Intel missed the chip boom, now investors, and rivals, are circling

Multiple parties are exploring investing in, or buying all of, Intel, Inc.

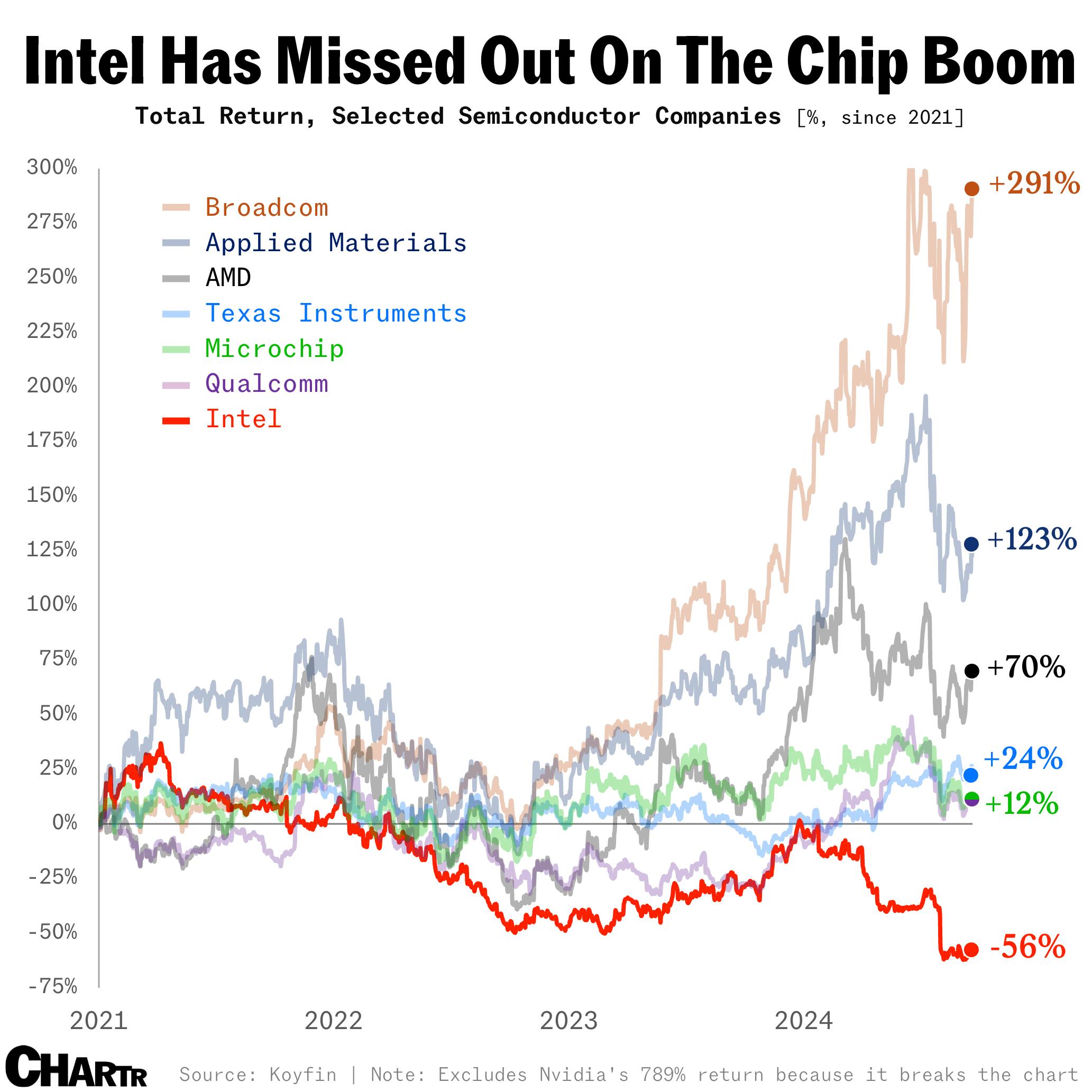

It’s been a good few years to be in the chip-making business — but Intel missed the memo.

Once the most valuable US semiconductor company, Intel has missed most of the AI wave that has propelled the share prices of its competitors. And now private equity firms and competitors are circling. Late Friday, The Wall Street Journal reported that fellow chipmaker Qualcomm has approached Intel about a potential acquisition, while Apollo is reportedly considering a $5 billion investment as the company embarks on an ambitious turnaround plan.

Intel’s stock has shed more than 56% of its value since 2021, while the broader semiconductor sector has experienced explosive growth. In response, the company announced a series of drastic measures last month, including cutting 15,000 jobs, slashing capital expenditures, and eliminating its annual dividend.

Wires crossed

Per The Economist, while many competitors adopted a "fabless" model, outsourcing chip production to foundries like TSMC, Intel doubled down on both designing and manufacturing its own chips. This eventually left the company trailing behind in the race to produce the fastest chips with the smallest transistors — an ironic fate for the birthplace of Moore’s Law.

The AI revolution further laid bare Intel’s lack of innovation. As demand shifted towards graphics processing units (GPUs), Intel’s focus on central processors (CPUs) was unhelpful. Nvidia famously “bet the farm” on the AI trend, and has since surged to a multi-trillion-dollar valuation. Meanwhile, Intel reported a $1.6 billion operating loss last month, resulting in the worst single-day drop in its stock price.

Despite securing funding through the CHIPS Act and announcing a partnership with Amazon to produce chips for AWS last week, Intel shares continue to hover around a decade low. Clearly, investors within both Apollo & Qualcomm see some potential for a turnaround.