Amazon delivered 9 billion items on the same or next day in 2024

Most American adults have a Prime membership. Jeffrey Bezos — congratulations, you did it!

Box clever

Ahead of its Q4 earnings on Thursday, Amazon has already been delivering some blockbuster figures this week, revealing on Tuesday that it shipped a staggering 9 billion items the same or next day last year.

Bezos’ big box giant also announced that Prime members around the world saved almost $95 billion on free delivery last year, while US subscribers saved $500 on average — almost 4x the annual price of Prime, the retailer was keen to point out.

Amazon Prime, which celebrates its 20th anniversary this year, has grown and morphed in the years since its inception. In 2011, the company let paying users access 5,000 films and TV shows, kickstarting what we know today as Prime Video; it launched Prime Music in 2014; teamed up with GrubHub to offer subscribers free food delivery in 2022; and obviously still provides its all-important same- and next-day delivery service. For better or worse, it’s become a subscription that many Americans choose not to live without.

Prime numbers

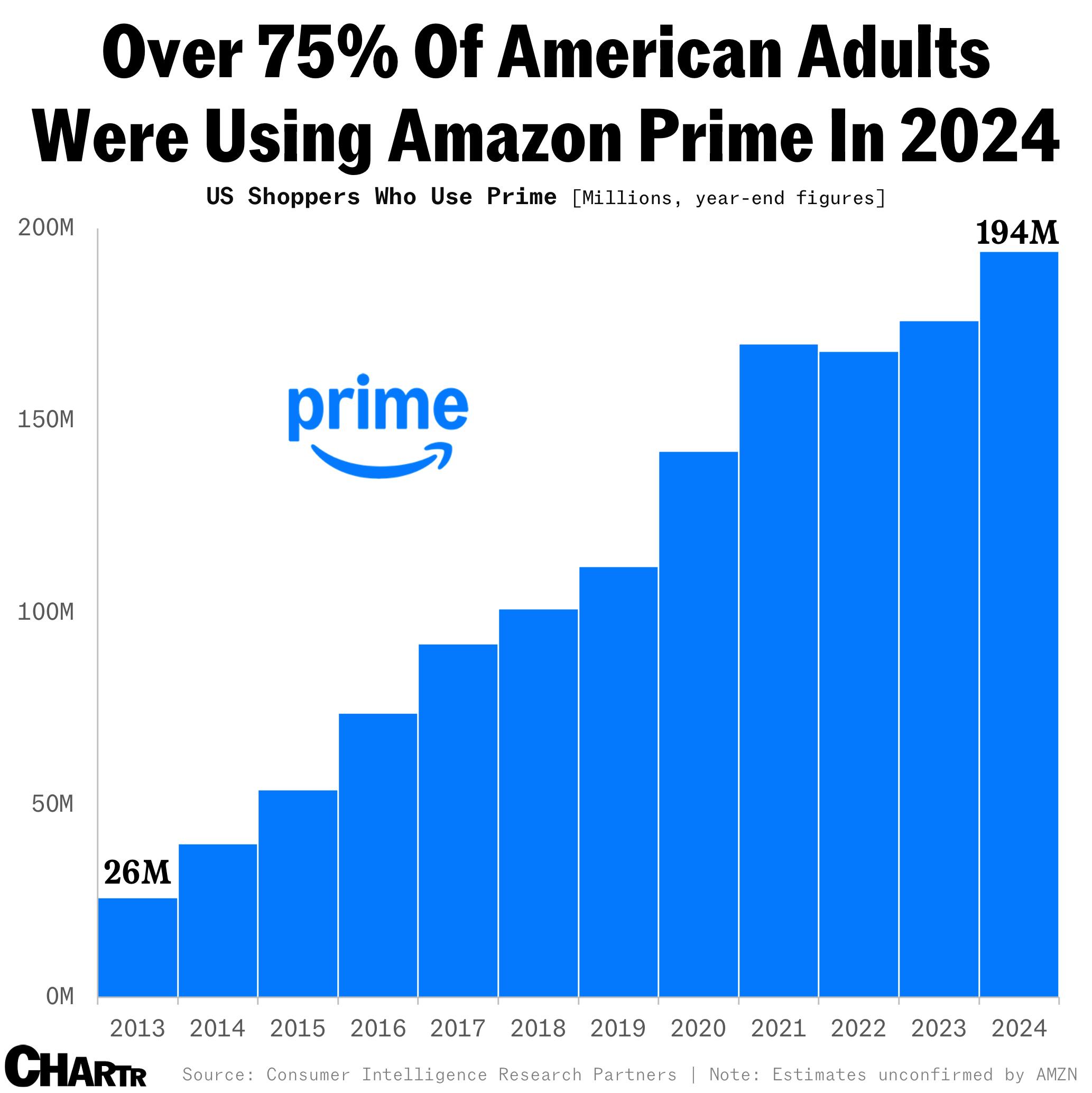

According to estimates from Consumer Intelligence Research Partners, the number of US shoppers who use Prime — not paid subscribers, just those who access a membership — hit a record 194 million by the end of 2024. The stat’s made even more impressive by the fact that just two years ago, the same firm declared that subscribers to Amazon’s flagship service were plateauing, a charge that Amazon publicly disputed at the time.

Amazon hasn’t commented on this latest release from CIRP, but then, why would it? The 194 million figure would mean that over 75% of US adults were using Prime in 2024, per Census Bureau data — a pretty healthy market share by anyone’s standards.