Apple’s record quarter shows that AI doesn’t sell iPhones

Apple just had its best quarter ever without a fully functional AI product.

Apple may have just made a great case against AI.

You may have heard: Apple has been an AI laggard for years. The company’s new AI Siri, which debuted later than other similar products, still struggles to answer basic questions, let alone perform more complicated tasks.

But that sure hasn’t hurt iPhone sales.

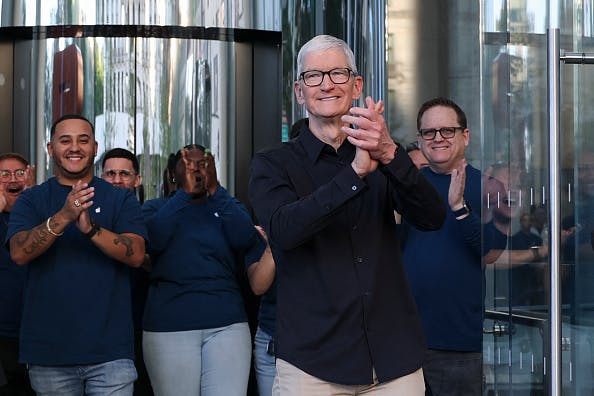

Apple reported all-time record iPhone revenue during its fiscal first-quarter earnings Thursday. What’s been driving those sales? Here’s CEO Tim Cook on the earnings call:

“It’s the display. It’s the camera. It’s the performance. It’s the new selfie camera. It’s the design. The design is beloved. And so, it’s all of these things that come together at once and are producing a very strong product cycle, as witnessed by our December quarter results.”

Notably absent from that list: AI, Apple Intelligence, or Siri. Sure, the iPhone maker is expected to finally release an AI Siri that integrates personal information and on-screen context — features it’s been promising and largely failing to deliver since June 2024 — next month. And a more chatbot-style Siri, something OpenAI and Google have offered for years, is slated to arrive this summer.

But as we’ve written before, AI features — and new phone features generally — don’t really drive sales. (For what it’s worth, AI doesn’t appear to sell PCs, either.)

According to the latest data from Consumer Intelligence Research Partners, only a small segment of iPhone buyers, 14%, bought a new iPhone last year for “new features.” More people, 19%, purchased a new iPhone because their existing one was lost, broken, or stolen. Nearly half made their purchase because their current phone needed replacing — say its battery life was failing, the software began slowing down, or the screen was cracked.

In other words, people aren’t dropping $1,100 — the base cost of the iPhone 17 Pro — for a smarter Siri, let alone the prospect of a smarter Siri in the future.

What’s more likely happening is that many of the people who bought iPhones during the 2020-21 supercycle are now running into the natural limits of those devices. An iPhone typically lasts about five years, which is roughly how long it’s been since a huge wave of consumers last upgraded.

That’s not to say AI isn’t useful, or that it won’t eventually become a baseline expectation for new phones. But for now, Apple’s earnings suggest something much less futuristic is driving sales: replacement demand.

iPhone sales have been going gangbusters without AI because they last and then, eventually, they don’t.

Of course, Apple’s share price is down 0.8% the morning after it reported record revenue and earnings. Maybe investors are a little more driven by AI hopes and dreams these days than prolific sales and profits.