No way to sugarcoat it

This morning brought bad news for our moderately Diet-Coke addicted editor, as the World Health Organization is set to label Aspartame — an artificial sweetener found in many diet sodas, chewing gum and many other products — as “possibly carcinogenic to humans”.

The report could prove controversial. Aspartame has been approved for consumption in the US since 1974, originally for use as a tabletop sweetener, before finding its way into many diet drinks as America began to watch its consumption of sugar.

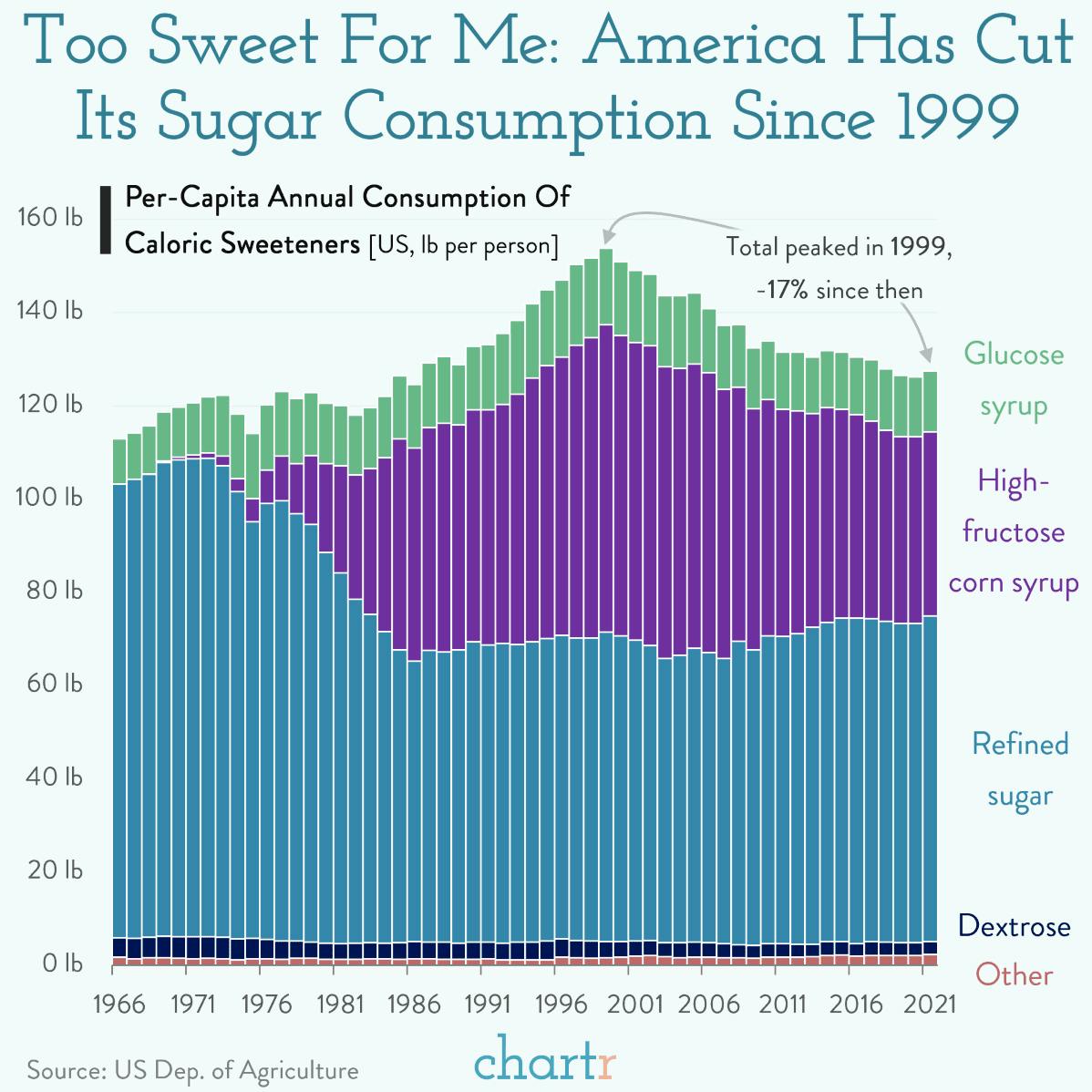

Indeed — perhaps surprisingly — Americans have been cutting down on their sugar intake for the last 20 years. Data from the USDA reveals that per-capita consumption of sugar peaked in 1999, following the boom in high-fructose corn syrups, and has fallen ~17% since.

Make it til you fake it

The soaring use of Aspartame and other artificial sweeteners is easy to understand — the Food & Drug Administration estimates that Aspartame is roughly 200 times sweeter than table sugar. Other products are even sweeter. Sucralose, the non-nutritive sweetener found in Splenda, is estimated to be 600 times sweeter than table sugar.

The FDA’s definition of what’s a safe and acceptable daily limit for artificial sweeteners is high. According to their guidelines, an adult weighing 150 pounds would have to consume around 18 cans of zero-sugar soda a day to experience severe negative health effects.