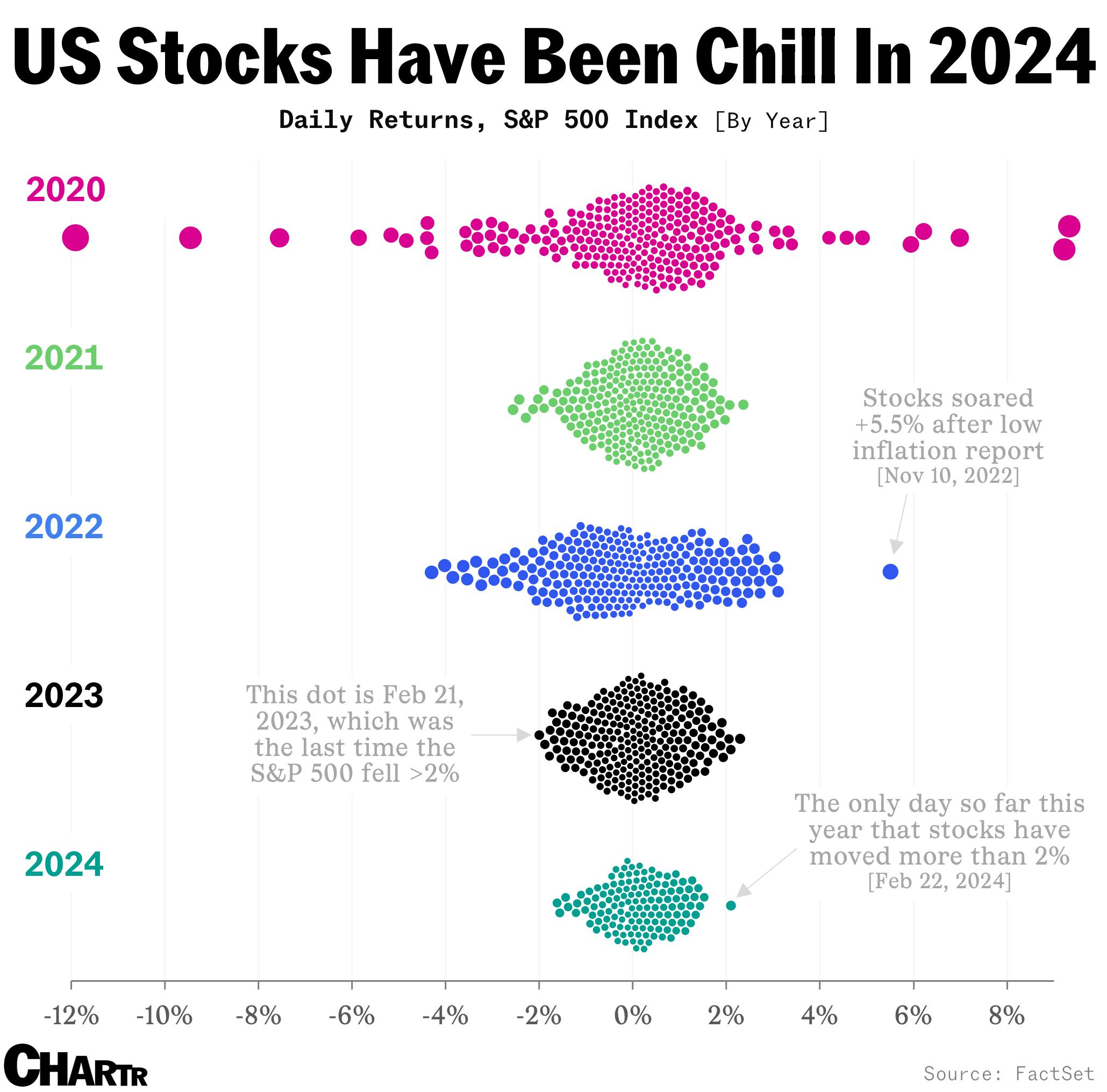

The last time the S&P 500 dropped more than 2% was 512 days ago

US stocks have climbed steadily this year, up 19% so far

Up 20 in ‘24?

The American stock market continues to climb higher, with the S&P 500 Index now just one more little uptick away from a 20% rise for 2024 — a surge that’s been about as smooth as it can be.

The chart below shows every individual day on the US stock market since 2020: so far this year, the flagship American index has only moved more than 2% in either direction once, when it gained 2.1% back in February.

Indeed, the last time the index fell 2% (a common occurrence during the more volatile days of 2020 and 2022) was all the way back in early 2023. That was 512 days, or 351 trading sessions, ago.

Small but mighty

In recent days, the AI trade — which powered much of the gains earlier this year — has given way to a new sentiment, as investors have rewarded smaller stocks. As Luke Kawa wrote yesterday “the Russell 2000 Index gained a whopping 3.5%, its fifth straight gain of 1% or more… making it the largest five-day outperformance of small caps versus the S&P 500 on record”.

Ironically, tech stocks have been the laggards of the last few days. But, everything’s relative: technology is still the best performing sector of the year so far (+25% in 2024).