Toy story

Toys "R" Us is back.

This week the iconic toy retailer announced it would be opening a 20,000 sq ft two-level, store in New Jersey, less than a year after the brand's first failed relaunch.

Children's Bargain Town

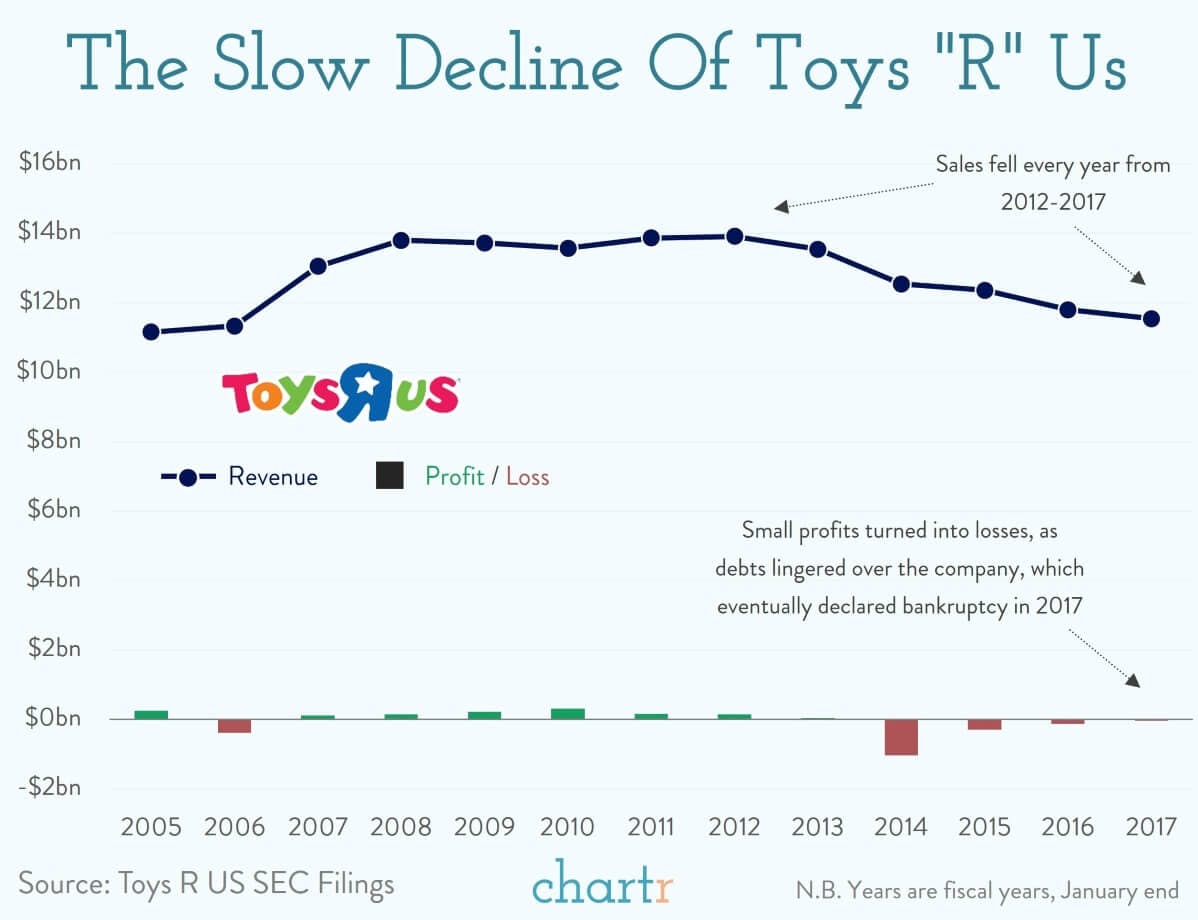

Toys "R" Us, first founded back in 1948 under the name "Children's Bargain Town", was one of the most iconic retailers to fall victim to big-box competition and e-commerce. At the height of its reach, the company operated more than 900 stores across the United States, all of which were closed in mid-2018 as the company fell into bankruptcy after 5 years of declining sales and a looming debt pile.

Since then, the Toys "R" Us brand has had quite a ride. After the bankruptcy the rights were picked up by a company called Tru Kidz Brand, which opened 2 smaller stores... which lasted about a year before succumbing to COVID-19, leaving the brand to be sold on again.

The latest owner is WHP Global, which along with building the new flagship store has struck a deal with Macy's to sell toys under the Toys "R" Us brand in more than 400 Macy's department stores. A Toys "R" Us comeback? Stranger things have happened.