Nvidia slips after poor guidance from one of its “great partners” and fears of chip export curbs

SK Hynix’s quarterly results and comments from the Dutch prime minister are casting a pall over the industry.

Nvidia is falling in the premarket after one of its suppliers delivered a lackluster outlook and the Dutch prime minister cautioned that additional export restrictions on chips may be in the offing.

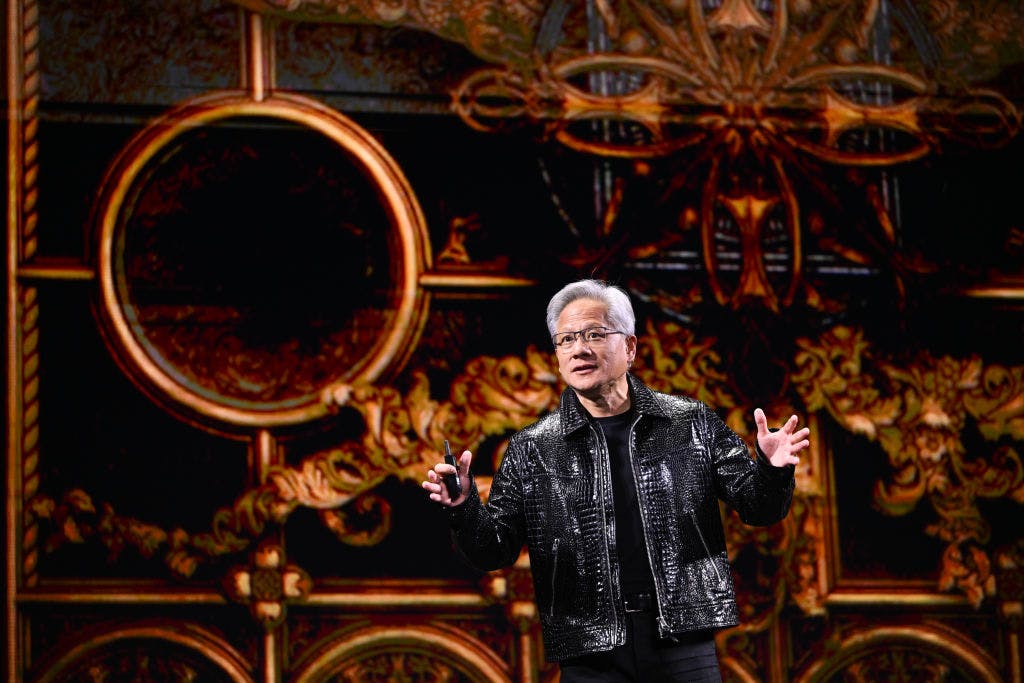

South Korea-based SK Hynix — one of Nvidia’s “great partners,” per CEO Jensen Huang — reported blowout fourth-quarter earnings and raised its dividend. But its guidance for the current quarter and plans to only modestly increase capital spending this year disappointed investors, contributing to a pullback in its shares along with those of the $3 trillion chip designer.

However, the parts of its business most linked to the AI boom still look to be in good shape. Management said that sales of its high-bandwidth memory (HBM) chips, a key input for data-center build-outs, are expected to more than double this year after being up 4.5x in 2024. Meanwhile, the company is looking for “inventory adjustment” in the consumer market in the near term before a recovery in the second half of 2025.

SK Hynix’s outlook, along with comments from Dutch Prime Minister Dick Schoof, appear to be driving consolidation across the semi space after a hot run saw the VanEck Semiconductor ETF rise nearly 9% over the last five trading days amid the rollout of the Stargate project. Micron and Dutch-based ASML are two notable underperformers in early trading on Thursday.

Schoof warned that further export curbs to China under US President Donald Trump’s administration were likely.