Trump is good for crypto, but are Trump’s crypto projects doing well?

We took a look at World Liberty Financial and Trump’s NFTs since the election

Donald Trump’s election win has set the stage for a massive crypto rally that is already gaining momentum with bullish investors betting on the incoming crypto-friendly administration.

The numbers speak for themselves: the total crypto market cap stood at $2.43 trillion on November 1 and has jumped to $3.41 trillion today. Bitcoin’s was hovering around $68,000 on Election Day. Today, it hit over $99,000 in the wee hours of the morning.

But the story is not all positive for the crypto endeavors of the self-proclaimed “crypto president.”

World Liberty Financial, the DeFi crypto project associated with Trump, and its token, WLFI, debuted in October to great fanfare but dismal interest. While the project is not dead in the water, it has been struggling.

.@WorldLibertyFi pic.twitter.com/rHEGQXl4jL

— Donald J. Trump (@realDonaldTrump) September 12, 2024

Just before the election, the company said it planned to sell “up to $30 million” worth of tokens “before terminating sale,” according to an October 31 Securities and Exchange Commission filing — a dramatic cut from the original $300 million ambition for sales.

World Liberty Financial’s website shows that 18.644 billion tokens remain. The project has sold 1.36 billion since its launch.

The token has enjoyed a mini bump since the election, but it’s a far cry from the market rally the crypto ecosystem has been enjoying since November 5. Data on Dune Analytics shows that from Election Day to November 18, the company sold about $6 million worth of tokens, bringing the total raised to just over $20 million, an amount that represents 67% of the smaller, revised target.

What happened?

First, many experts raised red flags about the project, from Anthony Scaramucci calling it a “full-on scam” to Galaxy Digital analysts saying that the launch occurred “not with a bang, but a whimper.”

JUST IN: Anthony Scaramucci calls Trump's World Liberty Financial token $WLFI a "full-on scam" that "hurts the industry."

— Crypto Briefing (@Crypto_Briefing) October 17, 2024

What do you think? pic.twitter.com/hzrb7OGLuR

On top of that, technical problems plagued the site on launch day. The token is available only to accredited investors — limiting the pool of individuals who have access to it — and it’s “nontransferable,” which means that “it is locked indefinitely in a wallet or smart contract,” according to its “gold paper” (most projects have a white paper).

All these factors have dampened investor enthusiasm, said Jon Alper, an estate and wealth management lawyer.

“While it’s premature to declare the project a complete failure, these setbacks suggest a challenging path forward,” Alper said.

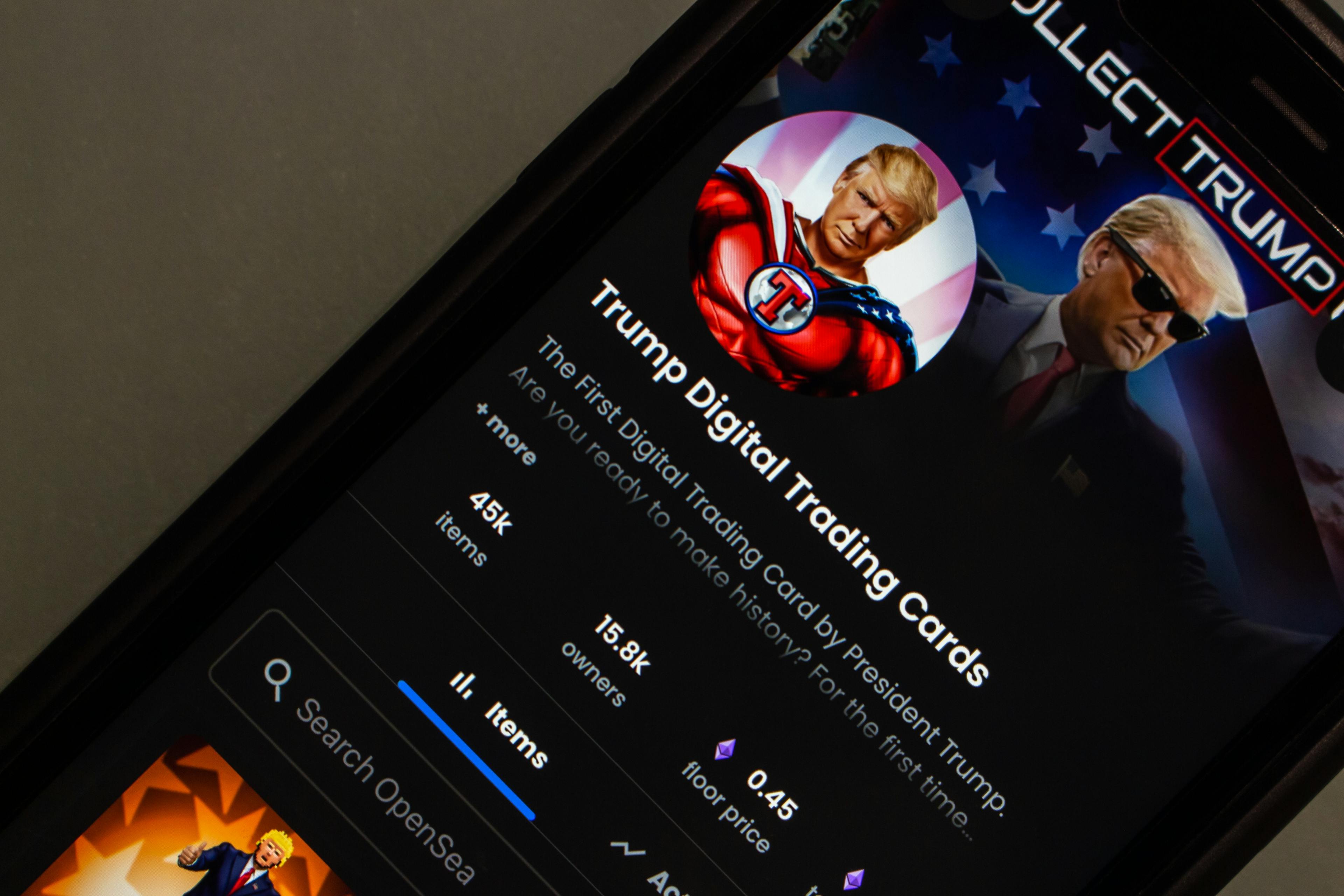

How Trump’s NFT collections are doing

Trump’s digital trading-card collections enjoyed a postelection sales volume spike… but it didn’t last.

Trump has released four batches of NFTs, the last one in August, the “America First” collection, which includes a whopping 360,000 cards. As with previous collections, NFTs were priced initially at $99 and buying a lot of them came with perks, like a dinner with him at Mar-a-Lago or a “piece of the actual suit from his famous debate!” The sale of this edition “has ended,” according the website, which gives no further details.

— CollectTrumpCards (@CollectTrump) August 27, 2024

The first collection, with 44,000 cards, and the second one, with 46,000, sold out. Meanwhile, the third collection, aka “The Mugshot Collection,” of 100,000 NFTs did not, nor did the “America First” edition.

The first NFT collection saw a 963% spike in sales volume 24 hours after the election, but netted just $17,714 in sales, a relatively tiny amount in the NFT market.

“Typically, top collections on Magic Eden or OpenSea get hundreds of thousands if not millions of dollars in daily volume,” Harrison Seletsky, director of business development at digital-identity platform Space ID, told Sherwood News.

And the Trump bump didn’t last. While sales look good for the first and second collection if you consider the last 30 days, with both reporting sales increases of over 200%, it looks a lot worse if you just consider the past seven days, with a 73% drop for the first collection and the second edition seeing a 69% decline in sales.

Similarly, that first collection’s floor price (the lowest price available for any NFT in the collection) saw a huge jump on Election Day to $253 from $135, but it’s back to $104 on November 22, just $5 over its 2022 price.

In comparison, other NFT collections have been able to ride the postelection crypto wave. Popular NFT collections like CryptoPunks are seeing a resurgence of interest, with its floor price hitting over $125,000 today, a rise of nearly 45% since Election Day. The NFT market as a whole saw $181 million in trading volume from November 11 to 17, a 94% week-over-week increase.

Taking the “past performance does not indicate future” results mantra to heart, Trump is still giving new crypto ideas a try. Trump Media & Technology Group is reportedly trying to buy crypto-trading platform Bakkt and filed a trademark for a crypto-payments service called TruthFi on Monday.

Yaël Bizouati-Kennedy is a financial journalist who’s written for Dow Jones, The Financial Times Group, and Business Insider, among others.