Expectations will be high for the company’s Q2 earnings on Thursday

While the restaurant industry was buzzing with the news of Starbucks poaching Chipotle's CEO Brian Niccol, and subsequently adding billions of dollars to its market cap, another fast-casual chain was quietly hitting record highs. Cava, the burrito chain's Mediterranean doppelgänger, saw its share price close just shy of $99 on Friday.

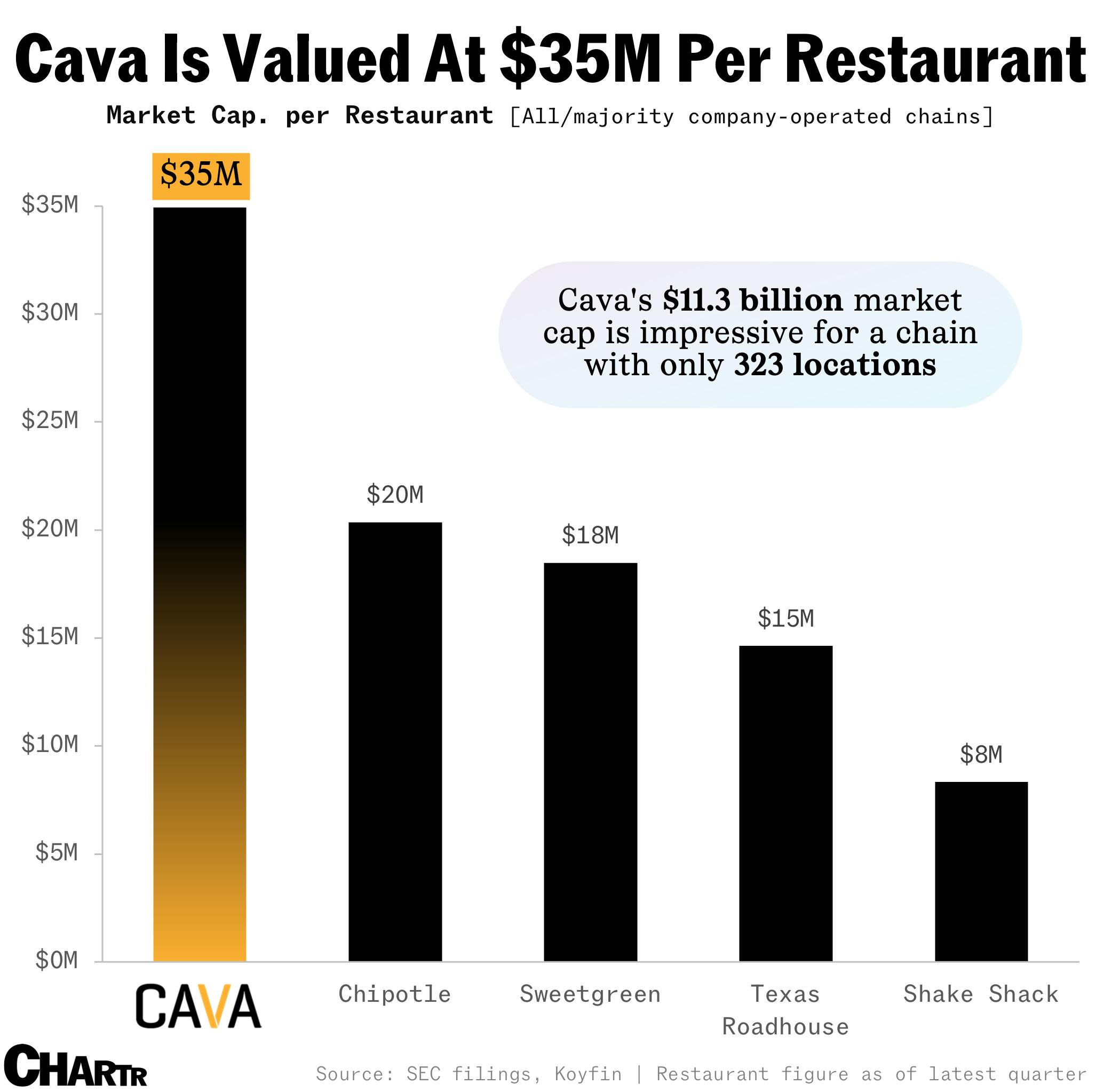

Having risen more than 150% since its IPO last June, Cava is now worth some $11 billion, 2.6x what rival salad chain Sweetgreen is worth. That’s modest compared to fast-food giants like McDonald's ($200 billion) or Yum! Brands ($39 billion), but it’s remarkable because Cava only has 323 stores to its name. That values Cava at about $35 million per store.

Profit-packed pitas

In an industry that often leans on the franchise model, Cava is forging ahead with its company-operated strategy, in a similar vein to Chipotle, which owns and operates all but 1 of its 3,500+ stores. So, why such a high price tag for a Mediterranean salad chain?

Well, investors are generally happy to pay up for two things: profits today or profits tomorrow. Cava promises more of the latter, with its revenue surging 30% last quarter and ambitious plans to open 1,000 new locations over the next decade, with a portion including higher-margin digital drive-thrus.

Some investors have also been drawn to the tantalizing "Cava is the next Chipotle" narrative. Since its IPO in 2006, the Mexican Grill stock has delivered eye-popping returns of over 6,000%. For Cava, expectations will be high for the company’s Q2 earnings on Thursday, August 22nd.