Steel tariffs would be terrible for Tesla’s low-cost car

Tesla CFO: “The imposition of tariffs, which is very likely, will have an impact on our business and profitability.”

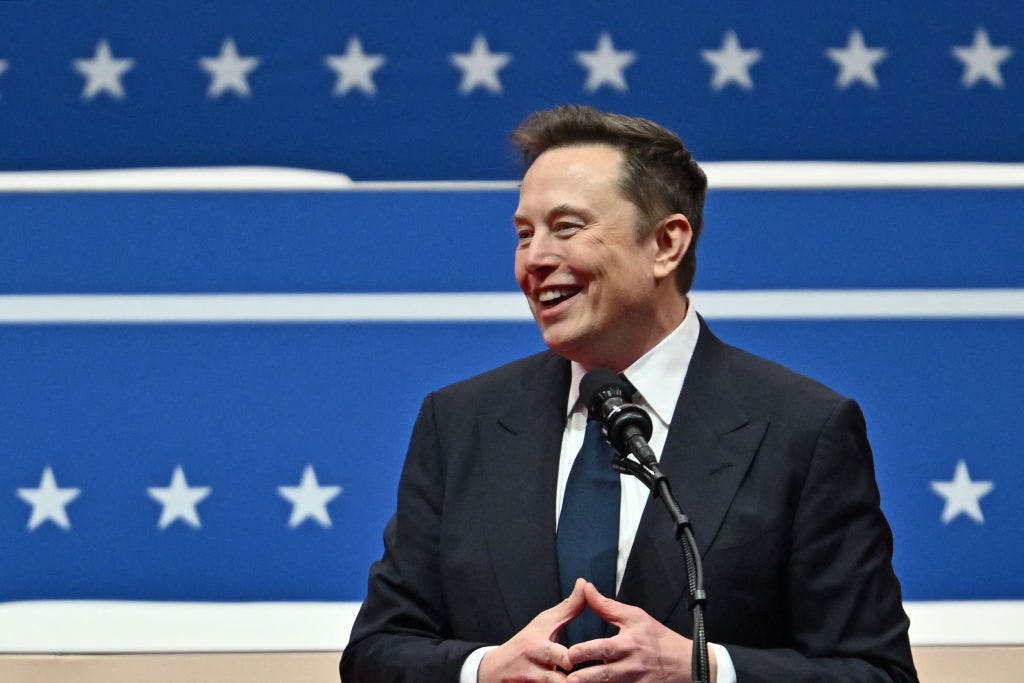

Another day, another Trump policy that could be bad news for his top benefactor, Tesla CEO Elon Musk. The president’s plans for 25% tariffs on aluminum and steel imports would be painful for US automakers, especially Tesla, which has been stringing along investors for years with the promise of a mass-market vehicle, which it plans to achieve by lowering production costs.

The stock was trading down 3% earlier today, though it was recently down just 0.5%.

During a presentation at the company’s last investor day, Tesla said it was hoping to lower the cost of goods sold per vehicle by 50% for the next generation of vehicles.

In the company’s latest earnings report, the company bragged that it got its COGS per car down to less than $35,000, and it reiterated:

“Affordability remains top of mind for customers, and we continue to review every aspect of our cost of goods sold (COGS) per vehicle to help alleviate this concern.”

As Morningstar strategist Seth Goldstein told Sherwood, “The key to their goal is to keep driving their costs down so they can offer more affordable vehicles while maintaining a strong profit margin.”

Producing its promised “more affordable models” in the first half of this year will be a lot harder to do if raw materials are more expensive. In the company’s latest 10-K, aluminum and steel were listed first among the company’s raw materials.

Additionally, about 20% to 25% of Tesla’s vehicle parts are made in Mexico, according a filing last year from the National Highway Traffic Safety Administration. Automotive supply chains are long and convoluted, but it’s safe to say Trump tariffs, or retaliatory ones, wouldn’t be good for the company or its consumers. (The filing combines parts made in the US and Canada, so you can’t break out how much of the 60% to 75% of those parts come from Canada.)

The company is seemingly aware of the damage tariffs could cause.

“Over the years, we’ve tried to localize our supply chain in every market, but we are still very reliant on parts from across the world for all our businesses,” Chief Financial Officer Vaibhav Taneja said during the company’s fourth-quarter earnings call. “Therefore, the imposition of tariffs, which is very likely, will have an impact on our business and profitability.”

To deal with those higher costs, Tesla would likely have to raise prices on their cars — or accept that margins would fall.

“It’ll be interesting to see how they go about this, because with the new vehicle, they want it priced competitively, something like a Toyota or a Honda,” Goldstein said. “So you really can’t set a price too far above the mid-$30,000 range or else you start to lose customers.”