Ireland has abandoned its long-held 12.5% corporate tax rate, agreeing, with other members of the OECD, to a global corporate tax deal that could see large companies pay an extra $100bn in corporate taxes, aligning their tax bills more equally with where they actually do business.

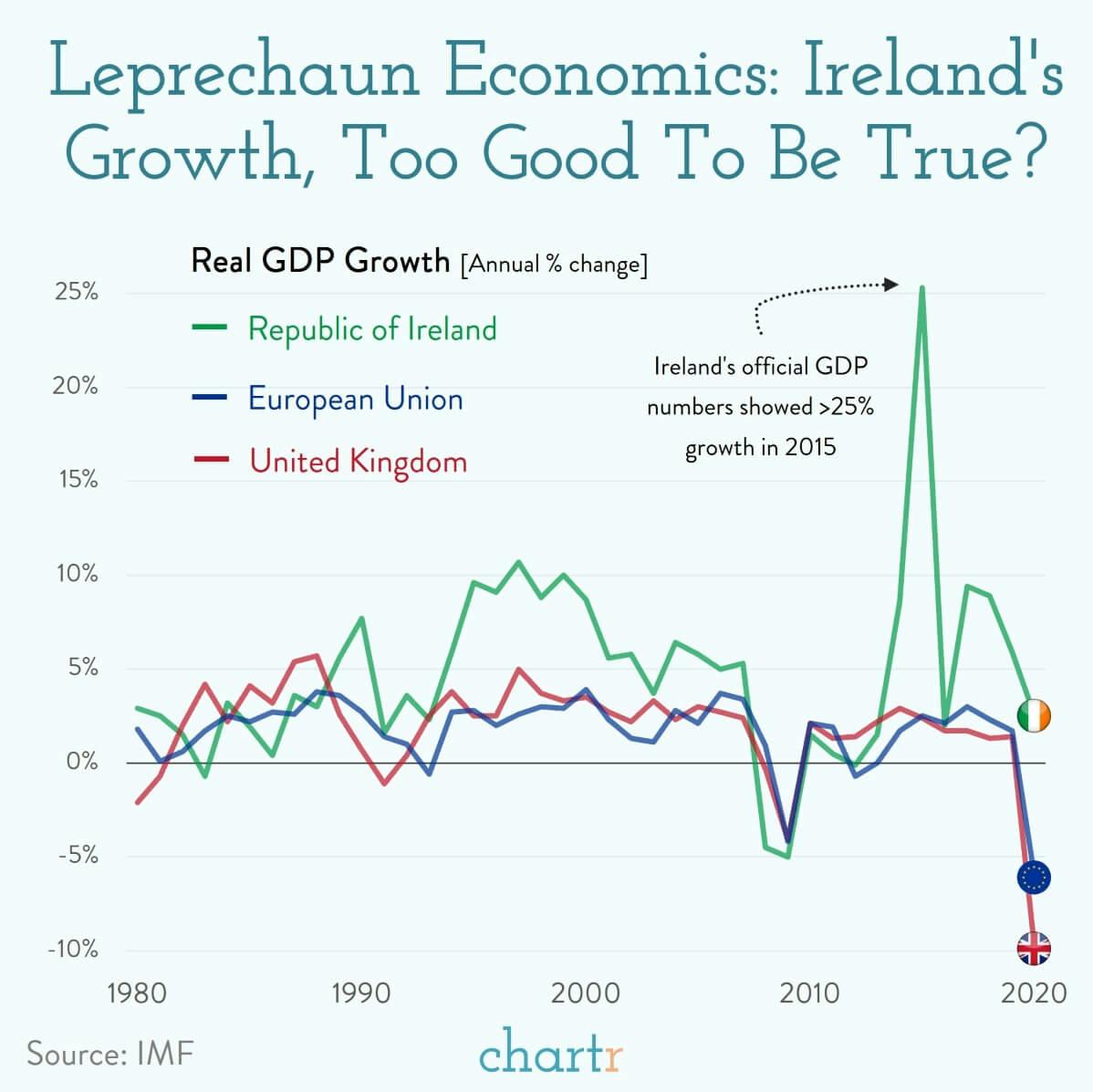

Ireland's signing is a particular coup for the deal, as the country has long benefited from its low corporate tax rate. In 2015 Ireland's official statistical office reported that the country had grown its economy (based on GDP), by more than 25%. For some context, fast-growing China has usually been happy with 6-7% growth.

**"Leprechaun economics"**

The reality was that the growth number was something of a phantom (although Ireland's economy was doing very well). It was distorted by tax inversions and internal restructuring at global tech companies that had re-domiciled to Ireland, in order to take advantage of its low corporate tax rate.

Apple's particular restructuring was behind the 2015 number, and the entire episode was dubbed "leprechaun economics" by Nobel Prize winner Paul Krugman, which even saw the Irish government come up with a better way to measure the economy.

So it's a big deal then that Ireland, along with a few other low-tax holdouts, appear to have agreed to a historic deal. If passed successfully and enacted it will directly impact the pots of gold that tech giants like Apple, Google, Amazon and Facebook have stored in Ireland, and other low-tax regions.