As far as corporate rivalries go, Coca-Cola vs. Pepsi is about as classic as it gets. And this week both reported that business was good, with revenue coming in ahead of expectations for each company, despite inflation becoming more of a challenge.

Either is fine, thanks

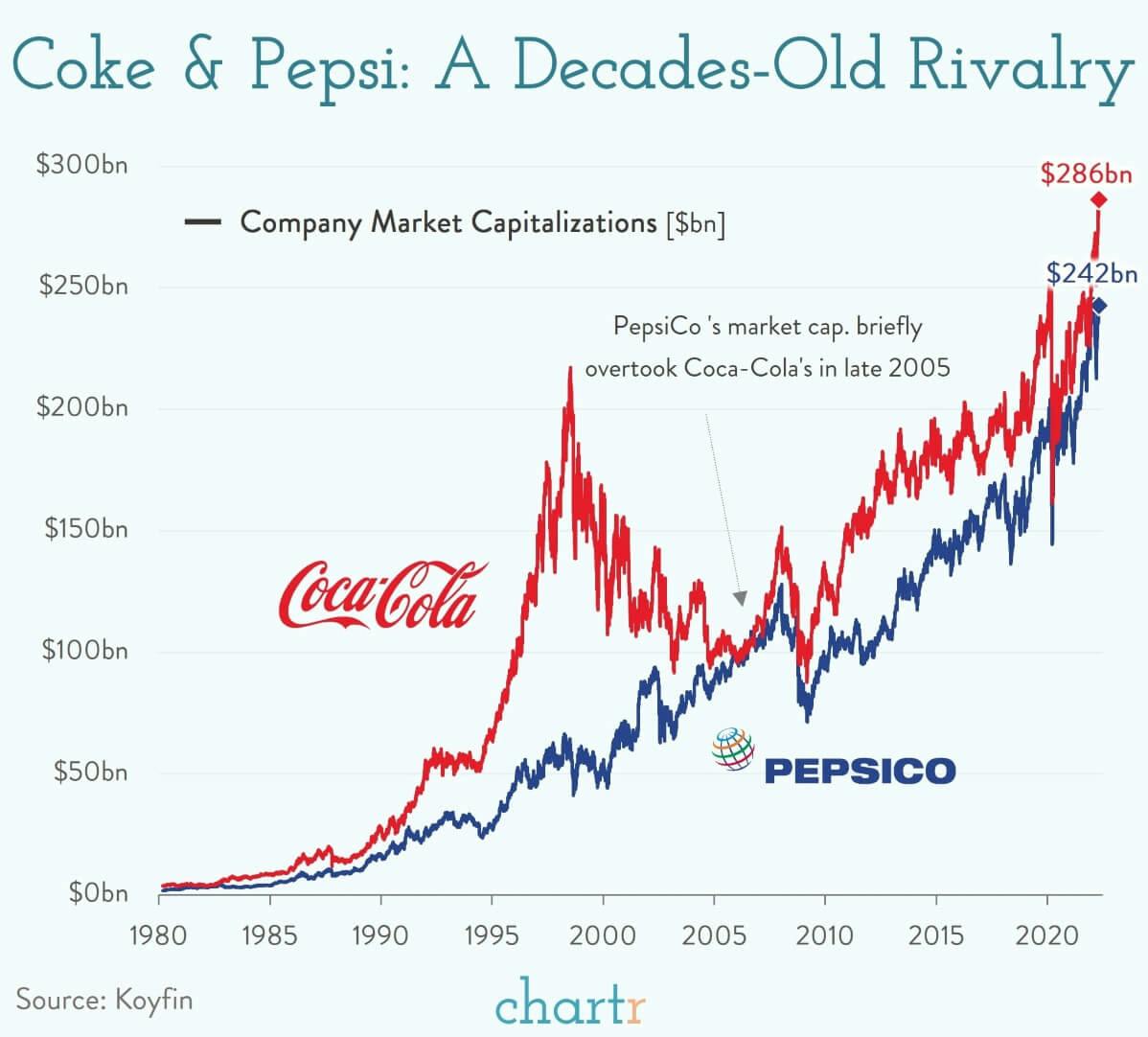

For almost the entire time both companies have been public, Coca-Cola has been the more valuable entity of the two, with a brief exception in 2005 when PepsiCo overtook Coca-Cola for the first time in 112 years.

But if you'd bought shares in either of them 40 years ago, you'd probably not be too dissatisfied with either. $100 in Coca-Cola shares bought 40 years ago would be worth something in the neighborhood of $9,200 today, and the same in PepsiCo would be worth north of $8,100.

Ports in a storm

The stability of selling drinks and snacks is proving attractive this year, with both becoming something of a safe haven at a time when tech stocks and other fast-growing companies have been getting hammered. The S&P 500 index is down 8% in the last month, the tech-heavy NASDAQ is down 12% and yet PepsiCo and Coca-Cola are chilling — both are actually up 6% in the last month. Some things never change, even in turmoil, and drinking cola and eating snacks are very much on that list.