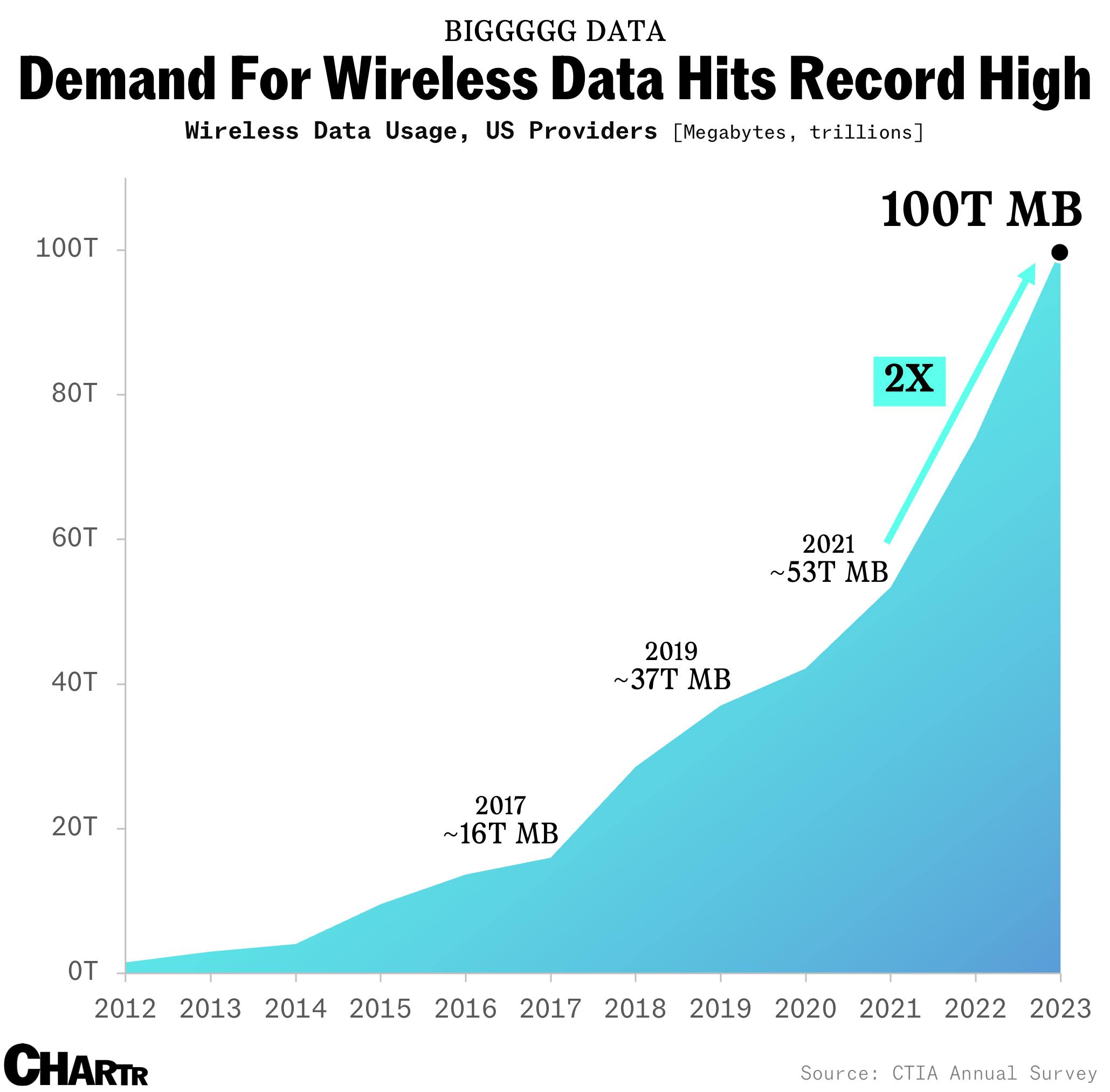

Americans are using more wireless data and it’s cheaper than ever

A new survey reveals that Americans used 100 trillion megabytes of wireless data last year

If you’ve tried to buy any kind of electronic good recently you’ve probably found a version that can connect to your phone and has an app that you need to download (which is usually terrible), with everything from smart watches, to smart light bulbs, to smart fridges, to self-driving cars now connected to the internet. Indeed, companies continue to produce connected versions of devices which, for years, functioned well without them.

But, in fairness to the people behind those products, all of the evidence shows one thing: that America loves being online and staying connected.

Indeed, according to wireless industry association CTIA’s annual survey, Americans used 100.1 trillion megabytes of wireless data in 2023, nearly double the traffic that was driven in 2021 and more than the amount used in all the years from 2010 to 2018 combined. That’s a lot of watching, scrolling, working, texting, and — realistically — even more watching.

The good news is that all of that mobile connectivity is a lot cheaper than it used to be. According to the report, Americans now pay $.002 per MB of wireless data — a 97% decrease from a decade prior and a 50% decrease since 2020, when the average cost of consumer goods and services began to soar.

The uptick has been driven in large part by the rollout of 5G, which the CTIA estimates to be used by almost 40% of all wireless connections today. The rise in wireless data usage comes amidst an ongoing standoff in Congress over how to find new spectrum, per Reuters.