Here’s how Hims & Hers will pivot now that it can’t mass produce copies of Wegovy and Ozempic

The new focus for Hims & Hers on the weight-loss front will be... selling even older Novo Nordisk GLP-1 drugs.

Hims & Hers has skidded 40% since the Food and Drug Administration declared that semaglutide — the active ingredient in Novo Nordisk’s Ozempic and Wegovy — is no longer in a shortage, complicating the tele-pharmacy’s ability to sell cheaper versions of the popular drugs.

Its plan? Selling Novo Nordisk’s older weight-loss drugs.

Hims & Hers said it won’t sell exact copies of Ozempic and Wegovy after the first quarter of this year, and it won’t in the future unless the FDA declares another shortage. It’s still able to sell personalized versions of the drug (dosages that Novo Nordisk doesn’t make, for example) but it will shift its focus to selling less effective weight-loss drugs that it is allowed to sell without personalization.

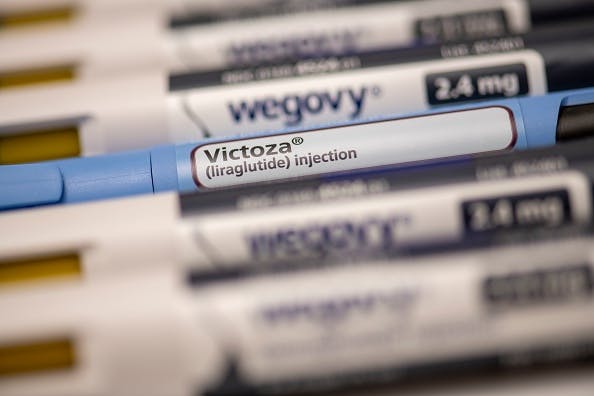

Those drugs include liraglutide, an older GLP-1 weight-loss drug Hims & Hers will add to its portfolio later this year, and “oral medication kits” made up of medication and supplements that can help with weight loss.

“My expectation is most parties in market that have been offering commercial available doses of semaglutide will cease to do that in the next couple of months,” Hims & Hers CEO Andrew Dudum told analysts on a Monday call.

This is a shift from the company’s tone the day the FDA lifted the shortage on Friday. Then, Dudum released a statement on X that focused on the company’s ability to personalize drugs and didn’t mention pivoting to other kinds of drugs.

Still, Hims & Hers said it expects to sell $725 million in weight-loss drugs in 2025. For context, that’s about half of its total revenue for 2024, which was $1.4 billion.

What is liraglutide?

Consumers are likely most familiar with semaglutide, sold by Novo Nordisk under the brand names Ozempic (approved for diabetes) and Wegovy (approved for weight loss). The blockbuster drug entered the market in 2017 and became increasingly popular because of its high efficacy rate.

But before Ozempic and Wegovy, Novo Nordisk had Victoza and Saxenda, two brand names for liraglutide.

Liraglutide is less effective and is injected daily as opposed semaglutide, which is weekly. The drug is still on the FDA’s shortage list, meaning compounding pharmacies can produce exact copies. The patent expired last year, so generics are starting to enter the market.

Perhaps most importantly, protecting market share for liraglutide is likely not a high priority for Novo Nordisk, which has launched ads questioning the safety of compounded drugs like those sold by Hims & Hers.

Martin Holst Lange, a Novo Nordisk executive, told analysts on a February 5 earnings call that the company was focusing on improving its portfolio of semaglutide drugs. Novo Nordisk sold about $25 billion of Ozempic and Wegovy in 2024, compared to the $1.7 billion it made from Victoza and Saxenda.

“Our marketed portfolio started with Saxenda,” he said. “We then set the bar with Wegovy’s attractive clinical profile with double-digit weight loss and a proven cardiovascular risk reduction from the select trial.”