The records have been coming thick and fast for AI phenomenon Nvidia recently — and yesterday it ticked off two more major milestones. The company crossed the $3 trillion market cap mark and simultaneously surpassed Apple to become the second most valuable company in the world.

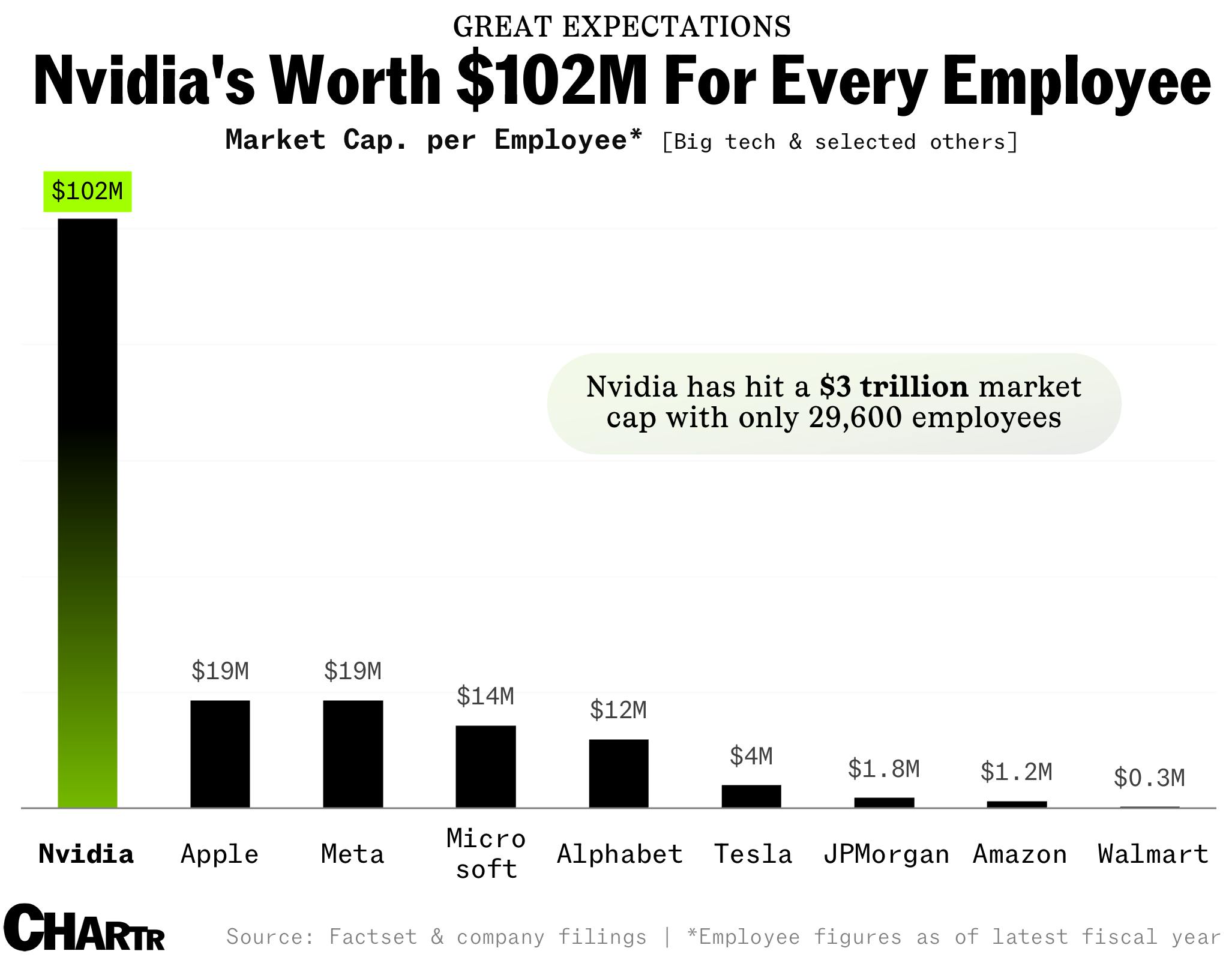

There are a lot of ways to value a company: price-to-earnings multiples, discounted cash flow analysis, or EV-to-EBITDA multiples are all favorites of equity analysts... though each is often more of an art than a science. One really simple fundamental metric is: how much value is being ascribed for every person that it employs? For Nvidia, after this latest run-up took it north of the $3T milestone, the company is being valued at more than $100M for each of its 29,600 employees (per its filing that counted up to the end of Jan 2024).

That’s more than 5x any of its big tech peers, and hundreds of times higher than more labor-intensive companies like Walmart and Amazon. It is worth noting that Nvidia has very likely done some hiring since the end of January — I think the company might be in growth mode — but even if the HR department has been working non-stop, Nvidia will still be a major outlier on this simple measure.

We are running out of ways to describe Nvidia’s recent run... but a nine-figure valuation per employee is a new one.