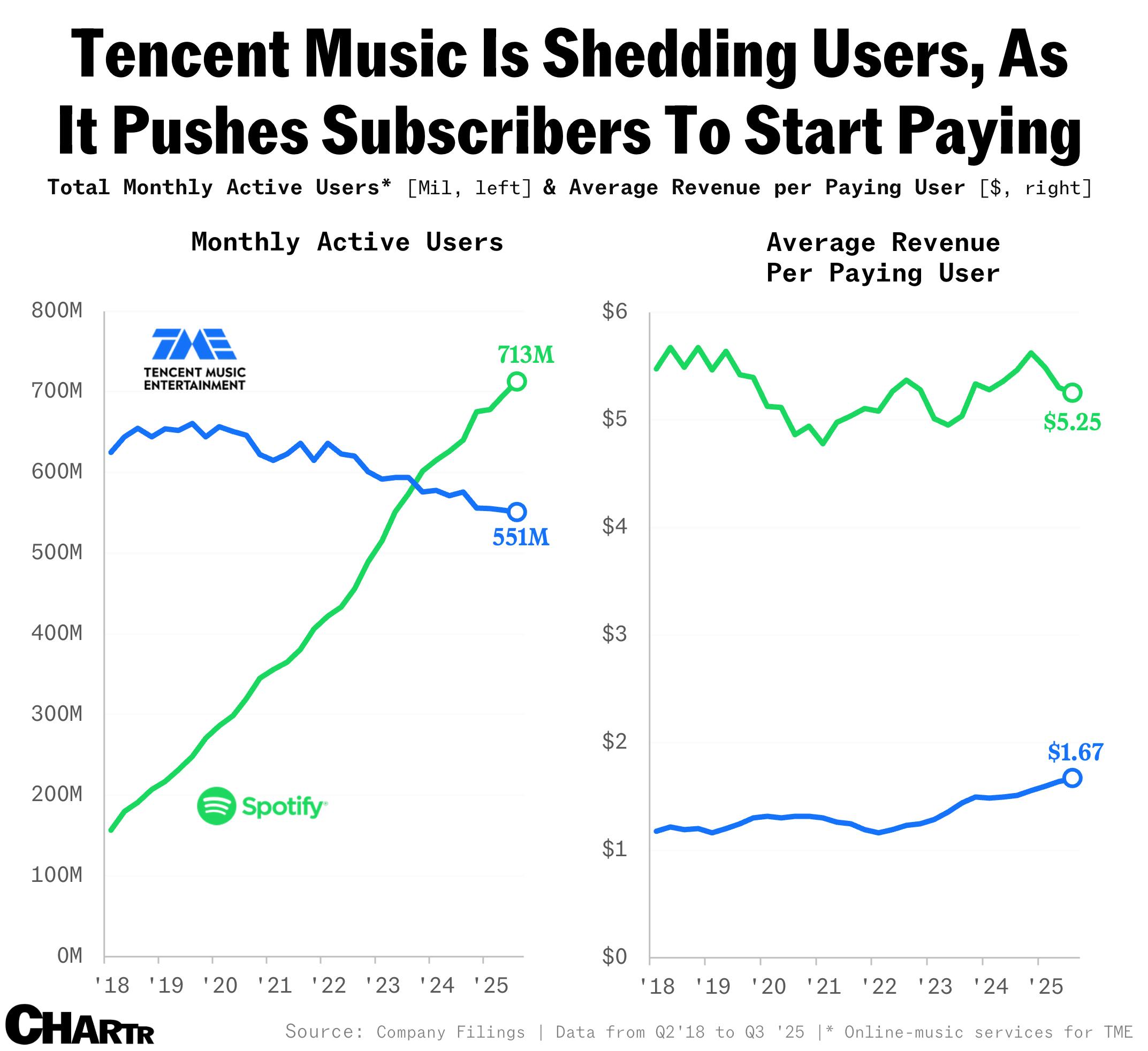

Founded in 2016 through a Tencent-led merger combining three Chinese streaming giants, TME already boasted 644 million total online music users by its 2018 IPO, roughly 3x Spotify’s global count. But after peaking in early 2020, that number has slipped to 551 million, and it now sits below Spotify’s 713 million.

Even so, TME has been getting better at milking the users it has: average revenue per paying user has climbed about 40% since 2018, toward ~$1.70 a month — though its Swedish counterpart earns over 3x more per premium subscriber, at roughly $5.30.

While the two streaming giants operate in largely separate worlds — Spotify everywhere but China, and Tencent mostly within China — TME is seemingly vying for global relevance: last week, the company said it would share its streaming data with Luminate (the firm behind Billboard’s global charts), marking the first time Chinese listening trends will feed into international rankings.