Turning a new leaf

Alternative vegan products — mostly soy, gluten, and plant protein fashioned into cow-less burger patties, pork-free sausages, and milk-that-isn’t-milk — have been leading the charge. Investment in veggie-friendly companies saw sales for plant-based foods grow 44% in the 3 years up to 2022, and some predict that plant-based food could make up to ~8% of the global protein market by 2030.

However, the plant-based “meat” market specifically has cooled. Despite US retail sales for plant-based meat doubling between 2017 and 2020, spearheaded by buzzy companies like Beyond Meat and Impossible Foods, purchases plateaued from 2020 onwards, with dollar sales actually shrinking slightly (-1%) between 2021-2022.

**It's just not the same?**

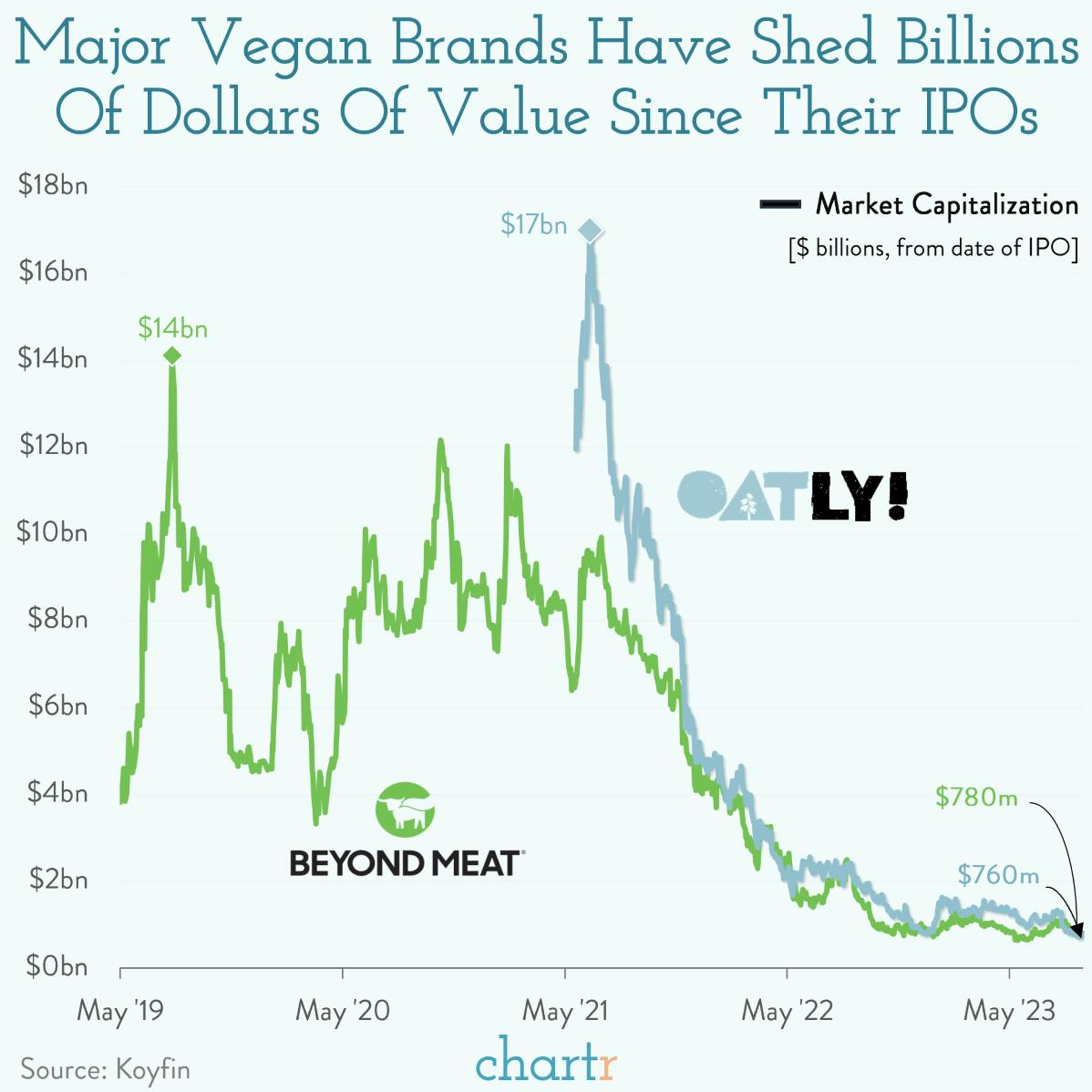

Beyond Meat burst into the field in 2009, having successfully harnessed a technology for realigning protein in plants, before pulling off 2019’s top US IPO — citing Bill Gates and Leonardo DiCaprio amongst its star-studded investors. The company's share price was driven up 163% on its first day of trading, eventually going on to reach a peak market cap of $14bn.

But, per nature, what goes up, must come down: Beyond Meat just couldn't maintain its sizzle, as sales slipped, costs rose and optimism faded. By late last year the company was worth less than $1bn. A similar fate befell the Oprah-backed, oat-derived plant-milk brand Oatly: after the initial excitement of its own IPO, Oatly’s value steadily drained— as we noted later that year — before settling around its current valuation of ~$760m. So far, the next big category-defining vegan-friendly company hasn't hit the mainstream.