Holding all the chips: Meta has nearly 600,000 Nvidia H100 GPUs

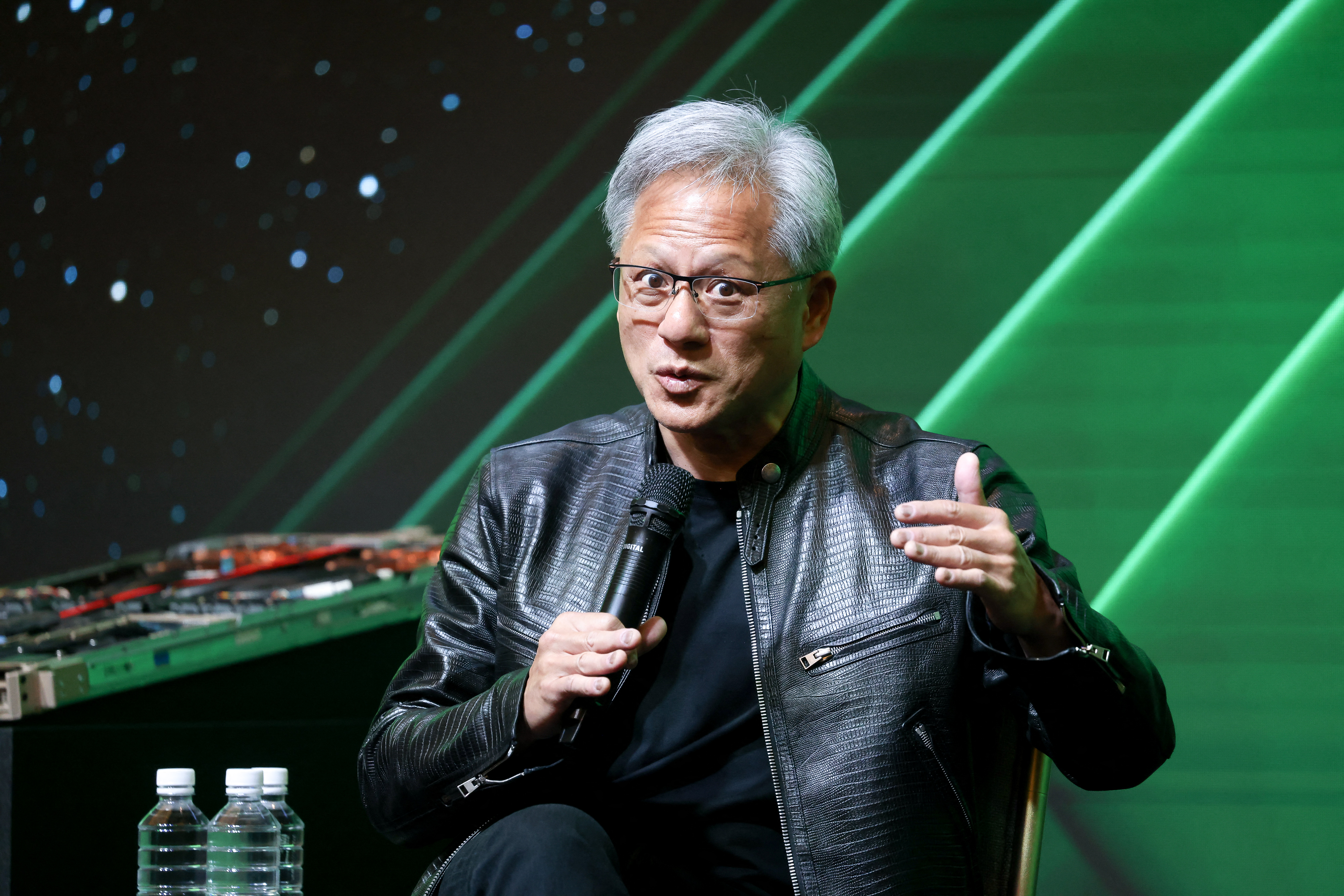

At the SIGGRAPH conference in Denver yesterday, Nvidia CEO Jensen Huang interviewed Meta CEO Mark Zuckerberg. The hour-long, wide-ranging conversation touched on Huang’s love of black leather jackets, Meta’s new Llama 3.1 large language model, and eating Zuckerberg’s “delicious” cows from his Hawaiian ranch.

Towards the end of the interview, Huang revealed an eye-popping stat that hasn’t been made public before.

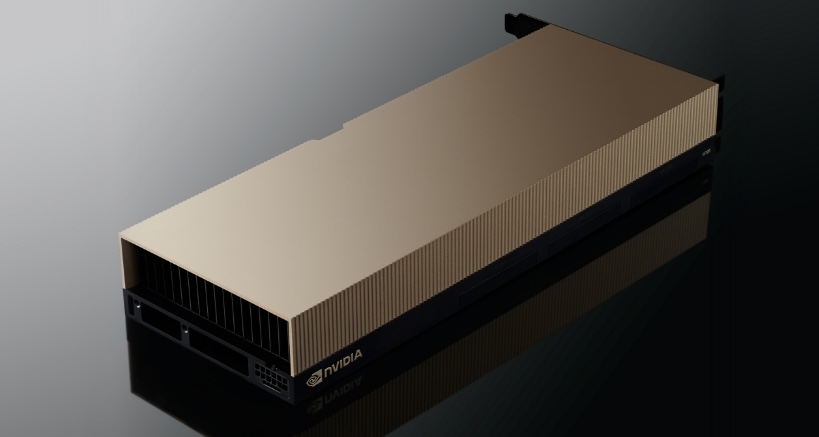

Huang and Zuckerberg were discussing how Nvidia bucked the norm of moving computing to smaller and smaller devices, and instead focused on building out massive computing systems powered by their specialized GPUs like the ones that Meta has invested heavily in.

Huang said, “When Zuck calls it his ‘data center of H100s’ there's like, I think you're coming up on 600,000.”

Zuckerberg smiled and nodded in response. “We're good customers. That's how you get the Jensen Q&A at SIGGRAPH.”

The H100 GPUs are a hot item in the AI industry, and companies are hoarding them to train larger and larger AI models. The price for each GPU is estimated between $20,000 and $40,000 meaning Meta’s investment in Nvidia chips may be north of $12 billion.