Substitute slowdown: Beyond Meat's sales are stalling, and now the company is being sued

Substitute slowdown

Beyond Meat, once a poster child for the future of plant-based meat substitutes, is having a tough time catching a break. Last week, it came to light that the company is being sued after a securities class action suit was brought on behalf of purchasers of Beyond Meat stock between May 2020 and October 2022.

The claim, essentially, is that Beyond Meat “misled investors” as to the likelihood and potential success of large-scale partnerships with retailers like McDonald’s, Starbucks, KFC and others, most of which never went beyond the testing stage. Whether the legal challenge holds up in court is one thing — the company itself blames “changing consumer patterns” — but even if it doesn’t, Beyond Meat is still a shadow of its former self.

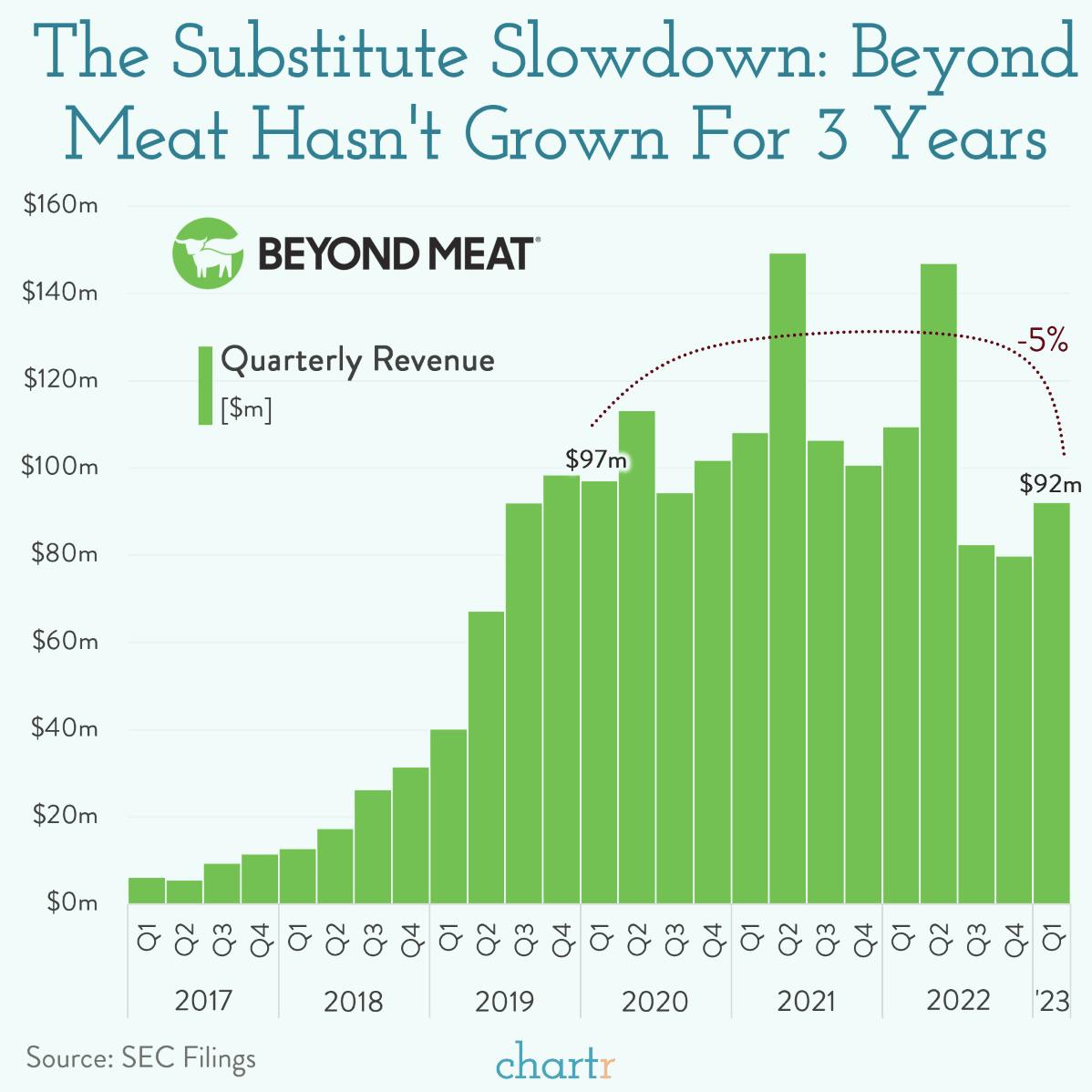

Just a few years ago the company was on top of the world. Health-and-planet-conscious consumers were eager to try meat alternatives, and Beyond’s revenues were soaring — clocking $97m of sales in the first quarter of 2020, nearly two-and-a-half times what it had managed the year before. Only the most cynical of naysayers would have predicted that by 2023 the company would report $92m of sales in the same quarter, down 5% after 3 years of effort — but that's exactly what's happened.

Some believe the writing is on the wall for fake meat, with consumers unconvinced by the products, reverting back to real meat or eating other plant-based foods. Others argue that it's simply a category in the "trough of disillusionment" part of the much-theorized hype cycle, and expectations simply need a reset. For the next major leap in innovation we may have to wait for lab-grown meat, which some companies are hoping will be as cost effective (and delicious) as real meat by as early as 2030.