America’s pork industry is enduring some of its leanest months in modern history, with pork demand falling just as supply surges.

The fat’s been trimmed

Ironically, part of the problem is that the industry has become almost too efficient, with pork production up 25% over the past 20 years, per reporting from the WSJ. But there’s simply not enough people eating pork to keep up with the increased supply: consumption is estimated to have fallen 9% over the same time frame, leaving farmers with a surplus that's sent profits plummeting.

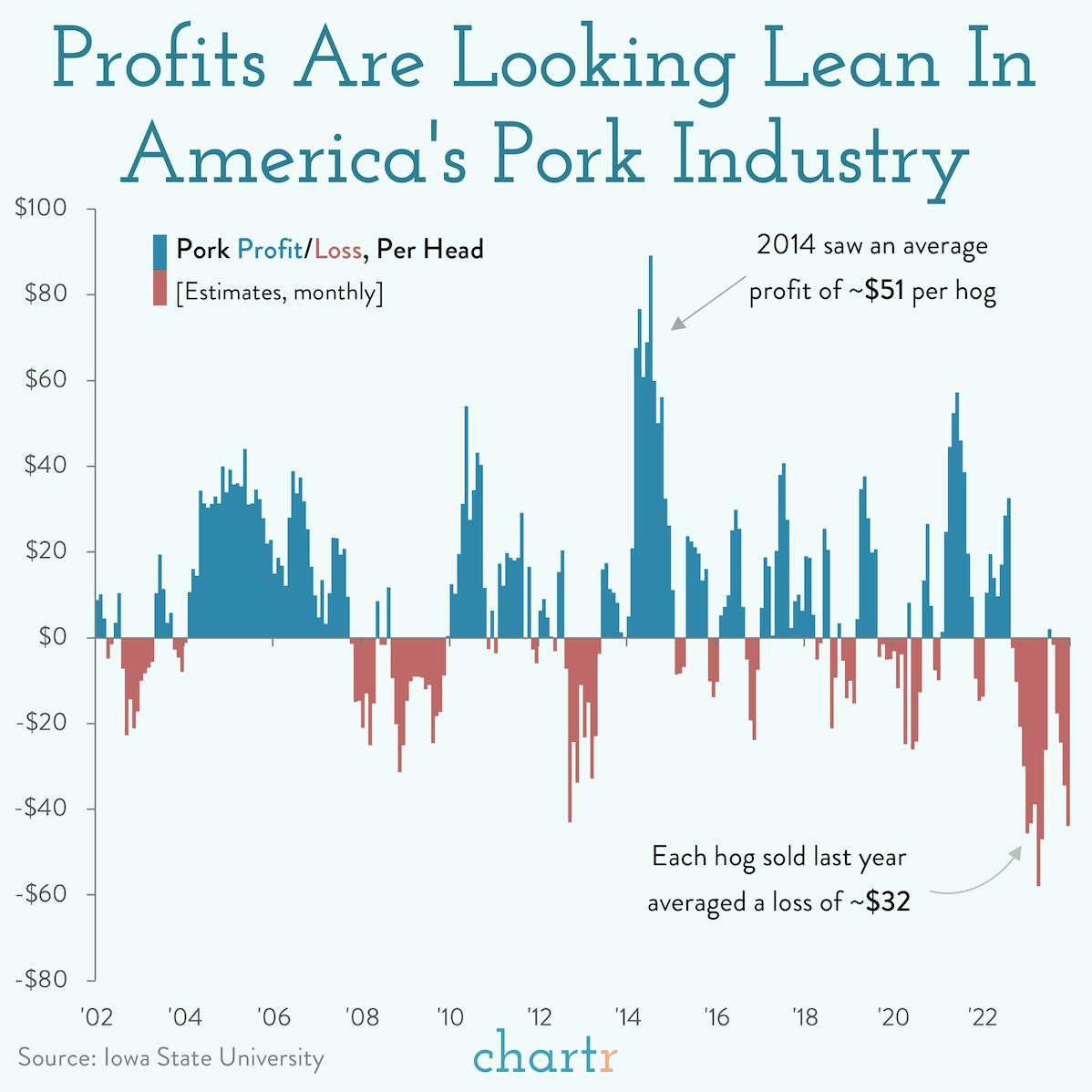

Indeed, according to estimates from Iowa State University, the average American farmer faced a loss of approximately $32 for every hog sold last year, in stark contrast with profits seen in the 2010s.

Chopped

Efforts to reinvigorate pork consumption have stumbled. Long-standing advertising campaigns rebranding pork as "the other white meat", aiming to capture some of the seemingly-endless appetite for chicken, haven’t worked in recent years. Pork’s higher price point, its tough texture when overcooked, and an increased awareness of the intelligence of pigs and pig farming practices, haven’t helped demand — particularly in younger consumers, who are eating less of the meat than previous generations.

Having seemingly lost the battle against chicken, the pork industry is seeing some of its problems as a marketing issue, which they're trying to resolve by pitching pork as an alternative to beef, with giants like Tyson Foods launching marinated “pork griller steaks”.

Related reading: China is facing a similar pork predicament.