Put bluntly

Last week, online streaming platform Twitch announced it would be laying off over 500 workers, or some 35% of its workforce, with CEO Dan Clancy conceding in a post-announcement stream: “I’ll be blunt, we’re not profitable”.

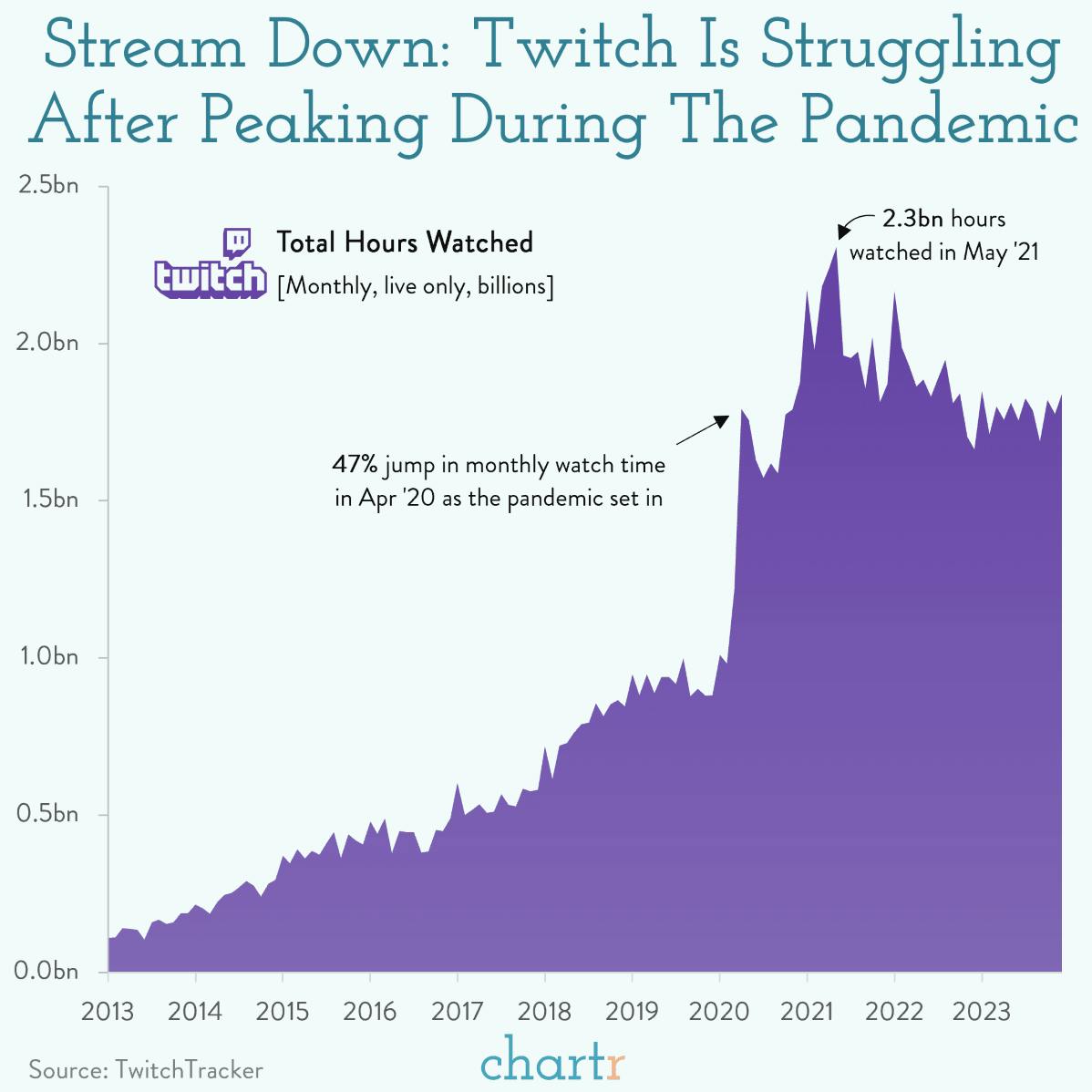

While the cutbacks come amidst a raft of layoffs at Twitch’s parent company Amazon, the platform has struggled to turn its pandemic-era boom into a profitable business. Indeed, when combined with a similar round of cuts last year (the streamer slashed 400 jobs in March), this latest round of layoffs leaves Twitch with roughly half of the staff that it had 12 months ago, at a time when viewership on the platform appears to be falling. Data from TwitchTracker reveals that the total number of hours watched is down ~25% from its 2021 peak, presumably translating into lower advertising revenue.

Watch this space

While much of the talk about the economics of Twitch has focused on the content creators on the platform, of whom only ~0.1% reportedly make above the minimum wage, the company itself has had trouble making ends meet since starting life as Justin.tv in 2007. Indeed, according to Forbes, rival YouTube can only prop up its live streaming platform thanks to its much more lucrative video arm — a safety net that Twitch doesn’t have to fall back on.