The "I" word

Even before the final chapters of 2021 had been written, one of the main topics for 2022 — inflation — was already emerging. As the impact of pandemic stimulus checks set in, supply-chain bottlenecks emerged and the geopolitical landscape looked increasingly uncertain, prices across nearly every industry hit record levels.

By January, gas was topping inflation tables, with prices at the pump up nearly 50% year-on-year. And then came the news that Russia, after months of posturing, had invaded Ukraine.

Sanctions where it hurts

Russia’s offensive shook the world as Putin’s campaign brought death and destruction to Ukraine — leading millions to flee the country and seek refuge westward in neighboring European countries.

Political retribution toward Russia was calculated, but arguably slow. Negotiations were long, but everyone knew, given Russia’s place as the third largest supplier of oil globally, that sanctions targeting Russian fossil fuel exports would hurt its economy most.

The issue was, and still is, Europe’s heavy reliance on Russian gas and oil, which accounts for over 40% of the European Union’s gas imports, and more than a quarter of petroleum imports. In the end, it took until December 5th for the 27 nations of the EU and the G7 to implement a $60-a-barrel price cap for Russian oil.

As oil prices spiked, and the cost to fill a car hit a new record nearly every week, Biden decided to tap into the Strategic Petroleum Reserve to alleviate some of the pain, bringing the reserve down to its lowest point since 1984.

Pull the big red lever

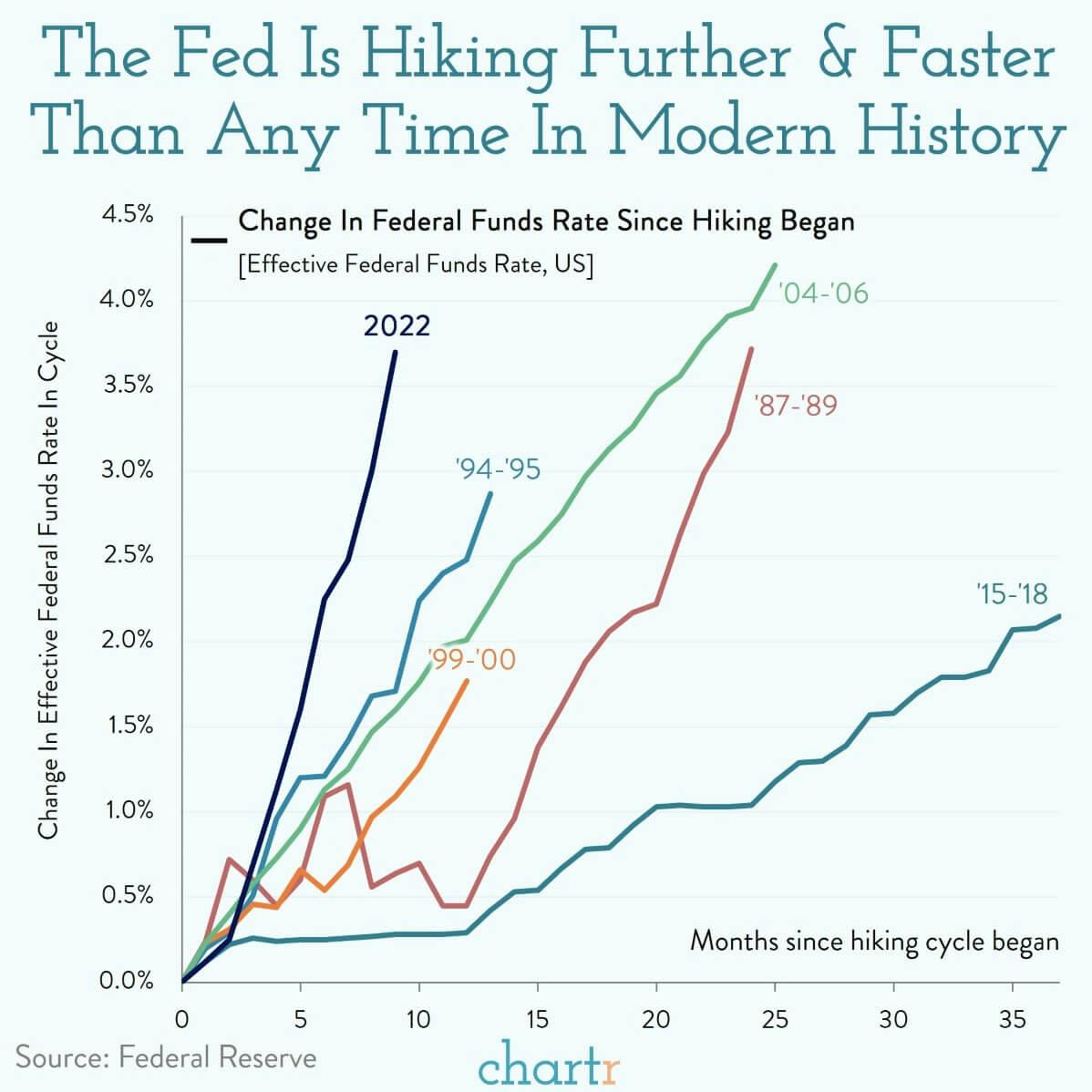

As energy inflation was exported around the world, central bankers eventually pulled the major lever at their disposal, with the word "transitory" leaving speeches almost as quickly as it arrived. In the US, the Federal Reserve acted at an almost unprecedented pace, hiking rates to signal their strong resolve to get double-digit inflation under control.

One hike to rule them all

The impact of the hikes is hard to overstate, rippling throughout almost every aspect of the economy. From strengthening the US dollar, fueling some of the sharpest mortgage rate rises for 35 years, and of course humbling the stock market — where investors had been riding a 21-month bull market — rate hikes likely had more of an impact on your wallet than almost anything else this year.

The good news is that, with inflation showing signs of cooling, 2023 may see less-aggressive central bank moves around the world.