On Friday, shares in Adobe rose more than 15%, after the company reported record quarterly sales of $5.3B and raised its annual revenue forecast. The design software giant appears to be reaping the rewards from its generative AI tool Firefly, with net-new annualized recurring revenue for its Digital Media division coming in $50M ahead of analyst forecasts.

That came after a tough week for the company’s PR team, who found themselves fighting a backlash against its updated terms and conditions — yes, thankfully there are some people who read them cover to cover — after users criticized language which seemed to suggest that Adobe could use customers’ work to train generative AI models.

Turns out this week won’t be that easy for Adobe PR, either: The US Justice Department sued the company, saying its subscriptions — which help drive the aforementioned revenue gains — are too hard for its users to cancel.

Trust fall

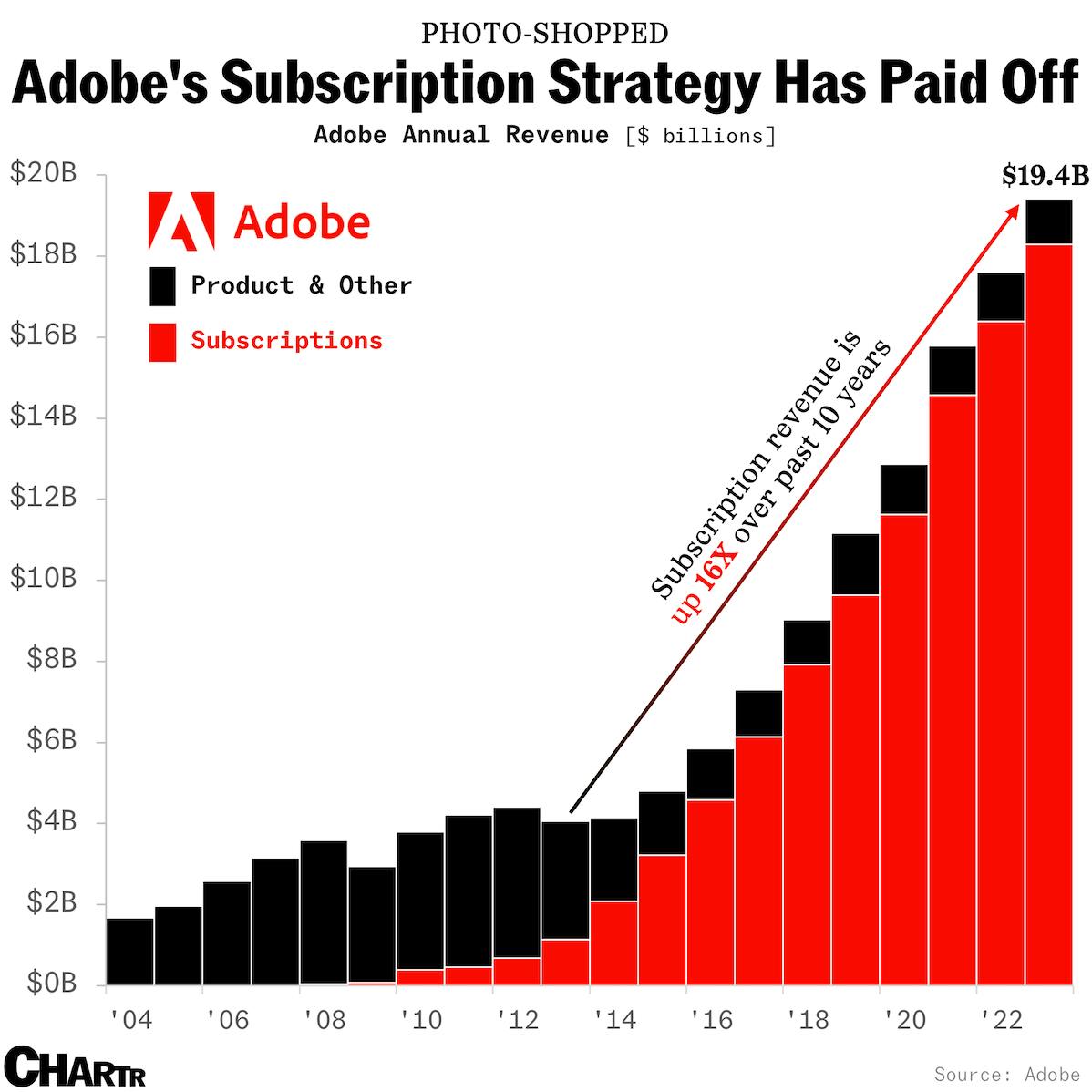

From a financial perspective, Adobe has done a phenomenal job of pivoting away from its old perpetual license model, where customers would buy once and own for a lifetime, to a monthly subscription model in which the product, and the terms of use that govern the product, are always changing. Indeed, over the past 10 years, subscription revenue has grown 16x, driving much of the company’s growth and turning it into a $200B+ giant… albeit one that isn’t universally trusted, per viral posts on X.

To clear up any confusion, Adobe says it will roll out a new terms of use agreement tomorrow, which will clarify that users own their work and that the company doesn’t train generative AI on customer content.

Zoom out: In a year marked by a record number of global elections, generative AI is taking off and users are asking simple questions like “how do I know what’s real?” and “how do I know my likeness or content isn’t being used by AI?” Companies don’t always have the answers.

Update (4 p.m. EST): Added new information following DOJ suit against Adobe.