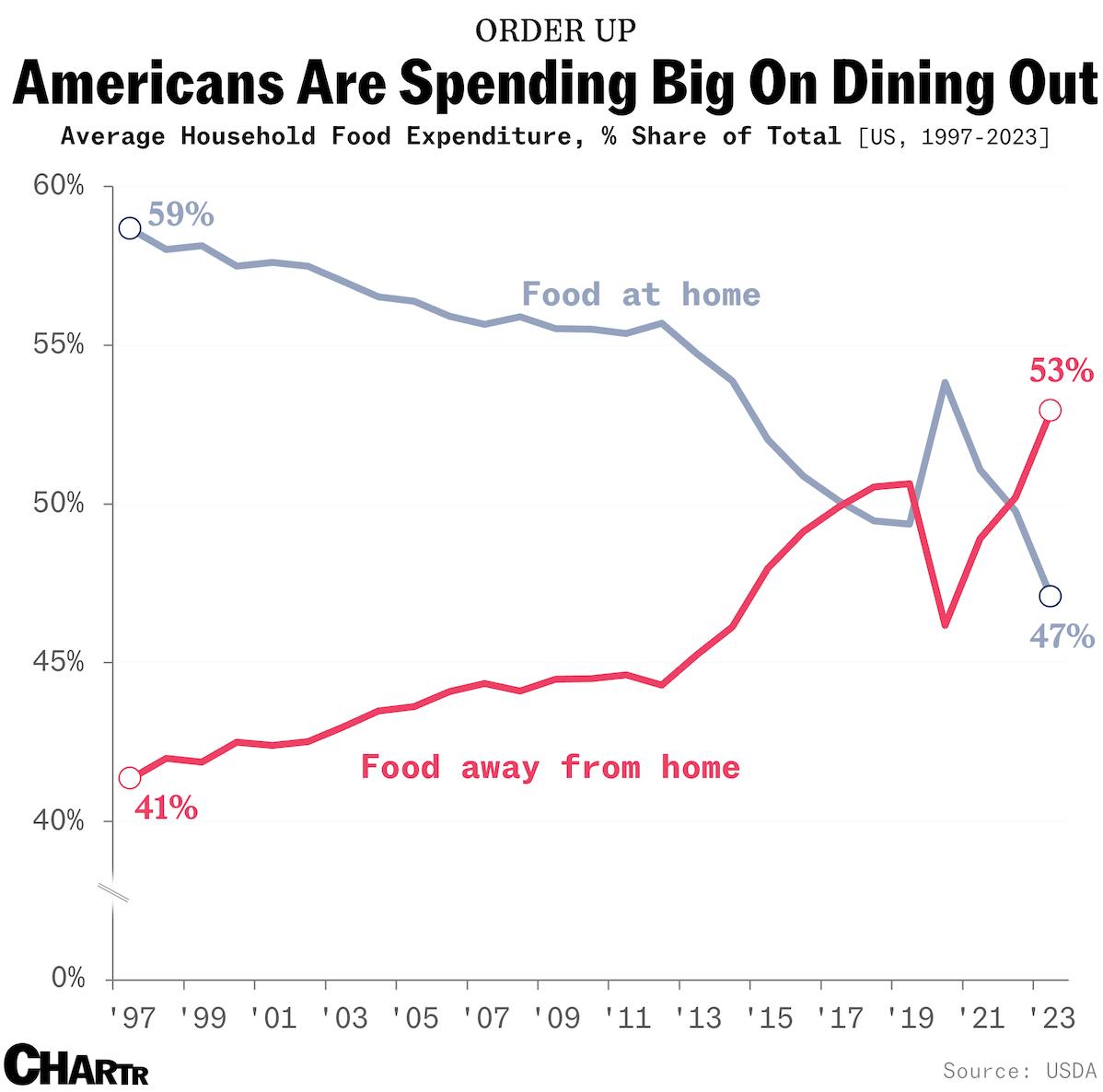

America now spends the majority of its food budget on food away from home

Turning tables

Despite some evidence that the backbone of the American economy, the mighty consumer, could be starting to crack under the weight of inflation, the nation’s restaurant industry remains on track for a record year.

Data out last week from the National Restaurant Association revealed that America’s restaurants — from fine dining to fast food — are set to haul in a total of $1.1 trillion this year, the highest figure on record, a few days later the WSJ reported that the hottest corner of the retail real estate market is the restaurant business.

Those reports underscore one simple fact: America has been dining out more and more, and it's showing no intention of stopping. Indeed, data from the USDA reveals that 53% of household food expenditure is now spent on food away from home, up from 41% in 1997.

That steady shift of about ~12% is associated with so many facets of modern life. The rise of convenience consumption, two-earner households, “foodie” culture, higher incomes, and cheaper and more available fast food have all played their part in America becoming a country that cooks less and eats out more.

On a longer time horizon, another trend is fascinating — America has been spending less of its income on food throughout the 20th century (chart here). But, in the last few years, that has started to tick back up, coinciding with the rise of spending on food away from home. Our takeaway? Food is increasingly an experience that America is willing to splurge on... even when inflation is hurting.