OpenAI releases Chrome competitor browser “ChatGPT Atlas,” sending Google shares down

ChatGPT currently poses little threat to Google’s search business, but an OpenAI browser — and the data that comes with it — could change everything.

OpenAI took aim at Google today with its own AI-powered web browser called “ChatGPT Atlas.” The new browser, which is currently only available for Macs, aims to merge ChatGPT with a modern web browser.

An OpenAI team member on the livestream called it “a new kind of browser for the next era of the web.” The newly-unveiled browser could help OpenAI further insert itself into users’ interactions with their computers, and prompt users to more extensively incorporate OpenAI tools in their daily lives.

The initial screen the user sees in the new browser looks a lot like ChatGPT, with a text box in the center. But instead of just entering in the name of a website or search query, users can ask the browser questions. This may take you directly to a website, but it also might search through your tabs and browser history, or pull information together from around the web to deliver a response. Atlas is built on Chromium, the open source version of Google’s Chrome browser.

Google’s AI overviews aim to do a similar thing in response to a search query, but Atlas can deliver answers without pages of search results. Google’s Chrome browser has been key to its domination of online advertising, generating $54.2 billion last quarter alone. Even a small slice of that market would help OpenAI offset the massive losses it is incurring as it ramps up its ambitious infrastructure plans.

One of the key features in Atlas is a persistent “Ask ChatGPT” button which grants the chatbot access to the contents of the webpage being viewed, letting the user ask questions about what is on the page. However, when I tried to ask Atlas questions about the front page of the New York Times, a message popped up that said “ChatGPT is unable to access the contents of this website,” likely due to the ongoing lawsuit between OpenAI and the newspaper.

That’s a reminder that the contents of your journey around the web can be used to train future models. Atlas does give users the ability to opt out, but the setting is turned on by default (but not for Business or Enterprise subscribers). Users can also open an “incognito mode” tab that will not remember what you search for, or what sites you visit.

Atlas has a deep memory — not only does it remember your searches and what sites you visit — your ChatGPT history is available to Atlas as well to help customize responses (this can also be disabled).

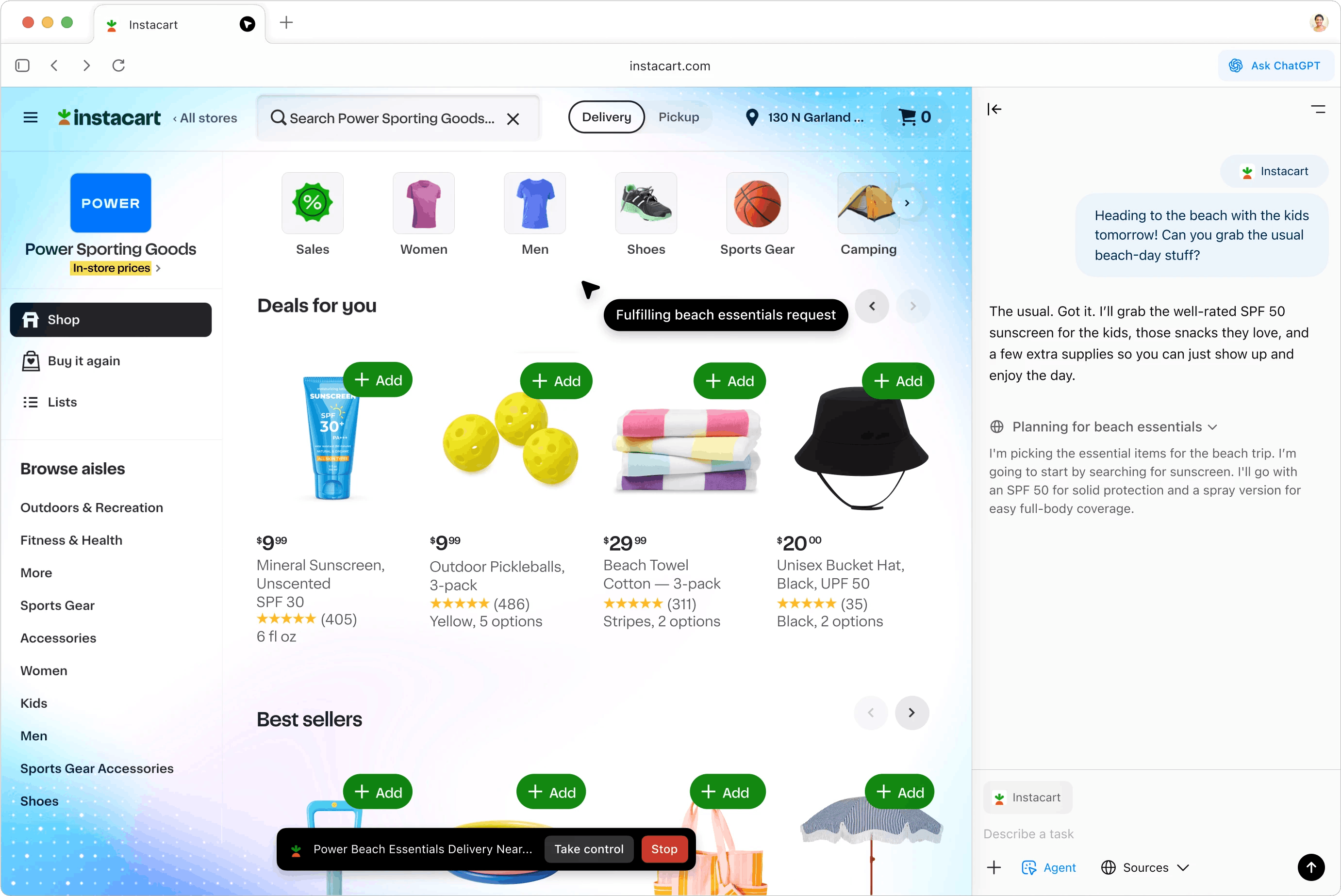

Listed as a “preview” feature, Atlas also has a built-in “Agent mode” that will control the web browser to complete tasks on its own. In the livestream, a demo showed Atlas visiting a supermarket website, and adding items to an order based on a recipe. The task took about 2 minutes to fill the cart.

Shares of Google took a nosedive before the announcement on Tuesday, dropping as much as 4%. After the livestream announcing Atlas, shares recovered slightly, but the stock was still down about 1.7%.