The decline of print: read all about it

Can you remember the last time you strolled up to a newsstand and picked up your daily? It's probably been a while — or perhaps more likely... you’ve never done that in your entire life.

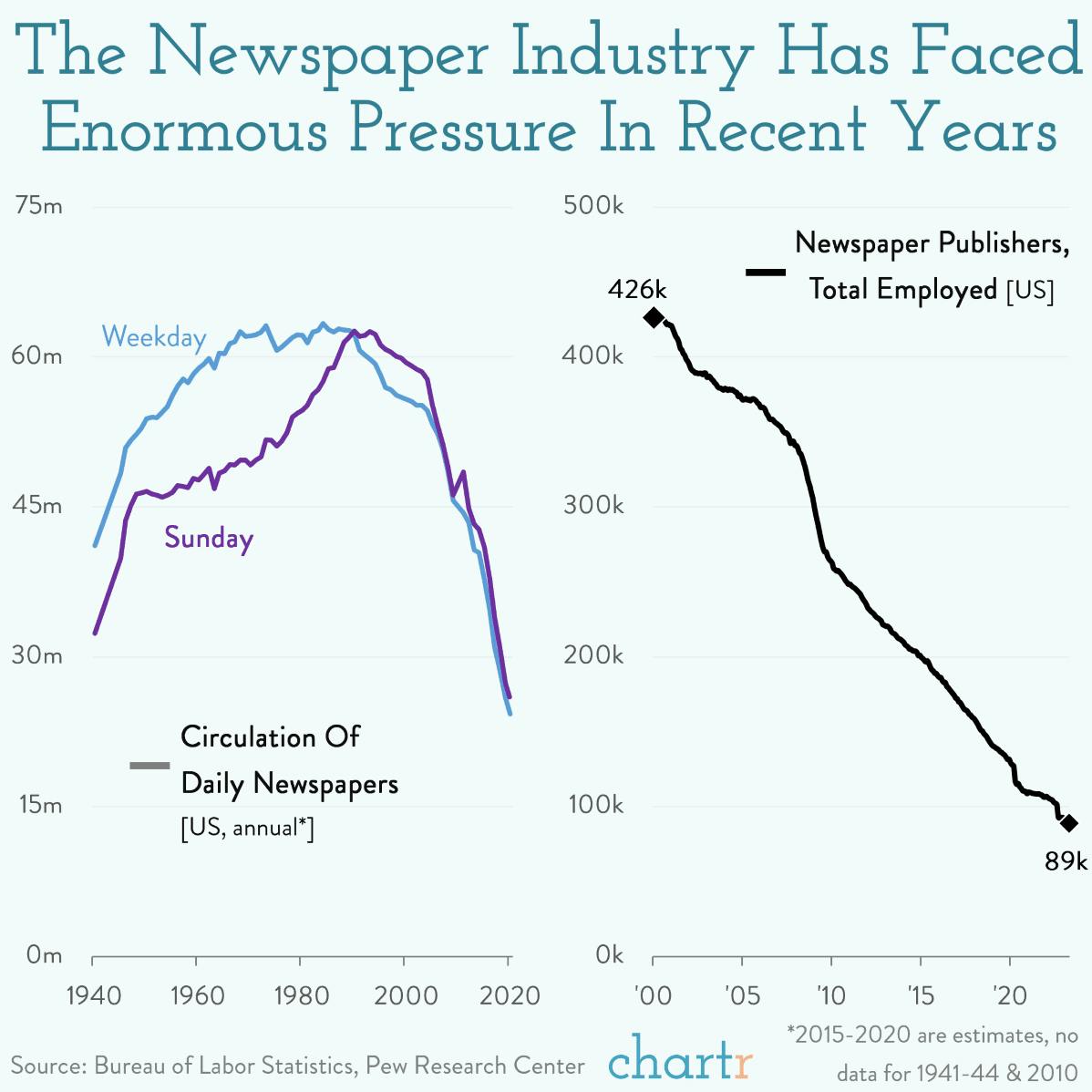

In the last 3 decades, the information diet of a typical citizen has changed dramatically. Physical newspaper circulation, both on weekdays and Sundays, has collapsed since the mid-1990s, as the friction of distributing information plummeted to nearly zero with the internet.

In its heyday, weekday editions would routinely reach more than 60 million readers, before beginning a slippery slope of decline in the early 1990s.

Interestingly, the Sunday papers — perhaps because they were filled with fewer "breaking stories", as this very Sunday edition itself is — staved off their eventual demise a little longer. Data compiled by Pew Research Center shows Sunday newspaper circulation holding on until almost the turn of the millennium, before plummeting in the early 2000s.

With declining circulation, job cuts were inevitable. In the last 20 years, thousands of journalists, editors and those involved in the physical production of millions of newspapers were laid off. America's newspaper industry shrunk from over 400,000 employed at the turn of the century to less than 90,000 as of April this year, as reported by the Bureau of Labor Statistics. Scores of newspapers have shut down, and the shrinkage is ongoing, with 360 local newspapers shutting down during the pandemic alone.

Even more nimble, digitally-native brands have struggled. Each burning brightly for a time, media companies like BuzzFeed, Vice, and Vox carved out a niche on the internet before the harsh reality caught up with them, with all 3 either closing divisions, laying off staff or going bankrupt entirely (Vice) this year.

But amidst this challenging landscape, the 170-year-old New York Times has survived, and even strangely thrived, retaining the title of largest daily print circulation, as reported by the Alliance for Audited Media.