Through brick and thin

Even with Lego’s modern legacy of movies, games, and theme parks, most of us think of Lego in its purest form: bright plastic bricks that can be built into whatever shape your creativity takes, from cars, to condos, to the Colosseum.

Despite the playful design and imaginative spirit that Lego is known for today, its roots actually trace back to the Great Depression. Ole Kirk Christiansen, a carpenter from Billund, Denmark, noticed that the demand for home construction and furniture was waning. To sustain his livelihood, Ole Kirk pivoted to making wooden toys in the early 1930s, which he initially traded for food for him and his family. Two years later, he christened his venture Lego, a name derived from the Danish phrase "leg godt", meaning "play well".

Plastic uptick

Lego's foray into plastic — the precursor to Lego we know today, dubbed by Christiansen as ‘automated binding bricks’ — didn’t start until 1947, when the material was still novel. However, sales stacked quickly, with plastic toys accounting for half of Lego's production by 1951. A devastating warehouse fire, which consumed the wooden toy inventory, forced the family to fully embrace their plastic future — a transition that marked the beginning of Lego’s meteoric rise. By the mid-1960s, Lego was sold in 40+ countries, and, by the 1990s, the company was one of the world’s largest toy manufacturers.

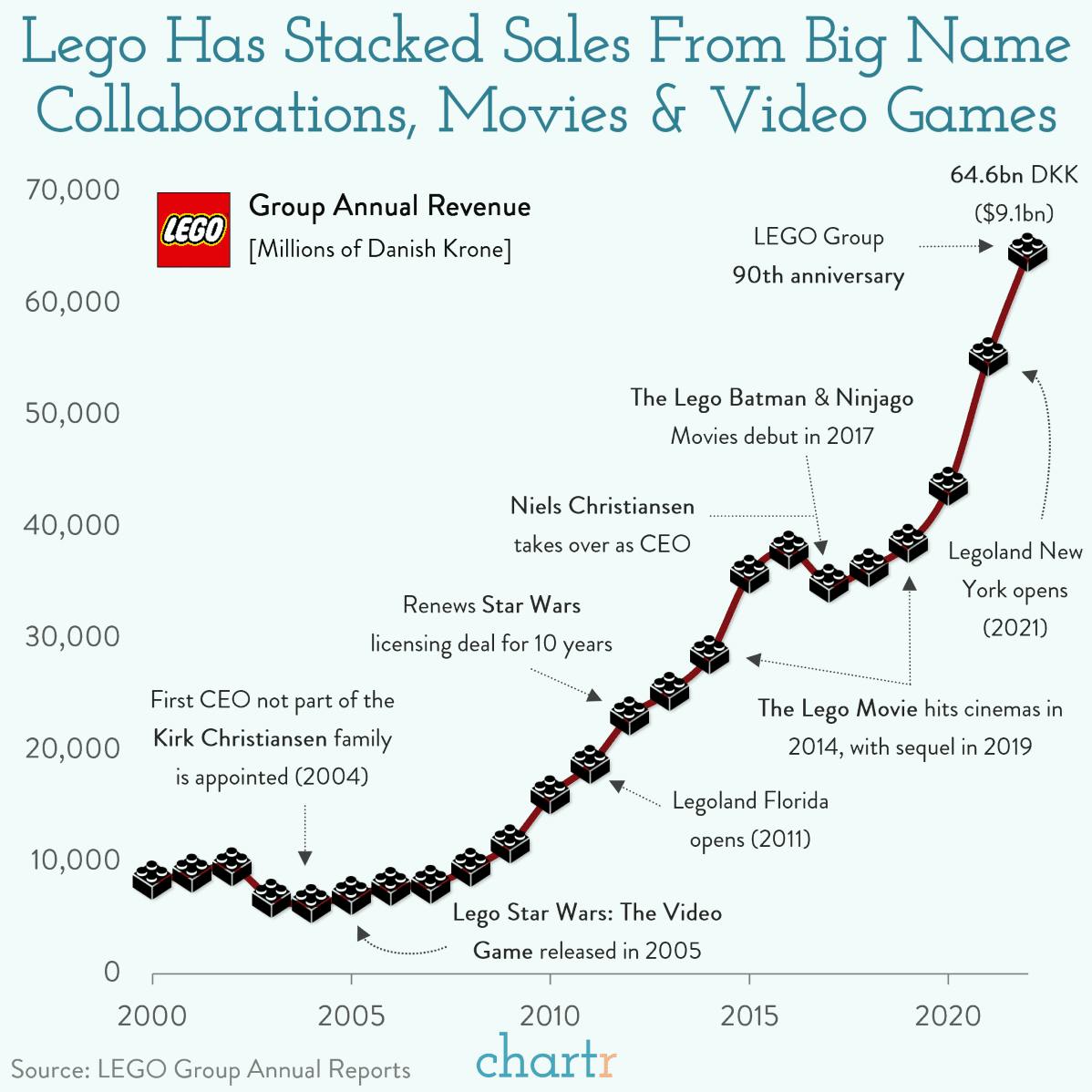

However, by the early noughties, Lego was struggling. Sales plummeted almost 30% in 2003, pushing the company close to bankruptcy. Seeking a revitalization, Lego appointed its first non-family member CEO, Jørgen Vig Knudstorp, who sold off non-essential parts of the business and went back to basics: halving the number of LEGO pieces produced, cutting jobs, and — perhaps most crucially of all — asking kids what they actually wanted to play with.

AFOLogy

While tracking playtime proved profitable for Lego — as they noticed that, rather than playing for mindless amusement, children enjoyed trying to master a skill with degrees of difficulty — more mature brick enthusiasts have also played a part in Lego’s present-day prosperity.

Indeed, Lego has an enormous legion of AFOLs (Adult Fans Of Lego). Whether driven by nostalgia, the need for stress relief, or just wanting to show people a self-completed 7,541-pieceMillenium Falcon, more adults are discovering, or rediscovering, the joy of Lego. In turn, the company has embraced the trend, designing retro-themed builds (like the $270 Pac-Man set released earlier this year) that tap into adults’ sentimental seeking of childhood favorites, with many AFOLs interested in the "displayability" of Lego sets, like Lego typewriters, Lego bonsai trees… or even a 9,090-piece Titanic model.