Highly motivated swipers

Dating giant Match Group is bumping up its most-expensive subscription level on dating app Hinge to $60 a month, or $720 a year. That price-point nearly doubles the current highest membership tier of $35 a month, as the company seeks “highly motivated daters” that are hoping to increase their chances of finding the one.

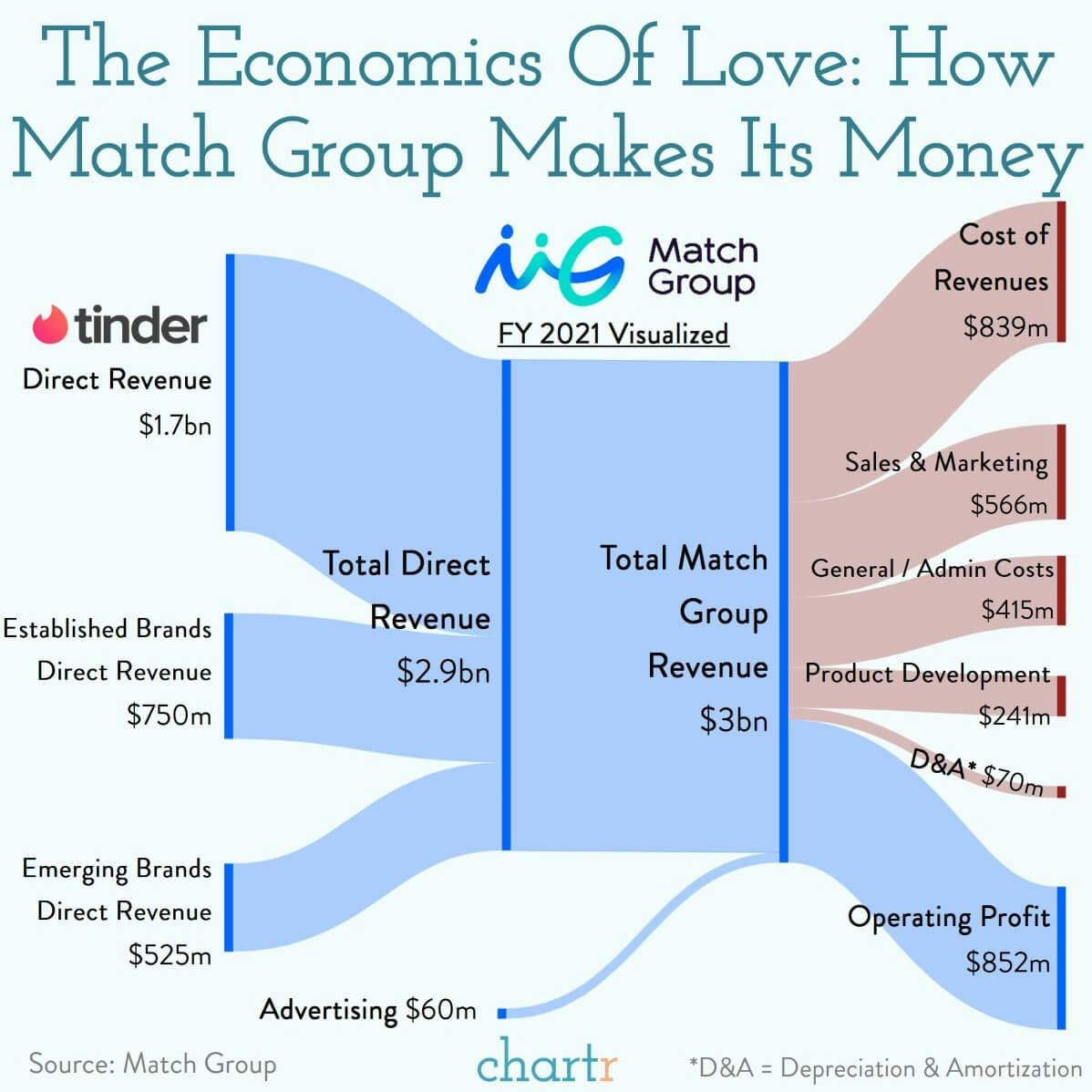

The motto for popular dating app Hinge, which Match Group classifies as one of its emerging brands, is that it's “designed to be deleted”. Although that might not feel like a sound business model, it's one that's actually remarkably profitable. In its most recent full year, Match Group made nearly $3bn in revenue, eking out a margin of nearly 30% despite high sales & marketing expenses.

With roots tracing back to Match.com in the 1990s, Match Group was officially formed after holding company IAC decided to bundle all of its dating businesses in 2009. Since then, the conglomerate has been on a buying spree, acquiring multiple dating brands, though Tinder remains Match Group's crown jewel. In 2021, Tinder swipers coughed up nearly $1.7bn to the app, outperforming all of the company's other 45+ brands combined, which includes Match.com, Hinge, OkCupid and PlentyOfFish. Surprisingly, unlike so many other online enterprises, just 2% of Match's revenue came from advertising, with the vast majority coming directly from paying users.

The attractive economics of a dating app, despite the pitfalls and safety issues associated with running one, have seen hundreds of competitors enter the market, with an increasing number of niche options for love-seekers. From apps that offer exclusive dating pools with celebrities to ones that help find other singles with the same food allergies, these days there's an app for everyone, and a premium paid option for serious swipers.