The largest cruise company in the world is back in the black, but profit margins aren’t quite what they used to be

On Monday, the world’s largest cruise company, Carnival Corp., announced that it’s retiring one of its flagship enterprises — P&O Cruises Australia — and folding it into the wider Carnival Cruises brand.

The boats that rocked

Carnival said the move should help further optimize “the company's brand portfolio creating operational efficiencies”... which is just the kind of corporate jargon that investors love. In turn, the company’s shares rose 6% yesterday amidst a strong day for cruise stocks in general — an industry that, after nearly collapsing 4 years ago, has sailed back into profitable territory and is seeking to cut costs wherever it can.

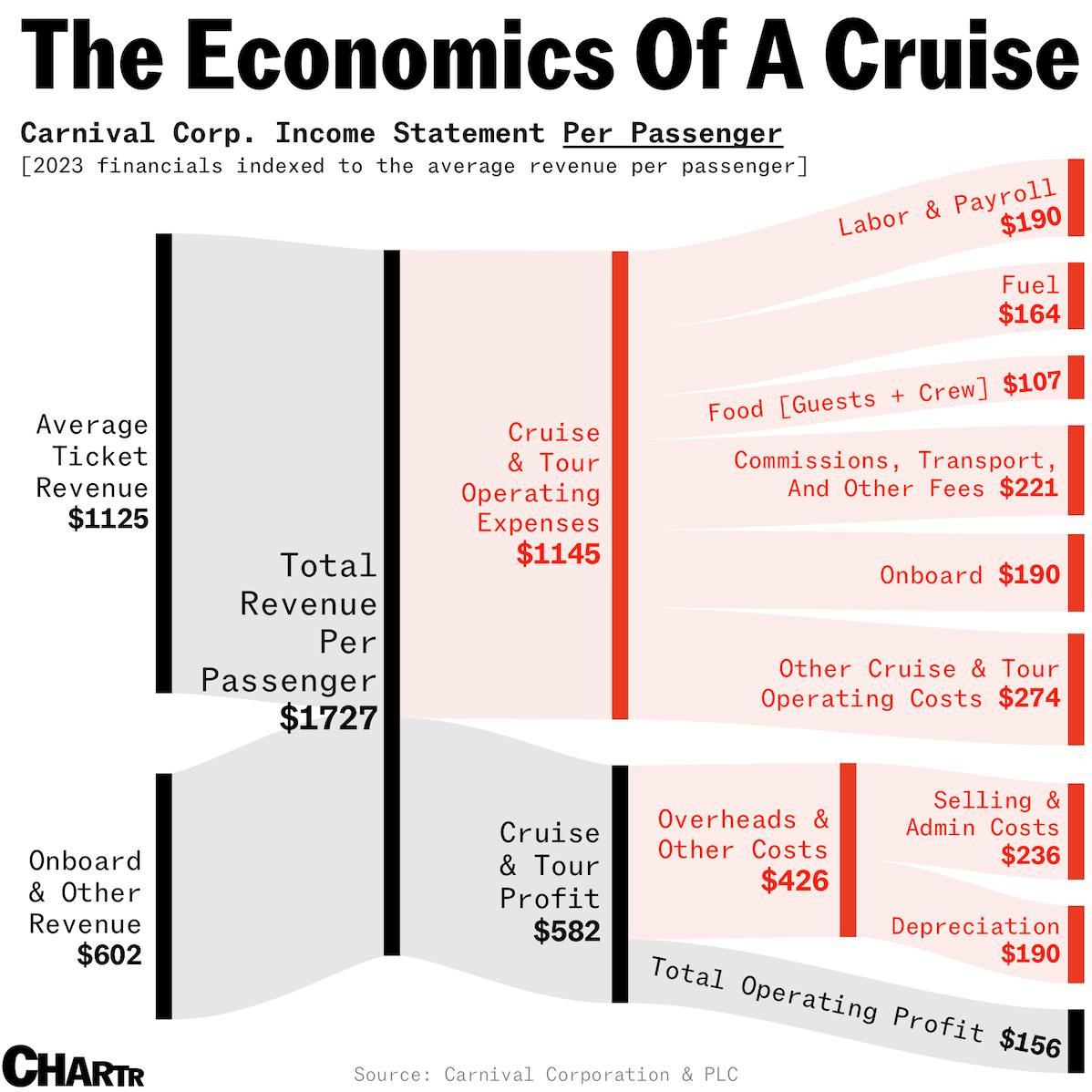

Indeed, 2023 was the first fiscal year since the pandemic that Carnival Corp. reported an operating profit (~$2B), after accruing cumulative operating losses of more than $20B between 2020-2022. So, if you were one of Carnival’s 12.5 million passengers last year, where exactly did your money go?

Per company filings, the average ticket in 2023 would have cost about $1,125. But your wallet doesn’t get off that lightly, with Carnival banking another $600 or so per customer on top of that thanks to excursions, food, drinks, casino games, retail sales, spa treatments, laundry services, internet access, and other onboard concessions.

Actually operating the cruise and tours cost the company $1,145 in our example, leaving a healthy $582 left to cover overheads. Of course, one major cost we’ve ignored until now is the ships themselves. That shows up predominantly in “depreciation”, with the company spreading the cost of its ships over a 30-year lifespan. So, what’s Carnival left with? About $150 out of the original $1,700, or a 9% margin. Company execs will be hoping that cutting less profitable routes will get it back to the 15-16% margins that were common pre-pandemic.