With its stock up ~50%, an almost ever-rising sub count, a silver medal in this year’s Emmy rankings, and analysts and publications tripping over themselves to crown it victor of the streaming wars, Netflix has had a pretty strong 2024 so far.

Thanks to the record-breaking 278 million paying subscribers around the world (at the latest count) tuning in to its vast library of scoffed-at movies and now-lauded TV shows, Netflix has pulled further ahead of its rivals. When pitted against NFLX on almost any measure — subscriber numbers, revenue per subscriber, award hauls — big names like Disney+, Prime Video, and Apple TV+ often come second best to the company that started out mailing DVDs in the late 1990s.

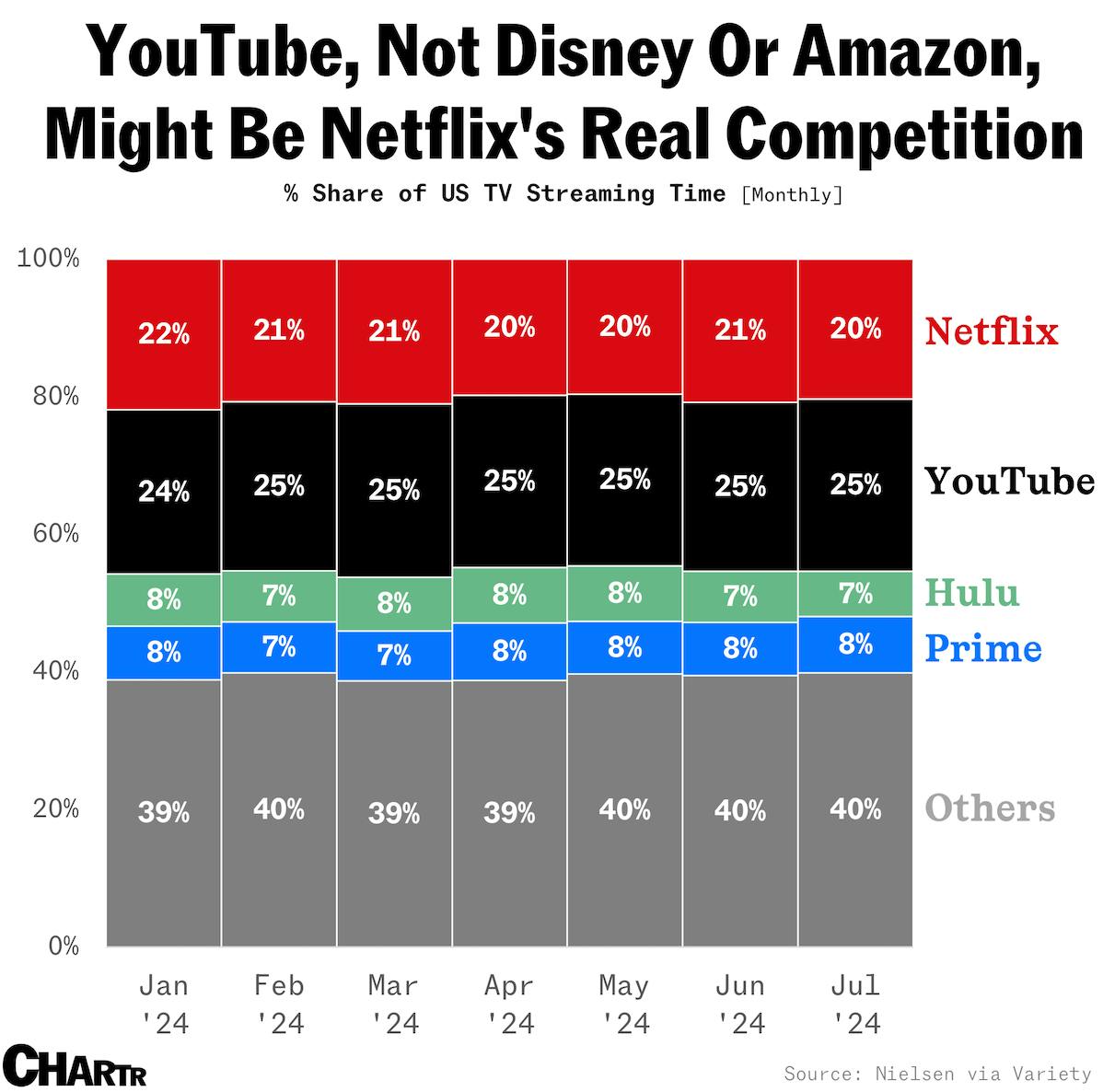

But, there is one video service that stacks up against Netflix on a couple of the most important metrics. According to monthly Nielsen data reported by Variety, Americans spend more time streaming YouTube content on their TVs than they do from any other service, including Netflix.

For the last 6 months, a quarter of all time spent streaming on US televisions has been on YouTube, compared to ~20% on Netflix, as Americans of all ages flock to the Alphabet-owned video-sharing platform for their entertainment fix. Even though Netflix is lagging YouTube in the watch time stakes, the pair are both pretty clear of the competition — Prime Video took the third-highest streaming share in July, but captured just 8%.

Okay, you might be thinking, so people are now watching hours of YouTube, but they’re not paying for the pleasure, so it’s a completely different business to Netflix’s pay-to-press-play model. You’d be right. But, at a headline level, it doesn’t make the former much less lucrative than the latter.

Before taking any income from subscribers to YouTube’s paid Premium and Music offerings into account, the two are almost neck and neck in the amount of revenue they’re generating each year, with Netflix’s $33.7 billion figure only 7% higher than YouTube’s advertising haul last year.

And, of course, YouTube doesn’t have to pay a dime to commission, produce, or license its content upfront. Its users just upload it for free (and then share in the advertising proceeds if eligible). On top of that, YouTube’s paid offerings, while small compared to Netflix, are still material: YT said it had crossed the 100 million mark in February.