Stabilizers needed

High-end fitness equipment company Peloton scored a big victory this week, announcing a deal with Amazon that sent the company's share price up some 20% on Wednesday. Unfortunately, like the day after a really long cycle, the pain soon set in for Peloton as they then released a quarterly earnings report that revealed a $1.2bn loss.

We should sell... fewer bikes?

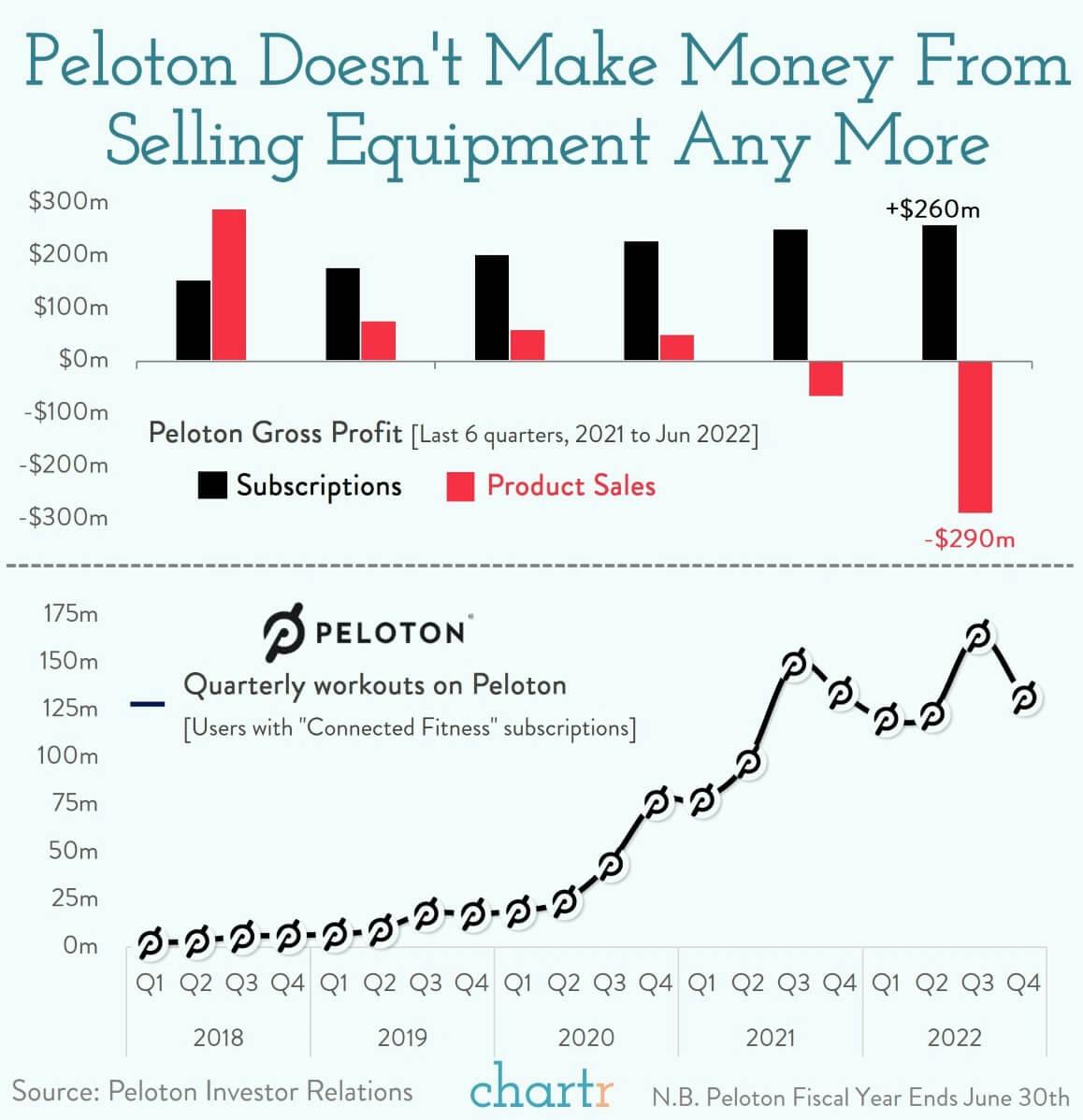

Among the many alarm bells in the report, the one ringing loudest of all is that Peloton is now losing money on what used to be its core business: selling fitness equipment. The company reported that it had "cut hardware prices in order to sell inventory ... despite selling that hardware at a negative gross margin".

That means the company is leaning heavily on its subscription business — where users pay monthly for access to live workouts, leader boards, advanced tracking and a library of fitness content.

Last quarter, Peloton counted more than 131 million workouts from the company's Connected Fitness subscribers. In total that was down only 2% on the same time last year, but on a per-user basis it was a major drop-off in engagement — last year in Q4 each Pelotonian averaged some 20 workouts per month, this year that number was closer to 15.

Peloton's new CEO is now hyper-focused on bringing the company back into the black. Giving up some control of its distribution, by partnering with retailers like Amazon, may mean even lower margins on its equipment sales, but if it gets more users signed up to a recurring high-margin subscription it may just help the wheels from coming off completely.